Schedule K 1 541 Beneficiary's Share of Income, Deductions, Credits, Etc Schedule K 1 541 Beneficiary's Share of Incom Form

Understanding the California Schedule K-1 (Form 541)

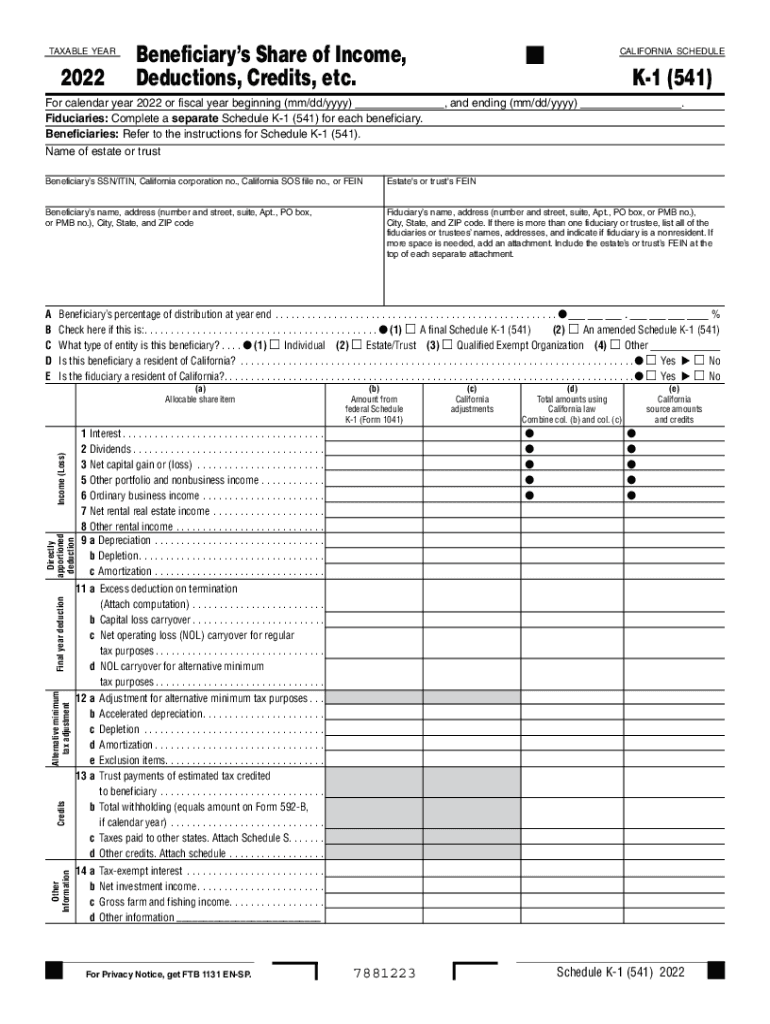

The California Schedule K-1 (Form 541) is a crucial document used by beneficiaries of estates, trusts, and partnerships to report their share of income, deductions, and credits. This form is essential for tax purposes, as it provides detailed information about a beneficiary's financial activity within a given tax year. Each beneficiary receives a K-1 that outlines their specific share, which they must include in their personal tax returns. Understanding this form is vital for accurate tax reporting and compliance with California tax laws.

Steps to Complete the California Schedule K-1 (Form 541)

Completing the California Schedule K-1 (Form 541) involves several key steps:

- Gather Required Information: Collect all necessary financial data related to income, deductions, and credits from the trust or estate.

- Fill Out the Form: Accurately input the beneficiary's share of income, deductions, and credits in the designated sections of the K-1.

- Review for Accuracy: Double-check all entries for correctness to avoid errors that could lead to tax complications.

- Distribute Copies: Provide each beneficiary with their respective K-1 for inclusion in their personal tax filings.

Legal Use of the California Schedule K-1 (Form 541)

The California Schedule K-1 (Form 541) serves a legal purpose in documenting the financial interests of beneficiaries in trusts and estates. It is essential for ensuring that beneficiaries report their income accurately to the state tax authorities. Failure to provide or accurately complete a K-1 can result in penalties or additional taxes owed. Therefore, understanding the legal implications of this form is crucial for both trustees and beneficiaries.

Key Elements of the California Schedule K-1 (Form 541)

Key elements of the California Schedule K-1 (Form 541) include:

- Beneficiary Information: Name, address, and taxpayer identification number of the beneficiary.

- Income Reporting: Breakdown of various types of income, such as ordinary income, capital gains, and dividends.

- Deductions and Credits: Specific deductions and credits allocated to the beneficiary, which can reduce taxable income.

- Trust or Estate Information: Details about the trust or estate, including its name and identification number.

Obtaining the California Schedule K-1 (Form 541)

Beneficiaries can obtain the California Schedule K-1 (Form 541) from the trustee or the estate administrator. It is typically provided after the end of the tax year, once the trust or estate has completed its financial reporting. Beneficiaries should ensure they receive their K-1 in a timely manner to meet their personal tax filing deadlines. If a beneficiary does not receive their K-1, they should contact the trustee or estate administrator for assistance.

Filing Deadlines for the California Schedule K-1 (Form 541)

The filing deadlines for the California Schedule K-1 (Form 541) align with the tax return deadlines for the trust or estate. Generally, the trust or estate must file its return by the fifteenth day of the fourth month following the end of its tax year. Beneficiaries must include their K-1 information when filing their personal tax returns, typically by April fifteenth. It is important for beneficiaries to be aware of these deadlines to avoid penalties and ensure compliance.

Quick guide on how to complete schedule k 1 541 beneficiarys share of income deductions credits etc schedule k 1 541 beneficiarys share of income deductions

Effortlessly Prepare Schedule K 1 541 Beneficiary's Share Of Income, Deductions, Credits, Etc Schedule K 1 541 Beneficiary's Share Of Incom on Any Device

Digital document management has gained traction among businesses and individuals. It offers a great environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without complications. Manage Schedule K 1 541 Beneficiary's Share Of Income, Deductions, Credits, Etc Schedule K 1 541 Beneficiary's Share Of Incom on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign Schedule K 1 541 Beneficiary's Share Of Income, Deductions, Credits, Etc Schedule K 1 541 Beneficiary's Share Of Incom with Ease

- Find Schedule K 1 541 Beneficiary's Share Of Income, Deductions, Credits, Etc Schedule K 1 541 Beneficiary's Share Of Incom and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Schedule K 1 541 Beneficiary's Share Of Income, Deductions, Credits, Etc Schedule K 1 541 Beneficiary's Share Of Incom and enhance effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 541 beneficiarys share of income deductions credits etc schedule k 1 541 beneficiarys share of income deductions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA Form 541 K 1 and why is it important?

The CA Form 541 K 1 is a crucial tax document used by California partnerships or LLCs to report each partner's or member's share of income, deductions, and credits. Understanding this form is essential for ensuring accurate tax filings, as it helps partners report their income on their personal tax returns correctly.

-

How does airSlate SignNow facilitate signing the CA Form 541 K 1?

airSlate SignNow streamlines the process of signing the CA Form 541 K 1 by allowing users to electronically sign documents securely and efficiently. This eliminates the need for printing and scanning, making it easier for partners to review and sign their tax documents remotely.

-

Can I integrate airSlate SignNow with accounting software for the CA Form 541 K 1?

Yes, airSlate SignNow offers seamless integrations with popular accounting software, making it easy to manage and send the CA Form 541 K 1 directly from your accounting platform. This integration enhances efficiency and ensures that all financial documentation is easily accessible.

-

What are the pricing plans for using airSlate SignNow to manage CA Form 541 K 1 documents?

airSlate SignNow provides flexible pricing plans that cater to different business sizes and needs. With competitive rates, businesses can choose a plan that suits their requirements and budget for managing essential forms like the CA Form 541 K 1.

-

Is airSlate SignNow compliant with the regulations for the CA Form 541 K 1?

Absolutely! airSlate SignNow adheres to strict compliance standards, including e-signature laws, ensuring that your CA Form 541 K 1 is executed legally and securely. This compliance helps protect both the sender and the signer throughout the signing process.

-

What features does airSlate SignNow offer for managing the CA Form 541 K 1?

airSlate SignNow includes features like customizable templates, document tracking, and reminders that enhance the management of the CA Form 541 K 1. These features ensure that users can efficiently monitor the signing status and streamline their document workflows.

-

How can airSlate SignNow improve the turnaround time for the CA Form 541 K 1?

By utilizing airSlate SignNow, businesses can signNowly reduce the turnaround time for the CA Form 541 K 1 through its fast electronic signing process. Users can send and receive documents in minutes, allowing partners to complete their tax obligations quicker.

Get more for Schedule K 1 541 Beneficiary's Share Of Income, Deductions, Credits, Etc Schedule K 1 541 Beneficiary's Share Of Incom

Find out other Schedule K 1 541 Beneficiary's Share Of Income, Deductions, Credits, Etc Schedule K 1 541 Beneficiary's Share Of Incom

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal