Form 541 T California Allocation of Estimated Tax Payments to

Understanding Form 541 T for California Estimated Tax Payments

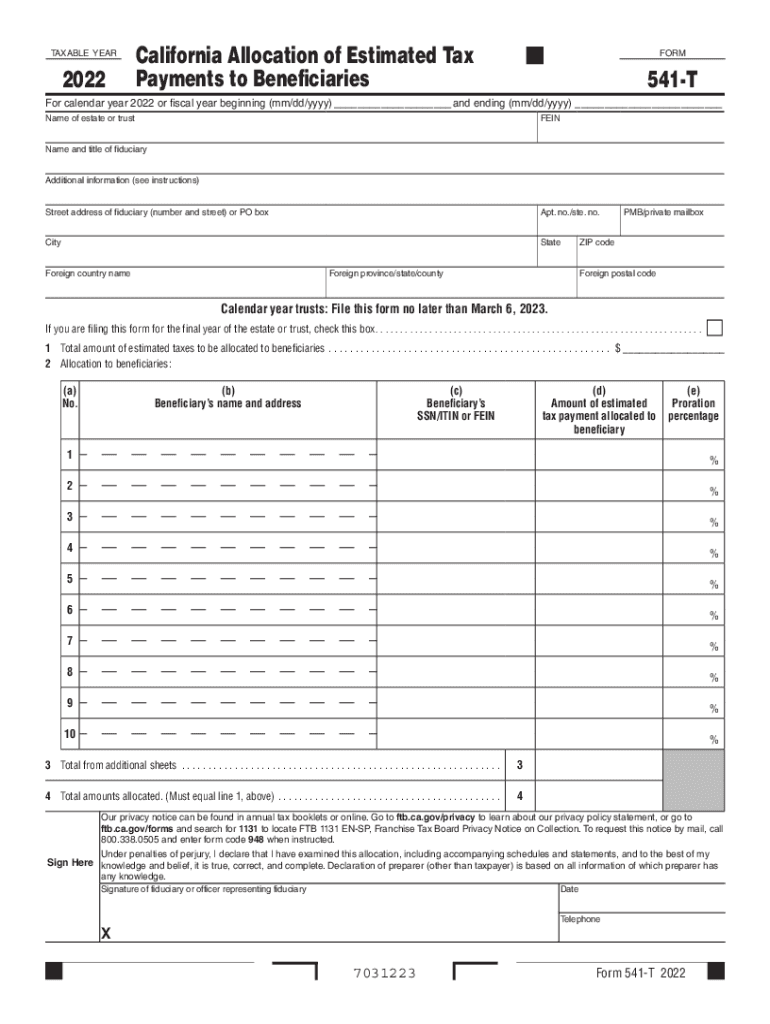

The Form 541 T is essential for California taxpayers who need to allocate their estimated tax payments. This form is specifically designed for partnerships, LLCs, and other pass-through entities to distribute estimated tax payments among partners or members. Understanding its purpose helps ensure compliance with California tax regulations and facilitates accurate tax reporting.

Steps to Complete Form 541 T

Completing the Form 541 T involves several key steps:

- Gather necessary information about the entity and its members or partners.

- Determine the total estimated tax payments made for the year.

- Allocate the estimated tax payments based on each member's share of income.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for any errors before submission.

Obtaining Form 541 T

Taxpayers can obtain Form 541 T through the California Franchise Tax Board's website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, some tax preparation software may include the form, making it easier for users to complete their tax filings electronically.

Filing Deadlines for Form 541 T

Timely filing of Form 541 T is crucial to avoid penalties. The form is typically due on the same date as the entity's tax return. For most partnerships, this means the form must be filed by the fifteenth day of the third month after the end of the tax year. It is important to stay aware of any changes to deadlines that may occur due to state regulations.

Legal Use of Form 541 T

Form 541 T is legally required for entities that need to allocate estimated tax payments among partners or members. Proper use of this form ensures compliance with California tax laws and helps avoid potential penalties for misreporting. Taxpayers should retain copies of the completed form for their records, as it may be needed for future reference or audits.

Key Elements of Form 541 T

Understanding the key elements of Form 541 T is vital for accurate completion. The form includes sections for reporting the total estimated tax payments, allocation percentages for each member, and the total amount allocated to each partner or member. It is important to ensure that all figures are correctly calculated and reported to reflect the entity's financial situation accurately.

Quick guide on how to complete form 541 t california allocation of estimated tax payments to

Complete Form 541 T California Allocation Of Estimated Tax Payments To effortlessly on any device

Online document management has gained popularity among enterprises and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right format and securely store it online. airSlate SignNow provides all the tools necessary to generate, modify, and electronically sign your documents quickly without delays. Manage Form 541 T California Allocation Of Estimated Tax Payments To on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form 541 T California Allocation Of Estimated Tax Payments To with ease

- Obtain Form 541 T California Allocation Of Estimated Tax Payments To and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 541 T California Allocation Of Estimated Tax Payments To and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 541 t california allocation of estimated tax payments to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 541 estimated tax and how does it apply to my business?

The 541 estimated tax refers to the potential tax obligations of businesses that earn income throughout the year but do not have taxes withheld. Understanding this tax is crucial for businesses to avoid underpayment and potential penalties. airSlate SignNow provides a simple way for businesses to manage and eSign documents related to tax obligations efficiently.

-

How can airSlate SignNow help me manage my 541 estimated tax documents?

With airSlate SignNow, you can easily create, send, and eSign documents related to your 541 estimated tax filings. The platform streamlines the document workflow, ensuring you never miss a deadline. Moreover, it keeps your tax documents organized and accessible, which is essential for maintaining compliance.

-

What are the pricing options for airSlate SignNow and what features are included?

airSlate SignNow offers competitive pricing plans that cater to various business needs, ensuring that you can manage your 541 estimated tax documents without breaking the bank. Features included in the plans are eSignature capabilities, document templates, and secure storage. Choosing the right plan helps you stay compliant with your tax obligations effectively.

-

Is airSlate SignNow secure for handling my 541 estimated tax documentation?

Yes, airSlate SignNow prioritizes security, utilizing advanced encryption to protect all your documents, including those related to your 541 estimated tax. The platform ensures that your information remains confidential and secure throughout the signing process. This level of security is crucial when dealing with sensitive financial documents.

-

Can I integrate airSlate SignNow with accounting software for easier 541 estimated tax management?

Absolutely! airSlate SignNow provides seamless integrations with popular accounting software, allowing you to streamline the management of your 541 estimated tax documents. This integration helps synchronize financial data and tax filings, making it easier to stay organized and compliant. It's a great way to enhance your workflow efficiency.

-

What are the benefits of using airSlate SignNow for my 541 estimated tax needs?

Using airSlate SignNow for your 541 estimated tax needs offers numerous benefits, including time-saving automation, improved document tracking, and easy access to eSigned agreements. The platform simplifies the entire signing process, making it more efficient and reliable. Furthermore, maintaining compliance becomes easier with organized document management.

-

How can I track the status of my 541 estimated tax documents in airSlate SignNow?

With airSlate SignNow, you can effortlessly track the status of your 541 estimated tax documents in real-time. The platform provides notifications and updates, keeping you informed of every step the document takes, from sending to signing. This feature is vital for maintaining organization and meeting critical tax deadlines.

Get more for Form 541 T California Allocation Of Estimated Tax Payments To

Find out other Form 541 T California Allocation Of Estimated Tax Payments To

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF