Insurance Verification Form Ver 2010

What is the Insurance Verification Form Ver

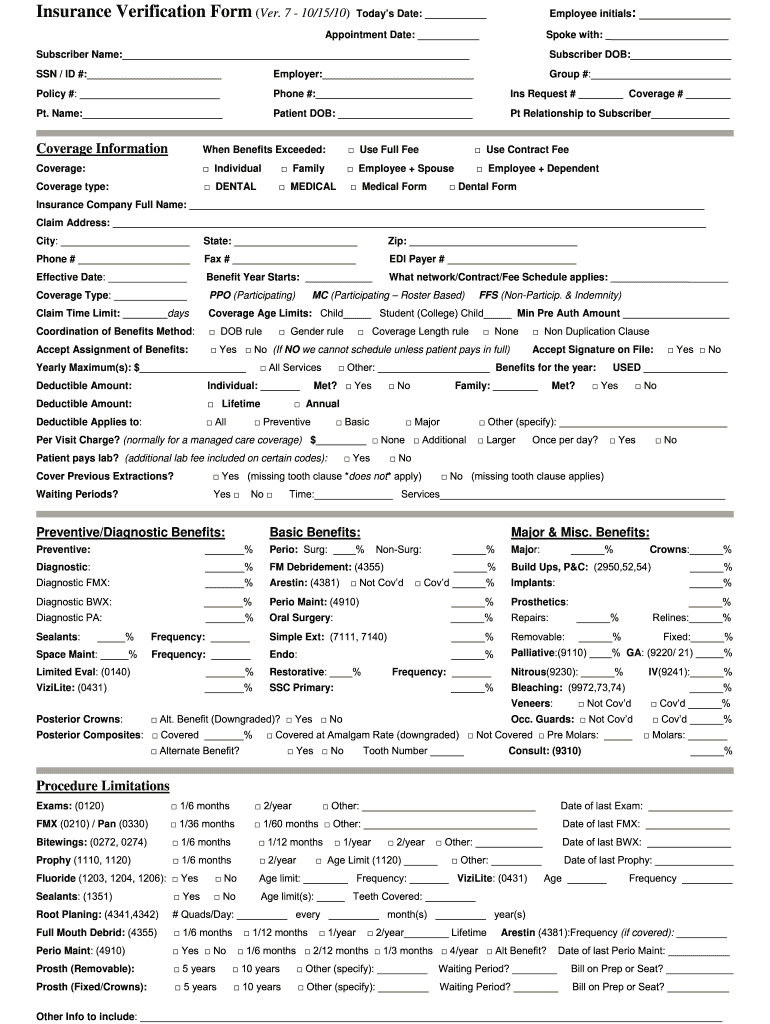

The Insurance Verification Form Ver is a crucial document used to confirm an individual's or entity's insurance coverage. This form is typically required by healthcare providers, financial institutions, or other organizations to ensure that a person has the necessary insurance in place before receiving services or benefits. It collects essential information, such as the policyholder's name, insurance provider, policy number, and coverage details. Understanding this form is vital for both individuals and businesses to ensure compliance with insurance requirements.

How to use the Insurance Verification Form Ver

Using the Insurance Verification Form Ver involves several straightforward steps. First, gather all necessary information, including personal identification and insurance details. Next, fill out the form accurately, ensuring that all fields are completed to avoid delays in processing. Once the form is filled, it can be submitted electronically or in person, depending on the requirements of the requesting organization. Utilizing digital tools, such as eSignature solutions, can streamline this process, making it easier to submit the form securely and efficiently.

Steps to complete the Insurance Verification Form Ver

Completing the Insurance Verification Form Ver requires attention to detail. Follow these steps for a successful submission:

- Gather necessary documents, including your insurance card and personal identification.

- Fill out the form with accurate information, ensuring that names and dates match your official documents.

- Review the completed form for any errors or omissions.

- Sign the form electronically or manually, depending on submission requirements.

- Submit the form through the designated method, ensuring you retain a copy for your records.

Legal use of the Insurance Verification Form Ver

The legal use of the Insurance Verification Form Ver is essential for ensuring that all parties involved are protected. This form serves as a binding agreement that verifies insurance coverage, which can be critical in legal and financial contexts. To be legally valid, the form must meet specific criteria, including proper signatures and compliance with relevant regulations. Utilizing a secure eSignature platform can enhance the legal standing of the document by providing an audit trail and ensuring compliance with laws such as ESIGN and UETA.

Key elements of the Insurance Verification Form Ver

Key elements of the Insurance Verification Form Ver include:

- Policyholder Information: Name, address, and contact details of the individual or entity insured.

- Insurance Provider: Name of the insurance company and contact information.

- Policy Number: Unique identifier for the insurance policy.

- Coverage Details: Types of coverage included in the policy, such as medical, dental, or vision.

- Signature: Required for validation, confirming the accuracy of the information provided.

Form Submission Methods

The Insurance Verification Form Ver can be submitted through various methods, depending on the requirements of the requesting organization. Common submission methods include:

- Online Submission: Many organizations accept forms submitted through secure online portals, allowing for quick processing.

- Mail: Forms can be printed and mailed to the appropriate address, though this method may take longer.

- In-Person: Some institutions may require forms to be submitted in person, especially for sensitive information.

Quick guide on how to complete insurance verification form ver

Effortlessly manage Insurance Verification Form Ver on any device

Digital document management has gained traction among companies and individuals alike. It presents an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents quickly and without hassle. Handle Insurance Verification Form Ver on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to amend and electronically sign Insurance Verification Form Ver effortlessly

- Find Insurance Verification Form Ver and click on Get Form to begin.

- Make use of the tools provided to complete your document.

- Emphasize key sections of the documents or obscure confidential information with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review all the details and hit the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate lost or misplaced files, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Insurance Verification Form Ver and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct insurance verification form ver

Create this form in 5 minutes!

How to create an eSignature for the insurance verification form ver

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Insurance Verification Form Ver?

The Insurance Verification Form Ver is a digital document designed for businesses to streamline the verification process of insurance information. With this form, users can easily collect and verify necessary insurance details, ensuring efficient communications and compliance. It simplifies the overall process and reduces the chances of errors often found in traditional methods.

-

How does the Insurance Verification Form Ver improve efficiency?

The Insurance Verification Form Ver enhances efficiency by allowing businesses to send and receive completed forms electronically. This not only saves time compared to paper-based processes but also facilitates quicker decision-making as responses can be received in real time. Moreover, automated reminders can be set up to prompt users to complete the form, reducing delays.

-

Is the Insurance Verification Form Ver customizable?

Yes, the Insurance Verification Form Ver is fully customizable to fit your business needs. You can tailor the form to include specific fields that are relevant to your industry, ensuring all necessary information is gathered. Custom branding options also allow you to maintain a professional appearance consistent with your company's identity.

-

What pricing plans are available for the Insurance Verification Form Ver?

airSlate SignNow offers flexible pricing plans for the Insurance Verification Form Ver, catering to businesses of all sizes. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required. This ensures you only pay for what you need, making it a cost-effective solution.

-

What are the key features of the Insurance Verification Form Ver?

Key features of the Insurance Verification Form Ver include electronic signatures, automated workflows, and real-time tracking of submitted forms. Additionally, the mobile-friendly interface allows users to complete the form on various devices, ensuring convenience. These features collectively enhance the user experience and streamline document management.

-

Does the Insurance Verification Form Ver integrate with other tools?

Absolutely, the Insurance Verification Form Ver integrates with various third-party applications, such as CRM systems and email platforms. These integrations facilitate seamless data transfer and enhance overall productivity by connecting multiple workflows. Such compatibility ensures that users can manage their documents without needing to switch between different tools.

-

How secure is the Insurance Verification Form Ver?

Security is a priority with the Insurance Verification Form Ver. It includes advanced encryption protocols to keep sensitive information safe from unauthorized access. Additionally, comprehensive audit trails and user authentication mechanisms provide further layers of security, giving businesses peace of mind while handling confidential insurance details.

Get more for Insurance Verification Form Ver

- Free utah bill of sale forms pdf eforms free fillable

- 2018 i 094 schedule ps wisconsin department of revenue form

- Idaho notice of hearing on name change minors form

- How to fill out the fafsa in 10 steps with pictures form

- Free alaska power of attorney formspdf templates

- Attorneys at law corporate transactions business and form

- Petition for administration of a small estate register of wills form

- Github ilovepdfilovepdf php ilovepdf rest api php form

Find out other Insurance Verification Form Ver

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT