California Form 3521 Low Income Housing Credit

What is the California Form 3521 Low Income Housing Credit

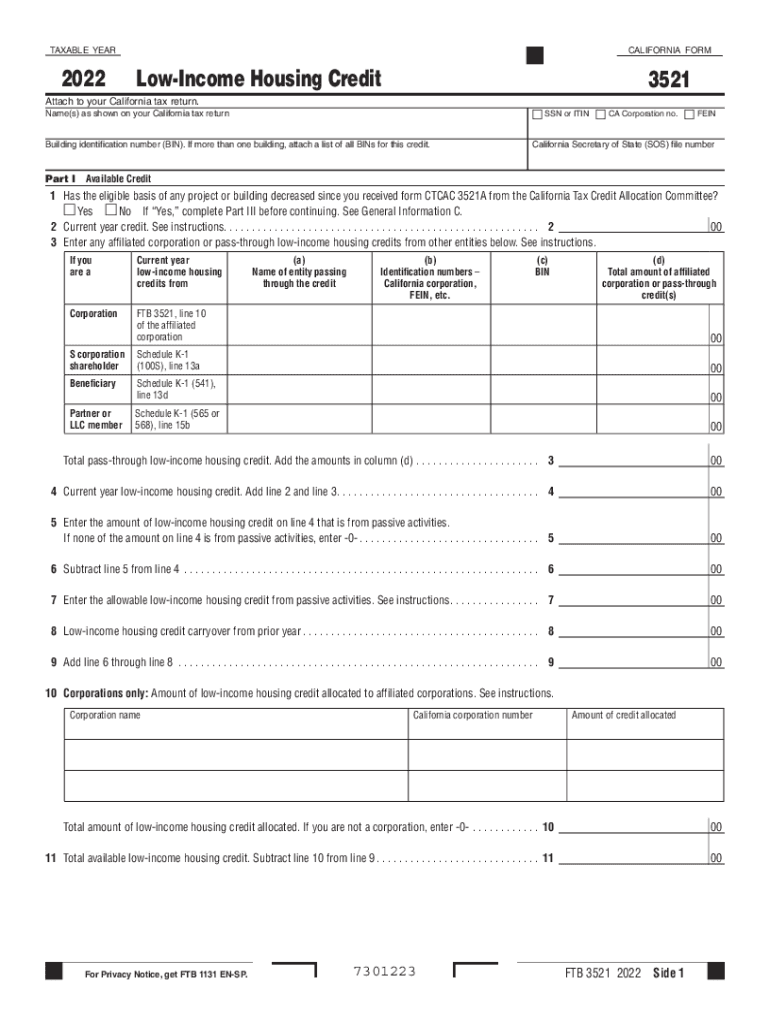

The California Form 3521 is a tax form used to claim the Low Income Housing Credit. This credit is designed to encourage the development and rehabilitation of affordable rental housing for low-income individuals and families in California. By providing a tax incentive, the program aims to increase the availability of affordable housing options across the state. The credit is typically claimed by property owners or developers who meet specific eligibility criteria set forth by the California Tax Credit Allocation Committee.

Eligibility Criteria

To qualify for the California Form 3521 Low Income Housing Credit, applicants must meet several criteria:

- The property must be located in California and must be designated for low-income housing.

- The housing must meet specific affordability requirements, ensuring that rents are within the reach of low-income tenants.

- Developers must comply with state and federal regulations regarding housing quality and tenant rights.

- Applicants must provide documentation proving that the property meets all necessary guidelines.

Steps to Complete the California Form 3521 Low Income Housing Credit

Completing the California Form 3521 involves several important steps:

- Gather all required documentation, including proof of property ownership and tenant income verification.

- Fill out the form accurately, ensuring all sections are completed as per the instructions provided.

- Calculate the amount of credit being claimed based on the number of qualified units and the applicable rates.

- Review the completed form for accuracy and completeness before submission.

How to Obtain the California Form 3521 Low Income Housing Credit

The California Form 3521 can be obtained through the California Tax Credit Allocation Committee's official website or by contacting their office directly. It is essential to ensure you have the most current version of the form, as updates may occur periodically. Additionally, many tax preparation software programs include the form, making it easier for users to complete their tax filings electronically.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the California Form 3521. Generally, the form must be submitted along with your tax return by the annual tax filing deadline, which is typically April fifteenth for individual taxpayers. However, if you are filing for an extension, ensure that the form is submitted by the extended deadline. Keeping track of these dates helps avoid penalties and ensures compliance with state tax regulations.

Key Elements of the California Form 3521 Low Income Housing Credit

The California Form 3521 includes several key elements that are essential for claiming the Low Income Housing Credit:

- Identification of the property and its location.

- Details regarding the number of qualified low-income units.

- Calculation of the credit based on the applicable percentage and eligible expenses.

- Certification of compliance with all program requirements.

Quick guide on how to complete california form 3521 low income housing credit

Effortlessly prepare California Form 3521 Low Income Housing Credit on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle California Form 3521 Low Income Housing Credit on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign California Form 3521 Low Income Housing Credit with ease

- Acquire California Form 3521 Low Income Housing Credit and then click Get Form to begin.

- Utilize our tools to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, such as email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign California Form 3521 Low Income Housing Credit and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 3521 low income housing credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3521 low income housing credit?

The 3521 low income housing credit is a tax incentive designed to encourage investment in affordable housing units for low-income families. It allows property owners to receive tax credits in exchange for maintaining affordability in their housing properties. This program plays a vital role in increasing the availability of low-income housing options.

-

How does the 3521 low income housing credit benefit investors?

Investing in properties that qualify for the 3521 low income housing credit can provide substantial financial benefits, including reducing tax liabilities. Developers and investors can tap into consistent cash flow while contributing to solving housing affordability issues. The long-term benefits of this credit can attract more investors into the market.

-

What documents are needed to apply for the 3521 low income housing credit?

To apply for the 3521 low income housing credit, applicants typically need to provide documentation on income levels, property location, and compliance with housing regulations. Detailed records of tenants and rental agreements may also be necessary. It's essential to ensure all required forms and applications are thoroughly completed.

-

Can I use the 3521 low income housing credit alongside other housing programs?

Yes, the 3521 low income housing credit can often be combined with other housing initiatives to maximize benefits. Many programs designed for affordable housing allow integration with additional credits or incentives. It’s advisable to consult with a housing finance expert to explore all available options.

-

How is the 3521 low income housing credit calculated?

The 3521 low income housing credit is typically calculated based on the qualified basis of the property, which includes factors such as eligible units and their associated costs. The standard percentage for the credit can be verified through calculating the total costs against the number of low-income units maintained. Consulting a tax advisor can provide precise calculations for your property.

-

What are the key features of the 3521 low income housing credit program?

Key features of the 3521 low income housing credit program include tax benefits for property owners, incentives for maintaining affordable housing, and compliance requirements to ensure the long-term use of properties as low-income housing. The program encourages both equity investment and ongoing engagement from the housing community. These features contribute to its signNow impact on local housing markets.

-

What should I consider before applying for the 3521 low income housing credit?

Before applying for the 3521 low income housing credit, it's crucial to assess your property’s eligibility and your readiness to comply with affordability requirements. Consider potential financial implications, the long-term commitment required, and the impact on your current financial situation. Consulting with legal and financial advisors is recommended for informed decision-making.

Get more for California Form 3521 Low Income Housing Credit

- Size chart form

- Vr 018 6 04 mva marylandgov form

- Provider dispute resolution request healthcare partners form

- Ga rush spirit order form back

- Super bill treasure coast ultrasound form

- 2017 easp form

- Personal bank account statement form

- Sea waybill for combined transport or port to port wec lines form

Find out other California Form 3521 Low Income Housing Credit

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now