Form 4868

What is the Form 4868

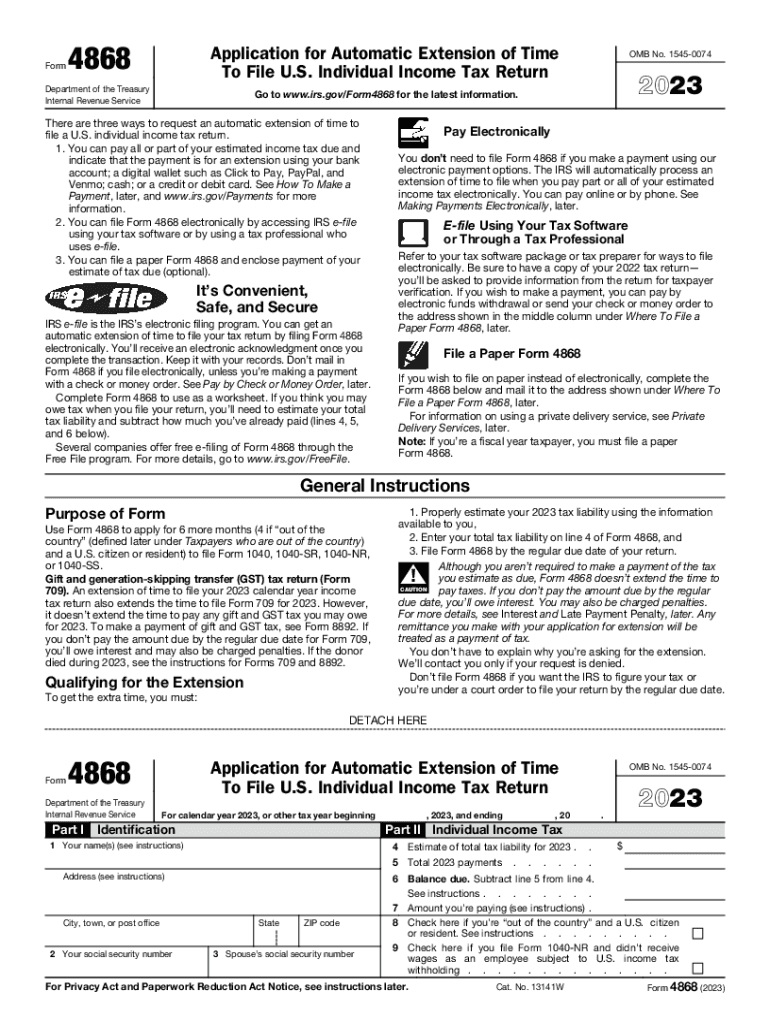

The Form 4868 is an application for an automatic extension of time to file your U.S. individual income tax return. This form allows taxpayers to extend their filing deadline by six months, providing additional time to prepare and submit their tax returns. It is important to note that while the form extends the filing deadline, it does not extend the time to pay any taxes owed. Taxpayers must estimate their tax liability and pay any amount due by the original due date to avoid penalties and interest.

How to use the Form 4868

To use Form 4868, you need to complete the form accurately, providing your personal information, including your name, address, and Social Security number. You will also need to estimate your total tax liability for the year and indicate any payments you have already made. Once completed, the form can be submitted electronically or via mail. If filing electronically, many tax software programs will guide you through the process. If mailing the form, ensure it is sent to the appropriate address based on your location.

Steps to complete the Form 4868

Completing Form 4868 involves several key steps:

- Gather your personal information, including your Social Security number.

- Estimate your total tax liability for the year.

- Calculate any payments you have already made towards your taxes.

- Fill out the form with the required information.

- Choose your submission method: electronically through tax software or by mailing the completed form.

Filing Deadlines / Important Dates

The deadline to file Form 4868 is typically the same as the due date for your tax return, which is usually April 15. If April 15 falls on a weekend or holiday, the deadline may be adjusted. It is crucial to submit Form 4868 by this date to avoid penalties. The extended deadline for filing your tax return, if the extension is granted, will be October 15.

Required Documents

When preparing to file Form 4868, you should have the following documents ready:

- Your previous year's tax return for reference.

- W-2 forms from employers.

- 1099 forms for any additional income.

- Records of any estimated tax payments made.

Form Submission Methods (Online / Mail / In-Person)

Form 4868 can be submitted in several ways. The most efficient method is to file electronically using tax software, which often includes built-in guidance. Alternatively, you can print the completed form and mail it to the appropriate IRS address based on your state. In-person submission is generally not available for this form, as most taxpayers will utilize electronic or mail options.

Quick guide on how to complete form 4868

Effortlessly Prepare Form 4868 on Any Device

Managing documents online has gained signNow traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to easily find the necessary template and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Form 4868 on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to Edit and eSign Form 4868 Without Hassle

- Find Form 4868 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, and errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Form 4868 and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4868

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What types of documents can I send with airSlate SignNow?

With airSlate SignNow, you can send various types of documents including contracts, agreements, and forms. The platform supports different file formats, ensuring you can upload and eSign whatever type of document you need. This flexibility makes it ideal for businesses in various industries.

-

How does airSlate SignNow's pricing structure work for different types of users?

airSlate SignNow offers a flexible pricing structure that caters to different types of users, from individual freelancers to large enterprises. Each plan is designed to provide value based on the features and document types you require. You can choose a plan that meets your specific needs without overspending.

-

What are the key features of airSlate SignNow for managing document types?

airSlate SignNow provides essential features for managing various types of documents, including template creation, bulk sending, and status tracking. The platform’s intuitive dashboard makes it easy to handle multiple types of documents efficiently. This ensures you can manage your workflow seamlessly.

-

Can I integrate airSlate SignNow with other applications for different document types?

Yes, airSlate SignNow integrates with numerous applications to enhance your document management experience. Whether you're using CRM systems, cloud storage solutions, or other business tools, you can connect with ease. This integration allows you to handle all types of documents from a centralized location.

-

What are the benefits of using airSlate SignNow for electronic signatures?

The primary benefit of using airSlate SignNow for electronic signatures is its ease of use. The platform allows users to eSign different types of documents quickly and securely. This not only saves time but also ensures compliance with legal standards for electronic signatures.

-

Is airSlate SignNow suitable for different business types?

Absolutely! airSlate SignNow is designed to accommodate a wide array of business types, from startups to established corporations. Its versatile features cater to various document management needs, making it an excellent choice for any organization looking to streamline their processes.

-

How can airSlate SignNow help in reducing document turnaround time?

airSlate SignNow signNowly reduces document turnaround time by offering features like real-time notifications and automated workflows. By streamlining processes for various document types, businesses can quickly access, sign, and share documents. This efficiency leads to faster decision-making and improved productivity.

Get more for Form 4868

Find out other Form 4868

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free