California Form 3885 Corporation Depreciation and Amortization

Understanding the California Form 3885 for Depreciation and Amortization

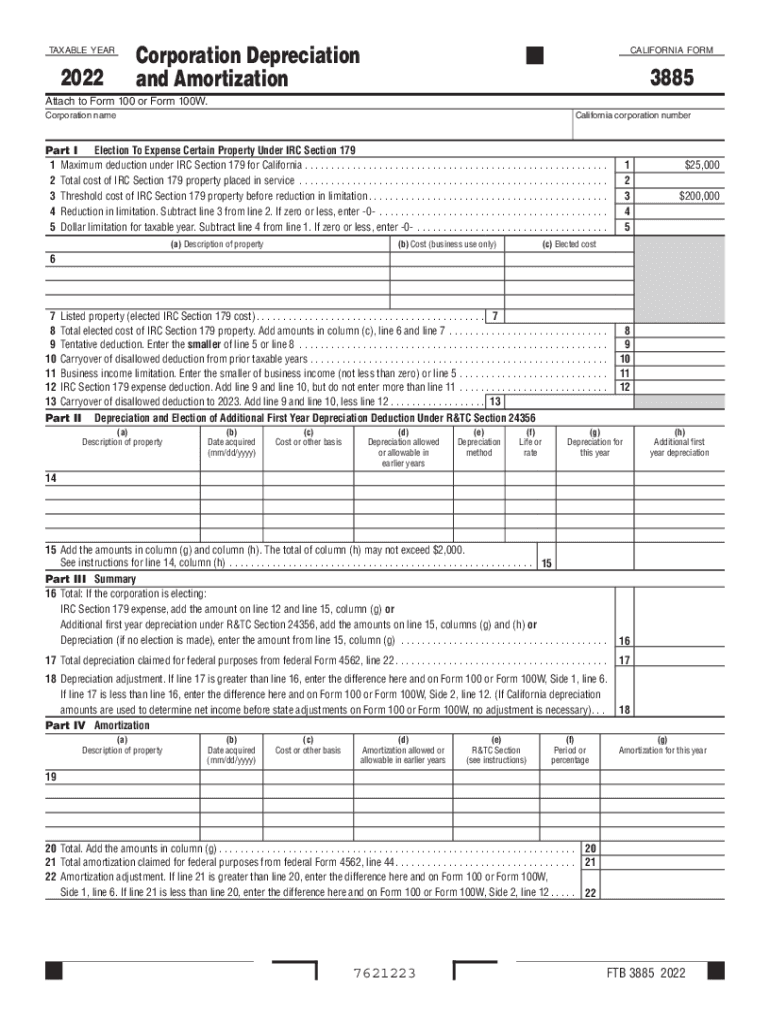

The California Form 3885 is a crucial document for corporations that need to report depreciation and amortization for state tax purposes. This form allows businesses to calculate and claim deductions on the depreciation of their tangible assets and the amortization of intangible assets. Properly filling out this form ensures compliance with California tax regulations and can significantly impact a corporation's taxable income.

Steps to Complete the California Form 3885

Completing the California Form 3885 involves several key steps:

- Gather necessary financial records, including asset purchase invoices and previous depreciation schedules.

- Identify the assets eligible for depreciation and their respective costs.

- Determine the appropriate depreciation method, such as straight-line or declining balance.

- Fill out the form by entering asset details, including descriptions, acquisition dates, and depreciation amounts.

- Review the completed form for accuracy before submission.

Obtaining the California Form 3885

The California Form 3885 can be obtained directly from the California Franchise Tax Board (FTB) website. It is available in PDF format, which can be downloaded and printed for completion. Additionally, businesses may also find the form through tax preparation software that supports California tax filings.

Key Elements of the California Form 3885

The form includes several critical sections that need to be accurately filled out:

- Asset Information: Details about each asset, including type, cost, and acquisition date.

- Depreciation Method: Selection of the method used for calculating depreciation.

- Amortization Details: Information on any intangible assets being amortized.

- Summary of Deductions: Total deductions claimed for the tax year.

Legal Use of the California Form 3885

The California Form 3885 must be used in accordance with state tax laws. Corporations are required to file this form to report depreciation and amortization accurately. Failure to comply with these regulations can result in penalties and interest on unpaid taxes. It is essential for businesses to understand their obligations under California tax law to avoid any legal repercussions.

Filing Deadlines for the California Form 3885

Corporations must adhere to specific filing deadlines when submitting the California Form 3885. Generally, the form is due on the same date as the corporation's tax return. Extensions may be available, but it is important to check with the California Franchise Tax Board for the most current deadlines and requirements to ensure timely submission.

Quick guide on how to complete california form 3885 corporation depreciation and amortization

Effortlessly Complete California Form 3885 Corporation Depreciation And Amortization on Any Device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any holdups. Manage California Form 3885 Corporation Depreciation And Amortization across any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The Easiest Way to Edit and Electronically Sign California Form 3885 Corporation Depreciation And Amortization with Ease

- Obtain California Form 3885 Corporation Depreciation And Amortization and then click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, SMS, or a shared link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign California Form 3885 Corporation Depreciation And Amortization and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 3885 corporation depreciation and amortization

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CA depreciation and how does it impact my business?

CA depreciation refers to the reduction in value of assets over time in accordance with California tax laws. Understanding CA depreciation is crucial for businesses as it can affect tax liabilities and overall financial planning. By leveraging CA depreciation effectively, businesses can optimize their tax deductions and improve cash flow.

-

How can airSlate SignNow help with CA depreciation documentation?

AirSlate SignNow provides an efficient way to eSign and manage documents related to CA depreciation. You can easily prepare, send, and track all documents required for reporting and compliance, streamlining your business processes. This reduces the time spent on administrative tasks and ensures accuracy in your compliance documents.

-

What features does airSlate SignNow offer for managing CA depreciation forms?

AirSlate SignNow offers features like customizable templates, automated workflows, and secure document storage, making managing CA depreciation forms a breeze. With its user-friendly interface, you can quickly create and send necessary documents for CA depreciation. This not only saves your team time but enhances document management efficiency.

-

Are there any pricing plans specifically for CA depreciation management?

AirSlate SignNow offers various pricing plans that cater to businesses of all sizes. While there isn’t a specific plan solely for CA depreciation management, all plans include features that simplify document management, including those needed for CA depreciation. Review our pricing options to find the best fit for your business needs.

-

What are the benefits of using airSlate SignNow for CA depreciation related processes?

Using airSlate SignNow for CA depreciation processes ensures that your documents are handled securely and efficiently. By reducing paperwork and providing a seamless eSigning experience, you can accelerate the CA depreciation documentation process. Additionally, the integration capabilities with other tools allow for smoother workflows across your organization.

-

Can I integrate airSlate SignNow with my existing accounting software for CA depreciation?

Yes, airSlate SignNow offers integrations with various accounting software solutions that can assist with CA depreciation calculations and reporting. By integrating these systems, you can ensure all financial data is aligned, making it easier to manage CA depreciation documents. This seamless connection helps reduce errors and saves your team valuable time.

-

Is airSlate SignNow compliant with CA depreciation regulations?

Absolutely, airSlate SignNow complies with all relevant laws and regulations, including those governing CA depreciation. Our platform ensures that all eSigned documents meet legal standards, providing peace of mind when handling CA depreciation paperwork. This compliance helps protect your business and simplifies the audit process.

Get more for California Form 3885 Corporation Depreciation And Amortization

Find out other California Form 3885 Corporation Depreciation And Amortization

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney