Form 1041

What is the Form 1041

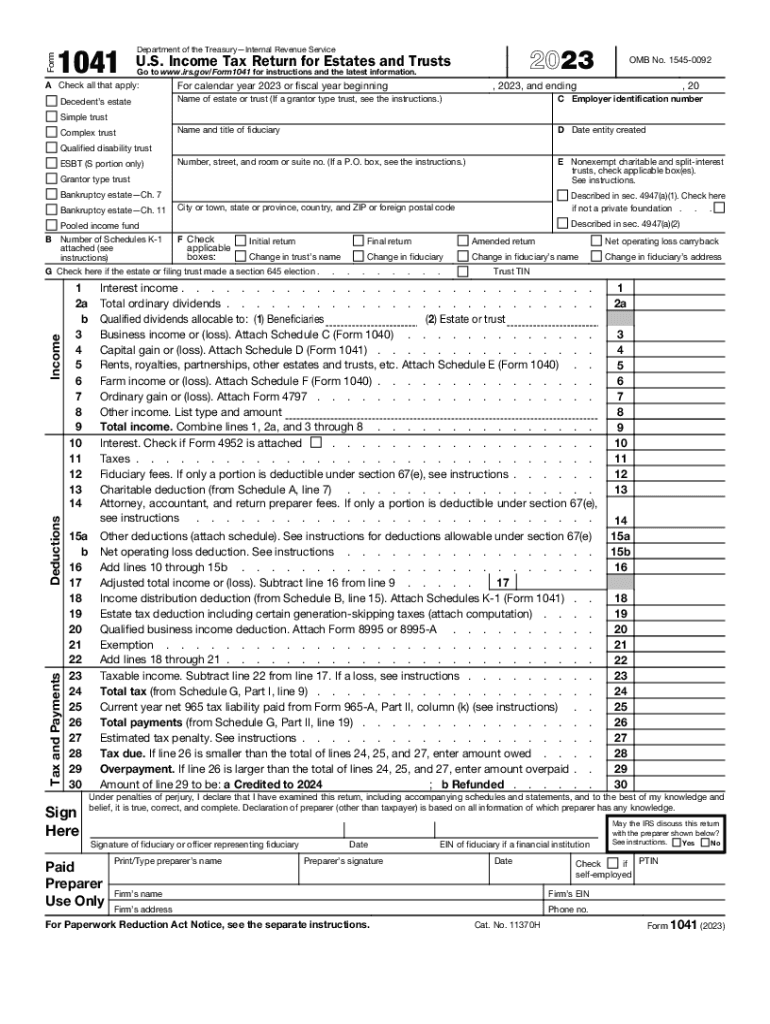

The Form 1041 is a tax return used by estates and trusts to report income, deductions, gains, and losses. This form is essential for fiduciaries, who are responsible for managing the assets of a trust or estate. The income generated by these entities must be reported to the IRS, and the Form 1041 serves as the official means to do so. It is important for ensuring compliance with federal tax laws and accurately reflecting the financial activities of the trust or estate.

How to use the Form 1041

Using the Form 1041 involves several key steps. First, gather all necessary financial documents related to the estate or trust, including income statements, expense receipts, and any prior tax returns. Next, complete the form by entering the required information, such as the name and address of the estate or trust, the taxpayer identification number, and the income and deductions. After filling out the form, review it for accuracy before submitting it to the IRS. The form can be filed electronically or by mail, depending on your preference.

Steps to complete the Form 1041

Completing the Form 1041 requires careful attention to detail. Begin by entering the name of the estate or trust at the top of the form. Next, provide the employer identification number (EIN) and the address. In Part I, report the income received by the estate or trust, which may include interest, dividends, and capital gains. In Part II, list the deductions, such as administrative expenses and distributions to beneficiaries. Finally, calculate the tax liability and sign the form. Ensure that all entries are accurate to avoid penalties.

Filing Deadlines / Important Dates

The filing deadline for Form 1041 generally falls on the fifteenth day of the fourth month after the end of the tax year. For estates and trusts operating on a calendar year, this means the deadline is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, if an extension is needed, Form 7004 can be filed to request an automatic six-month extension. However, any taxes owed must still be paid by the original due date to avoid penalties and interest.

Required Documents

To successfully complete the Form 1041, certain documents are necessary. These include the trust or estate's financial statements, records of income received (such as bank statements and investment income), and documentation of expenses incurred. Additionally, any prior tax returns may be useful for reference. It is also important to have records of distributions made to beneficiaries, as these will affect the deductions claimed on the form. Keeping organized records will streamline the filing process and ensure compliance with IRS requirements.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 1041. These guidelines outline the necessary information to be reported, the calculations required for tax liability, and the documentation needed to support claims. It is crucial to refer to the most recent IRS instructions for Form 1041, as tax laws and regulations may change. Adhering to these guidelines helps ensure accurate reporting and minimizes the risk of audits or penalties.

Penalties for Non-Compliance

Failure to file Form 1041 on time or inaccurately reporting information can result in significant penalties. The IRS may impose a failure-to-file penalty, which is typically calculated based on the amount of tax owed and the length of the delay. Additionally, incorrect information may lead to audits, further penalties, and interest on unpaid taxes. To avoid these consequences, it is essential to file the form accurately and on time, ensuring all required information is included.

Quick guide on how to complete form 1041 701765086

Complete Form 1041 effortlessly on any device

Digital document management has become widely adopted by companies and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 1041 on any device through airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Form 1041 without stress

- Find Form 1041 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searches, and errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 1041 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1041 701765086

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer that build trust in document signing?

airSlate SignNow provides robust features like secure e-signatures, audit trails, and customizable templates. These features ensure authenticity and accountability, allowing users to trust that their documents are handled securely. Additionally, multiple layers of encryption further enhance trust in your document signing process.

-

How does airSlate SignNow ensure the trustworthiness of electronic signatures?

airSlate SignNow complies with global e-signature laws such as ESIGN and UETA, ensuring that electronic signatures are legally binding. Trust is further established through rigorous authentication processes, including two-factor authentication and secure access controls. This legal compliance and security contribute to a reliable e-signing experience.

-

What kind of customer support does airSlate SignNow offer to build trust?

To ensure users feel supported, airSlate SignNow provides 24/7 customer service via chat and email. Trust in our customer support is built through quick response times and knowledgeable representatives who are ready to assist with any queries. Additionally, our comprehensive knowledge base offers resources that help users maximize the platform’s features.

-

Is airSlate SignNow cost-effective while maintaining trust in quality?

Yes, airSlate SignNow offers competitive pricing plans that provide great value without compromising on quality. By focusing on affordability, businesses can trust that they are investing in a reliable e-signature solution that meets their needs. The range of features included at different price points assures that customers find a plan that fits their budget.

-

How does airSlate SignNow integrate with other tools to enhance trust?

airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and Salesforce. This integration allows for a smooth workflow, ensuring that users can trust the reliability of their documents regardless of the platform they use. Connecting your tools enhances efficiency, making it easier to manage documents securely.

-

What are the benefits of using airSlate SignNow for business contracts?

Using airSlate SignNow for business contracts ensures a streamlined signing process, saving time and reducing errors. The trust built through our secure platform enhances collaboration, allowing teams to focus on important tasks. With e-signatures, businesses can execute contracts faster, improving turnaround times and enhancing client satisfaction.

-

Can I trust airSlate SignNow with sensitive documents?

Absolutely, airSlate SignNow employs advanced security measures such as AES-256 encryption and secure socket layer (SSL) protocols to protect sensitive documents. This focus on security fosters trust among users who handle confidential information. Our commitment to user privacy and data protection is paramount to our service offerings.

Get more for Form 1041

- Wells fargo center commemorative brick order form

- Beltone audiogram beltone hearing centre edmonton home form

- Sellers short term possession after closing addendum form

- Nouns test reading level 03 pdf ereadingworksheets form

- Art of living flyers generator form

- Form of nomination under bye law no32

- Apply for a loweamp39s escrow account community buying group form

- Henry transou memorial junior golf classic tygajuniorgolf form

Find out other Form 1041

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online