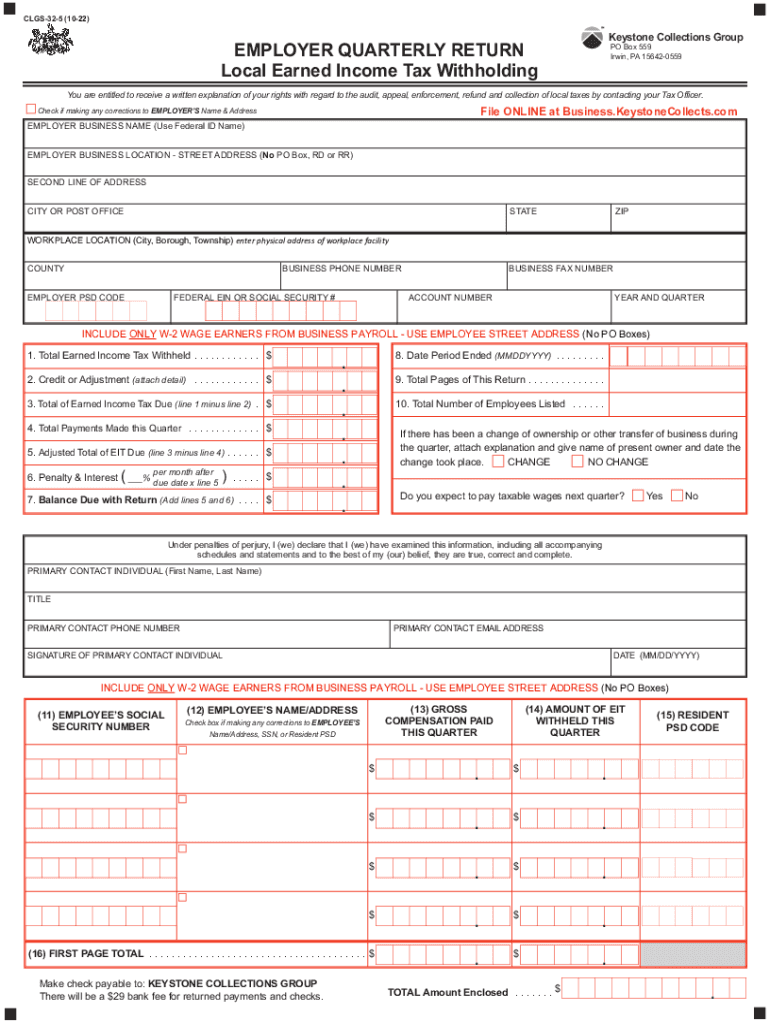

Delinquent Earned Income Tax Department Form

What is the Delinquent Earned Income Tax Department

The Delinquent Earned Income Tax Department is a governmental body responsible for managing and collecting unpaid earned income taxes. This department ensures compliance with tax regulations and addresses issues related to delinquent accounts. It plays a crucial role in maintaining the integrity of the tax system by enforcing tax laws and ensuring that all taxpayers fulfill their obligations.

Steps to complete the Delinquent Earned Income Tax Department

Completing the Delinquent Earned Income Tax Department requires several key steps:

- Gather necessary documents, including previous tax returns and income statements.

- Review any outstanding notices from the department regarding unpaid taxes.

- Fill out the required forms accurately, ensuring all information is current.

- Submit the completed forms through the appropriate channels, either online or by mail.

- Monitor the status of your submission and respond promptly to any follow-up requests.

Legal use of the Delinquent Earned Income Tax Department

Utilizing the Delinquent Earned Income Tax Department is essential for taxpayers who have outstanding earned income taxes. Legal use includes submitting required forms, paying owed taxes, and adhering to deadlines set by the department. Failure to comply can result in penalties, including additional fines or legal action. Understanding the legal framework surrounding this department ensures that taxpayers can navigate their obligations effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Delinquent Earned Income Tax Department are critical for compliance. Typically, taxpayers must submit any outstanding forms by specific dates to avoid penalties. It is advisable to keep track of these important dates, which may vary by state or locality. Regularly checking for updates can help ensure that you meet all necessary deadlines and avoid complications.

Required Documents

To effectively engage with the Delinquent Earned Income Tax Department, certain documents are required. These typically include:

- Previous tax returns for the relevant years.

- Proof of income, such as pay stubs or bank statements.

- Any correspondence from the department regarding unpaid taxes.

- Identification documents to verify your identity.

Penalties for Non-Compliance

Non-compliance with the requirements of the Delinquent Earned Income Tax Department can lead to significant penalties. These may include financial fines, interest on unpaid taxes, and potential legal action. Understanding these penalties is crucial for taxpayers to avoid unnecessary financial burdens and to maintain good standing with tax authorities.

Form Submission Methods (Online / Mail / In-Person)

Submitting forms to the Delinquent Earned Income Tax Department can be done through various methods. Taxpayers have the option to submit forms online via the department's official website, mail them directly to the designated address, or deliver them in person at local offices. Each method has its own processing times and requirements, so it is important to choose the most suitable option based on individual circumstances.

Quick guide on how to complete delinquent earned income tax department

Prepare Delinquent Earned Income Tax Department effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to generate, modify, and eSign your documents swiftly without any hold-ups. Manage Delinquent Earned Income Tax Department on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Delinquent Earned Income Tax Department with ease

- Locate Delinquent Earned Income Tax Department and click on Get Form to commence.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools provided by airSlate SignNow designed specifically for this purpose.

- Craft your signature using the Sign tool, which only takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Delinquent Earned Income Tax Department to guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the delinquent earned income tax department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 32 5 form used for in airSlate SignNow?

The 32 5 form is a customizable document template that allows users to efficiently gather electronic signatures and important data. With airSlate SignNow, you can easily create, send, and manage the 32 5 form all in one platform. This streamlines your signing process, making it both seamless and effective for your team.

-

How much does it cost to use the 32 5 form with airSlate SignNow?

Pricing for using the 32 5 form with airSlate SignNow depends on the plan you choose. We offer various pricing tiers to fit different business needs, starting from a free trial to premium packages with advanced features. This ensures you pay only for the features you need when handling your documents.

-

What features does airSlate SignNow offer for the 32 5 form?

airSlate SignNow includes features like document templates, secure electronic signature capture, customizable workflows, and real-time tracking for the 32 5 form. These features enhance your document management efficiency, allowing for a smooth user experience from creation to signing. Users can also access analytics to track the performance of their documents.

-

Are there any integrations available for the 32 5 form in airSlate SignNow?

Yes, airSlate SignNow provides integrations with numerous third-party applications, enhancing the functionality of your 32 5 form. You can seamlessly connect it with tools such as Google Drive, Salesforce, and more. This integration capability allows for a more cohesive workflow across different platforms.

-

How can airSlate SignNow improve the workflow related to the 32 5 form?

With airSlate SignNow, businesses can automate their workflows around the 32 5 form, reducing time spent on manual processes. The platform's user-friendly interface enables quick document preparation and distribution, streamlining the signing process. This leads to faster turnaround times and increased productivity.

-

Is the 32 5 form secure when using airSlate SignNow?

Absolutely! The 32 5 form is secured with industry-standard encryption and compliance measures within airSlate SignNow. We prioritize document security, ensuring that your data remains confidential during the signing process. Our platform also provides audit trails to guarantee transparency and accountability.

-

Can I customize the 32 5 form in airSlate SignNow?

Yes, customization is one of the strongest features of the 32 5 form in airSlate SignNow. You can modify text fields, add logos, or change colors to align the form with your brand identity. This level of customization makes it relevant to your specific business needs.

Get more for Delinquent Earned Income Tax Department

- American history chapter 18 packet cold war conicts form

- Jdf 1111ss form

- What type of doctor specializes in sleep disorders form

- Application to sell foreign currency cross border foreign exchange transaction reporting applicable bank purchase from customer form

- Toyota motor engineering amp manufacturing north form

- Form omha 100 request for administrative law judge alj hearing or review of dismissal hhs

- Entry form dressage 2017 2019

- Jdf 1103 formpdffillercom

Find out other Delinquent Earned Income Tax Department

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy