Form BA 404 Instructions Tax Credits Earned, Applied, and

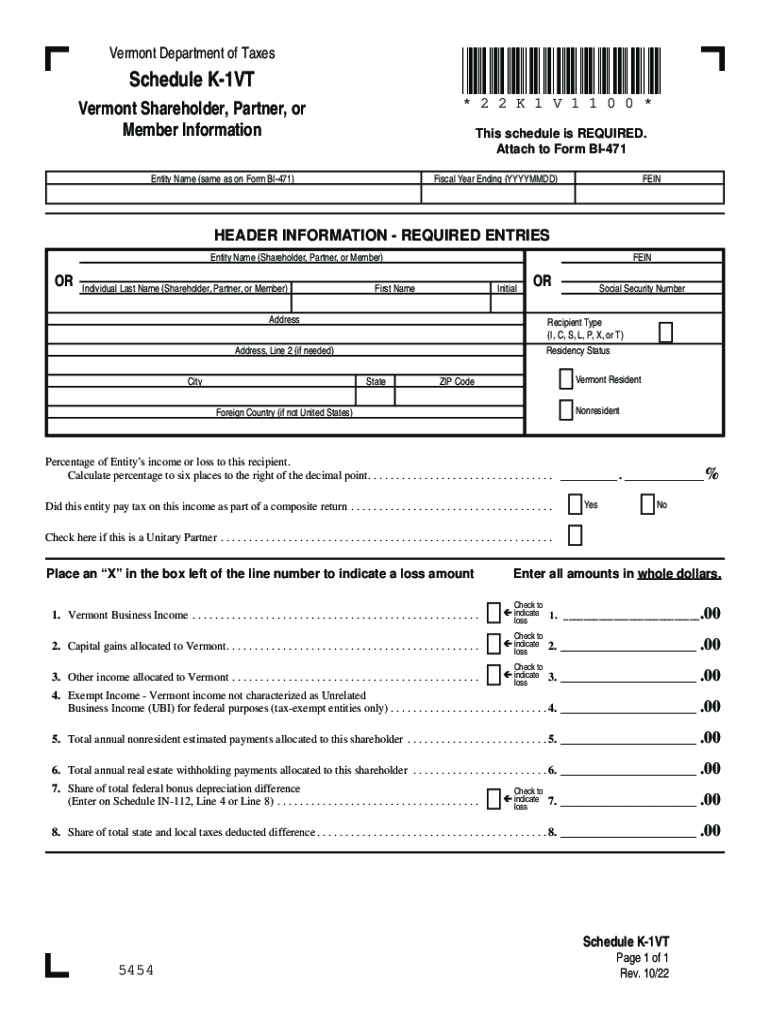

Understanding the VT Schedule K-1VT

The VT Schedule K-1VT is a tax form used to report income, deductions, and credits for partners in a partnership or shareholders in an S corporation in Vermont. It is essential for individuals who are part of a business entity that files taxes as a partnership or S corporation. The form provides detailed information about each partner's or shareholder's share of the entity's income, which is necessary for personal tax filings. Understanding this form is crucial for accurate tax reporting and compliance.

Steps to Complete the VT Schedule K-1VT

Filling out the VT Schedule K-1VT involves several key steps:

- Gather necessary information about the partnership or S corporation, including its federal tax identification number and the names of all partners or shareholders.

- Determine the income, deductions, and credits allocated to each partner or shareholder based on the entity's financial records.

- Complete the form by entering the relevant details, ensuring accuracy in reporting each individual's share of income and deductions.

- Review the completed form for any errors or omissions before submission.

Filing Deadlines for the VT Schedule K-1VT

It is important to be aware of the filing deadlines associated with the VT Schedule K-1VT. Generally, the form must be issued to partners or shareholders by the entity by March fifteenth of the year following the tax year. This allows sufficient time for individuals to incorporate the information into their personal tax returns, which are typically due by April fifteenth. Adhering to these deadlines is essential to avoid penalties and ensure compliance with state tax regulations.

Key Elements of the VT Schedule K-1VT

The VT Schedule K-1VT includes several key elements that are critical for accurate reporting:

- Identification of the partnership or S corporation, including name and address.

- Details about the partner or shareholder, including their name, address, and identification number.

- Income items such as ordinary business income, rental income, and interest income.

- Deductions and credits allocated to each partner or shareholder.

Legal Use of the VT Schedule K-1VT

The legal use of the VT Schedule K-1VT is to ensure that all partners and shareholders report their share of the entity's income accurately. This form serves as a necessary document for tax compliance and is recognized by the Vermont Department of Taxes. Failure to provide accurate information on this form can lead to penalties for both the entity and the individual partners or shareholders.

Obtaining the VT Schedule K-1VT

The VT Schedule K-1VT can be obtained from the Vermont Department of Taxes website or through tax preparation software that supports Vermont tax forms. It is advisable to ensure that you are using the most current version of the form to comply with any updates in tax regulations. Keeping a copy of the completed form for your records is also recommended for future reference.

Quick guide on how to complete form ba 404 instructions tax credits earned applied and

Effortlessly Prepare Form BA 404 Instructions Tax Credits Earned, Applied, And on Any Device

Digital document management has gained signNow traction among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Form BA 404 Instructions Tax Credits Earned, Applied, And on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Form BA 404 Instructions Tax Credits Earned, Applied, And with Ease

- Locate Form BA 404 Instructions Tax Credits Earned, Applied, And and select Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize critical portions of your documents or anonymize sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Form BA 404 Instructions Tax Credits Earned, Applied, And and ensure flawless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ba 404 instructions tax credits earned applied and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1vt partner search in airSlate SignNow?

The 1vt partner search in airSlate SignNow allows businesses to find trusted partners quickly and efficiently. This feature helps streamline the selection process for collaborations by presenting verified partners that fit your specific needs.

-

How does airSlate SignNow support the 1vt partner search?

airSlate SignNow supports the 1vt partner search through its intuitive interface and advanced filtering options. Users can easily navigate the platform to find and evaluate potential partners based on relevant criteria, saving time and effort.

-

What are the pricing options for using the airSlate SignNow 1vt partner search?

Pricing for the airSlate SignNow 1vt partner search is designed to be cost-effective, with various subscription plans to fit different business sizes. Clients can choose a plan that offers the best balance of features and budget, ensuring value for their investment.

-

What benefits does the 1vt partner search provide to businesses?

The 1vt partner search provides numerous benefits, including increased efficiency in finding suitable partners and improved collaboration opportunities. By utilizing this feature, businesses can enhance their operational capabilities and build lasting partnerships.

-

Are there any integrations available for the 1vt partner search?

Yes, airSlate SignNow's 1vt partner search seamlessly integrates with various popular business applications. This connectivity allows users to manage partnerships more effectively and leverage existing tools to maximize workflow efficiency.

-

How user-friendly is the 1vt partner search tool?

The 1vt partner search tool is designed with user-friendliness in mind, featuring a simple navigation system and straightforward search functionalities. Even those new to the platform can quickly learn how to utilize this powerful feature.

-

Can the 1vt partner search benefit remote teams?

Absolutely! The 1vt partner search is ideal for remote teams as it facilitates the discovery of partners regardless of geographical location. This capability enables organizations to collaborate effectively with partners from around the globe.

Get more for Form BA 404 Instructions Tax Credits Earned, Applied, And

- Per0118 pre contract binder rev 11 19 doc form

- This application must be completed for all construction plan submittals excluding one and two family dwellings form

- Building permits ampamp inspections city of pompano beach form

- City of toledobuilding inspection and permitsbuilding permits ampamp inspections city of knoxvillepermitcenter welcome to the form

- City of pompano beachdepartment of development ser form

- Solar and energy loan fund loan application solar and energy loan fund program overview thank you for your interest in the form

- Fence permit application city of lakeland form

- City of pompano beach building department permit search form

Find out other Form BA 404 Instructions Tax Credits Earned, Applied, And

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement