Form 100 2016

What is the Form 100

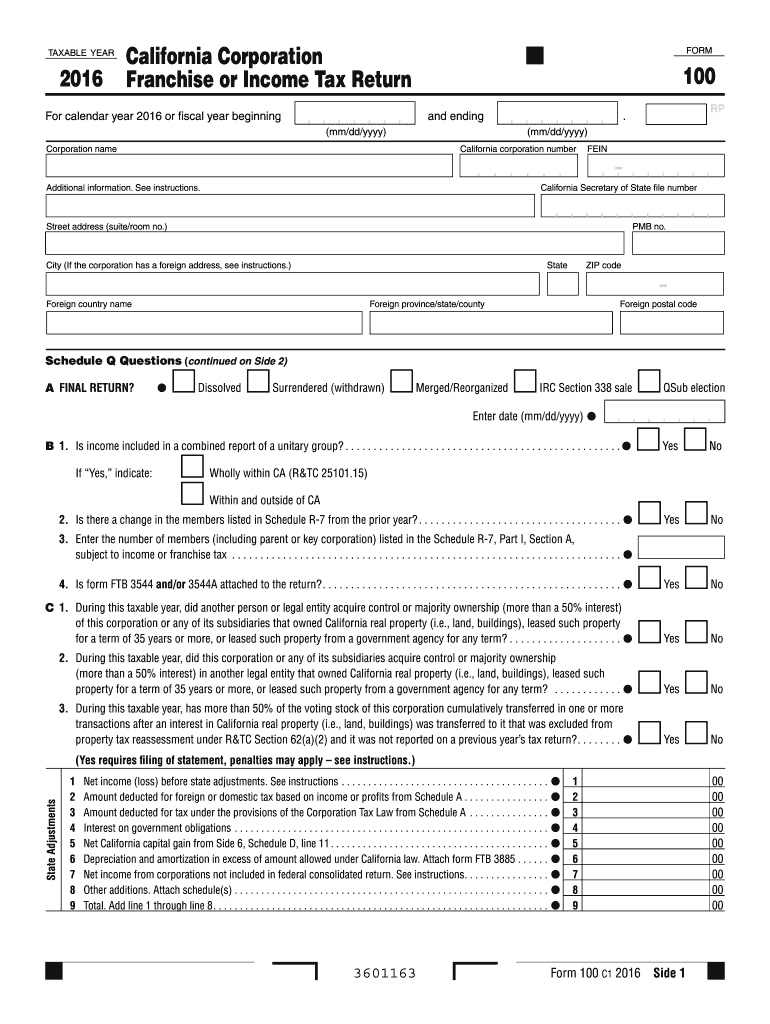

The Form 100 is a tax document used by corporations in the United States to report their income, deductions, and credits to the state tax authority. This form is essential for ensuring compliance with state tax regulations and is typically required for C corporations. It provides a comprehensive overview of a corporation's financial activities over the tax year, allowing the state to assess tax liability accurately. Understanding the purpose and requirements of Form 100 is crucial for any corporation looking to maintain good standing with tax authorities.

How to use the Form 100

Using the Form 100 involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, complete the form by entering relevant information such as total income, allowable deductions, and tax credits. After filling out the form, review it for accuracy, ensuring that all figures are correct and consistent with your financial records. Finally, submit the completed Form 100 to the appropriate state tax authority by the designated deadline to avoid penalties.

Steps to complete the Form 100

Completing the Form 100 requires careful attention to detail. Follow these steps for accurate submission:

- Gather financial records, including income statements and expense reports.

- Fill in the corporation's identification information at the top of the form.

- Report total income from all sources, including sales and other revenue.

- Detail allowable deductions, such as business expenses and depreciation.

- Calculate the taxable income by subtracting deductions from total income.

- Apply any applicable tax credits to reduce the overall tax liability.

- Review the completed form for accuracy and consistency.

- Submit the form by mail or electronically, depending on state requirements.

Legal use of the Form 100

The legal use of Form 100 is governed by state tax laws, which outline the requirements for corporations to report their financial activities. It is essential for corporations to ensure that the information provided is accurate and complete, as discrepancies can lead to audits or penalties. The form must be filed by the deadline set by the state tax authority to maintain compliance and avoid legal issues. Understanding the legal implications of Form 100 is vital for corporate governance and financial accountability.

Filing Deadlines / Important Dates

Filing deadlines for Form 100 can vary by state, but most require submission by the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year basis, this typically means the deadline is April 15. It is important to be aware of any extensions that may be available, as well as specific state holidays or observances that could affect filing dates. Keeping track of these deadlines is crucial for avoiding late fees and maintaining compliance.

Required Documents

When completing Form 100, several documents are necessary to ensure accurate reporting. These typically include:

- Income statements detailing revenue generated during the tax year.

- Balance sheets showing the corporation's assets, liabilities, and equity.

- Documentation of business expenses and deductions claimed.

- Records of any tax credits or incentives the corporation is eligible for.

- Previous year’s tax returns for reference and consistency.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting Form 100, depending on state regulations. Most states allow for electronic filing through their tax authority's website, which can streamline the process and reduce processing times. Alternatively, corporations may choose to mail a paper copy of the form to the appropriate address. In some cases, in-person submission may be available at local tax offices. Understanding the available submission methods can help corporations select the most efficient way to file their taxes.

Quick guide on how to complete form 100 2016

Your assistance manual on how to prepare your Form 100

If you’re interested in learning how to create and submit your Form 100, here are some concise guidelines to simplify tax submission.

To begin, all you need to do is register for your airSlate SignNow account to revolutionize your online document handling. airSlate SignNow offers a highly user-friendly and powerful document management system that enables you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can navigate between text, checkboxes, and eSignatures, and return to modify any responses if necessary. Enhance your tax administration with advanced PDF editing, eSigning, and a simple sharing experience.

Follow the instructions below to complete your Form 100 in just a few minutes:

- Establish your account and start working on PDFs within moments.

- Utilize our catalog to locate any IRS tax form; browse through various versions and schedules.

- Press Get form to access your Form 100 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if required).

- Review your document and correct any errors.

- Save your modifications, print a copy, submit it to your recipient, and download it to your device.

Use this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper submissions may lead to increased errors and delayed refunds. Additionally, before e-filing your taxes, visit the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form 100 2016

FAQs

-

What is the most selfish act you have ever witnessed?

When I was twelve, my dad died. I have five siblings and we ranged at the time from seven years old to eighteen. The eldest was leaving for college that week, but came back and spent the year at home at my mom's request.Before Dad had been dead a whole month, my mom started sort-of dating a sort-of homeless guy (he had been homeless and then was living in an RV on someone's property as their caretaker) my family had helped before (we volunteered for years prior to this at the local homeless shelter).A month. Our father had died of unexpected of complications from heart attacks just a month prior. We four youngest didn't know what was going on at first and she didn't let our older two siblings know. All we knew was that almost every night mom would have us get in the van, and she'd be in her pajamas and robe, and we'd drive down to his place and she'd send us to go play in the yard while she "said goodnight" and "ministered" to him.Eventually she'd come out with a shit-eating smirk, load us up in the van and drive back home.Less than two months after that she moved him into the house and started claiming they were married to everyone. (They weren't.)Why this was so incredibly selfish was because we weren't allowed to grieve anymore after that. We all had to be happy because mom had a new boyfriend-then-husband, and we all felt like we couldn't even talk about Dad anymore. Mom still talked about him but only to force our good behavior, ie: "You are all such terrible children! Your father wanted you to be raised this way and I've sacrificed so much for you...!" He wasn't even a good stepdad. He could have been worse, sure, but he'd fight with mom then storm out of the house and she'd blame it on us.Less than six months after my dad died he and my mom went on a drive and left me to change a curtain rod. I was still twelve and very small for my age, and I couldn't signNow the curtain rod. I tried, hard, but I kept falling off the back of the couch. They got back and saw that I hadn't done it, so the step-dad kept saying to me "Hah, I knew you were useless." while laughing and repeating it over and over like it was hilarious. I lost my temper and said "You're just a fat old man!" (he was 13 years older than my mom so he seemed quite elderly to me.) He, in front of my mother who had been laughing at his denigration of my handyman attempts, grabbed me, shook me hard, and screamed in my face "You stupid little b***ch!" and stormed out of the house.Mom then spanked me for trying to ruin her marriage.I just wanted my dad back, but I couldn't even say that because what if it made the step-dad feel bad?

-

I have scored 100 in CLAT 2017 (Gen). Is this the end of my life? I am a failure.

Hello there, I see that you are in a situation which is very similar to the one which I was in 2015. So let me begin from the beginning. I had always been a good student, always in the top 10 of my class, not exceptionally outstanding but a good student nevertheless. I scored 90% in my tenth boards (went to an ICSE school, almost everyone gets a 90), took up PCM because thats what everyone around me was doing. I joined a JEE coaching and for the next two years struggled to pass in school and in keeping up with the course at the coaching centre. I was miserable and my grades kept on dropping. So cut to 2015. Board year is here again. College applications are an extra addition. I'm barely passing my classes. I see no future for myself. I fill out forms of all engineering exams.Now, here starts the interesting part. I had always been interested in current affairs, and in politics and governance and international relations. I was an avid reader with a good grip on both general knowledge and English. I had known about CLAT for quite a long time so I finally decided that I'll try my luck in CLAT too.The first half of 2015, I slogged really hard, preparing for boards and engineering exams and a little bit for CLAT. Board exams do not go great. The engineering exams were a mixture of good and bad( I cracked some of those, even though my rank wasn't that great). I had joined a month long crash course in April for CLAT preparations.10th May, 2015- Dday arrives. Sadly, I was not equipped for the paper. I scored much less than what I had expected. I scored some 90 odd marks (it was a very low scoring CLAT year). I still remember they released the score 2 days before declaring the rank. I was devastated. I felt like all my dreams were crushed. I had scored a meager 72% in my tweflth boards and I had no desire to study engineering, obviously with this dismal score in boards and due to normalization rules my JEE mains rank was quite a large digit, even though I had qualified a few other engineering exams, those prospects were not very promising.So for the next two days, before declaration of CLAT rank, I used to cry all day long thinking I had no future. Thinking that I was a failure. I felt like I had let down my parents, my teachers and myself. My family tried to console me, but I was so deeply immersed in self-pity and melancholy that I remained gloomy.When I got my CLAT rank, it was not as bad as I thought it would be after seeing my score but it definitely was not what I had hoped for during preparations. Soon the counseling process started. I got NUSRL, Ranchi in the first list. I was both relieved and disappointed at the same time. I was relieved after the score fiasco that atleast I qualified for an NLU but disappointed as I didn't make it to the top tier NLUs. Moreover, NUSRL was a fairly new NLU with its own share of problems. Nevertheless I joined NUSRL and life went on.I felt like I had not given CLAT my 100%, so I decided to attempt CLAT in 2016 too. Now, I was to make this attempt while coping with a full fledged semester in law school. I had to balance law school and my CLAT preparations. Man, it was tough. As a cruel twist of fate, I was again allotted NUSRL, Ranchi in the first list in 2016. That was it, it was an offical sign from the universe that NUSRL was my future. I nearly got debarred for shortage of attendance that semester. So I picked up the broken pieces of my dreams and decided to move on. I am not going to tell you that it was easy, it was really tough. I used to cry myself to sleep every night. I felt like a failure more than ever before. And because I had missed my classes a lot at NUSRL, I had no time to mop around, I had to catch up fast as end semester exams were approaching. May and June, 2016 were really tough for me.But you know what, all these failures made me stronger. I learnt that in life you will not always get what you desire, so sometimes one has to make the most of what one gets. I did the same. I cried and wept and lost heart and struggled but I finally overcame this, I made peace with my situation. I embraced my shortcomings, worked really hard at school, focused on developing myself and I can proudly say that I'm a very different person than what I was an year back, I'm stronger and better at handling failure. I made the best of what I got and became a whole new better person. So I will suggest you to do the same. Embrace and accept your shortcomings and work on them, don't lose heart, keep working hard and never feel like a failure just because you didn't do well on a test, I will not lie to you that test scores don't matter, they do but they are in no way the measure of a person's full potential. Your father is right, don't lose heart, you have the chance to handle failure and make the best of an unfavourable situation. All the very best for your future endeavours. And if you need any help, feel free to ping me, always here to help.-A person who had been in your situation once and learnt how to make the best of it.

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How will private medical colleges accept NEET 2016 scores for admissions? What can be the expected cut off for private colleges?

The most concerned cause of medical admission to the private medical colleges through NEET is hereby brought to the kind notice of the concerned to solve for the benefit of aspiring medical students.1. No problem with the students who gets seats in the 15% of all India quota in the government medical colleges across the country. Because, the admission process is very well streamlined.2. The students who qualified in NEET and wish to take the seats in private medical colleges are not clear with the following issues either from the CBSE or MCC or MCI or State or central authorities till date;a) Are seats in private medical colleges meant for the respective states only or open to all India?, If they are open to all India, the students of the respective states will have no priority of getting seats in the colleges of their own states, but to compete at all India level with all seats of all private medical colleges across the country.b) In private medical colleges, 15-20% of total seats are going to be Management quota (NRI., etc where it is believed that NEET is not necessary) and naturally they are open to all India level ,there is no geographical boundary for such seats. Therefore, seats in private medical colleges, other than management quota, should be made available for the NEET qualified students of the respective states. It is a natural and ethical rights of students of respective states.C) If the private medical college seats are meant for the respective states only, then there should be one all India Rank for 15% of all India quota in Government Medical colleges across the country and one state rank for private medical college seats, other than the Management Quota seats, of respective states.D ) If the state rank is given for the seats of private colleges of respective states, then who will coordinate and allot the seats. There should be single window system like CET or NEET.E) Because, in Karnataka COMEDK has invited application separately from the NEET qualified candidates at all India level to register online by paying somewhere around Rs.600.00 -1000.00 for the seats in the colleges comes under its fold. It is once again one’s own responsibility after qualified in NEET, notwithstanding, his position of NEET ranking has to register afresh. The very purpose of NEET was to avoid multiple competition and spending money for multiple registration and wandering of parents and children for counseling from college to college.F) Apart from COMEDK there are many other medical colleges comes under Private universities and linguistic and religious minorities associations .It seems, Many of them have been told ( not officially known yet) to register individually with all those institutes separately by paying the registration fee somewhere around Rs.1000.00 to 1500.00 once again and apply with NEET rankings. Then how the purpose of NEET shall safeguard the interest of the meritorious candidates according to their order of NEET rankings, if the private colleges are enrolling for the counseling in their colleges separately. In such case, one may easily guess that the order of NEET ranking will be nothing to do with one to get seat, why because the higher ranking candidates may miss the opportunity for the lower rank because he may not be capable of applying for all these colleges separately.G) If the seats of all private medical colleges across the country are open to all India quota and each student need to register separately with each college, as the situation prevails now, there are not less than 250 private medical colleges(according to MCI total 400 + medical colleges – Govt Medical Colleges) in the country and one has to pay Registration fee more or less around Rs.2,50,000.00, at an average of Rs.1000.00 per college, in addition to the traveling cost of attending the counseling at different colleges at different places.H) Is it possible to the candidates to attend the counseling personally across the width and breadth of the nation with in the scheduled time frame and what to do in case of overlap dates of counseling of different colleges at different places.I) The fee in the private medical colleges is very expensive for the poor, lower middle class and middle class people, kindly consider the same to bring in to the limits of affordability as the professionals are going to safe guard the health of the citizens of this nation which is most important and precious.Thanking you,Obediently yours,

-

What's your GATE 2018 result and are you satisfied with it?

I am 2016 pass out from a private college in Mechanical engineering.During campus placements I got placed in TCS, but I didn’t join and opted for coaching from made easy Bhopal. I appeared for GATE 2017 as my first attempt and just cleared the cutoffs by TWO marks.My first attempt was mostly consumed mostly by the fear and some imaginary notion that my preparation is not up to the mark.Braced myself for the second attempt. ( But only doubt I had was “ Will I be able to make that big jump from 30’s to 80’s)Planned everything well this time: Collected all the standard books, studied from them, solved numerals, prepared short notes, formula sheets, took made easy (fully completed) and exergic (half completed) test series. I was constantly under 500 rank in full length test series of made easy. Exergic was a bit too hard to score.In short I did everything I could do.3rd Feb, 2018: Appeared for the morning session. Paper was very much moderate level compared to last year. Attempted 60 questions. ( My best attempt during test series was 55). I was hoping 75+ marks even after normalization.16th March, 2018: My world came crashing down. 63 marks AIR 5099. I was shattered beyond limits. I checked the answers and I found that I had lost 21 marks in silly mistakes. SIMPLE STRAIGHT CALCULATIONS. 16 marks NAT type out of range and rest MCQ. I never felt so hopeless in my entire life as I am feeling now. I am 26 and I have only few psus left I guess to apply even if I attempt gate again.I don’t know what to do and yes I am deeply UNSATISFIED.Suggestion and feedback's from people who has passed this phase in the past. Please!

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How can I prepare for the CSE 2016 (working professional)?

50 hours per week? Wow... You could not have asked for a better. You are safely placed and timed for 2016 CSE. To be confident about cracking CIVILS is being ridiculous. Being ridiculous is an art. You have to practice this art everyday.I started preparing in June last year. But I filled the UPSC form for CSE 2014 itself not thinking about level of my preparation. I appeared in interview last month. When I started I just wanted to go to next stage of exams, but today, I believe that I will not be giving second attempt. I joined classes at Vajiram and Ravi for CS 2015 but I was racing towards 2014. I hardly attended 10-20 classes out of year long course and I feel coaching is overrated. So you are evenly placed with everyone else if you are doing self study. (From this paragraph, my confidence sounds ridiculous, that's what I mean practice it everyday).I will advice you to fill CSE 2015 form. With your present level and consistency, I believe you can easily crack prelims and may also crack mains. Just keep doing 50 hrs per week and you will see ocean of knowledge and opinion you will have before 14th December this year. NCERTs are best books if one is religious with newspaper and good in analysis of issues and do answer writing practice without fail. I have not read yearbook, any economy book, g c leong and any art and culture book so far. You need to work on your strength. Take a second and think what's yours. My strength lies in looking issues broadly, writing positively in constructive fashions, and giving a touch of current affair to every analytical answer. Remember, you are being judged about your general studies on 100 questions, reading a topic or not won't affect more than half percent even if direct questions are asked as all general studies topic are interrelated and you will be able to write something worthy of examiner time for sure.I took teaching and legal assignments in between as an advocate. Trust me, it's in your signNow. 50 hours is really good number. Just don't skip any week and you must study 6-7 hours other than newspaper per day. You will crack CSE 2015, leave 2016. Roman's video is all about nurturing confidence. Internalize that and move ahead. Follow insightsonindia for answer writing practice and other current topics they write regularly. Further, if you want notes of coaching institutes, check out with this shop image runners, they will dispatch the handwritten notes within 24 working hours. Their print is better quality than others. Take subject wise notes, ethics @ vajiram is not good. Do take geography of VAJIRAM. Economy of Vajiram or Sriram. History by Ojha/Baliyan. He will suggest you options and ask someone who is living in Karol bagh area these days.All the best. A2A if you need.

Create this form in 5 minutes!

How to create an eSignature for the form 100 2016

How to make an electronic signature for the Form 100 2016 in the online mode

How to generate an electronic signature for the Form 100 2016 in Chrome

How to make an electronic signature for putting it on the Form 100 2016 in Gmail

How to generate an electronic signature for the Form 100 2016 from your smartphone

How to make an eSignature for the Form 100 2016 on iOS devices

How to create an eSignature for the Form 100 2016 on Android OS

People also ask

-

What is Form 100 and how can airSlate SignNow help with it?

Form 100 is a crucial document for various business processes, including tax reporting and compliance. airSlate SignNow streamlines the process of sending, signing, and managing Form 100, ensuring that your documents are completed efficiently and securely. With our user-friendly platform, you can easily prepare and share Form 100 with your team or clients.

-

How does airSlate SignNow ensure the security of Form 100?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Form 100. Our platform utilizes advanced encryption protocols and complies with industry standards to protect your data. You can confidently send and receive Form 100 knowing that your information is safeguarded.

-

What features does airSlate SignNow offer for managing Form 100?

airSlate SignNow offers a range of features specifically designed to simplify the management of Form 100. You can easily create templates, track document status, and set reminders for signatures. Additionally, our mobile app allows you to manage Form 100 on-the-go, ensuring you never miss a deadline.

-

Is airSlate SignNow affordable for small businesses needing Form 100?

Yes, airSlate SignNow provides a cost-effective solution for businesses of all sizes, including small businesses that need to manage Form 100. Our pricing plans are designed to fit different budgets while offering essential features that enhance productivity. You can choose a plan that best suits your needs without breaking the bank.

-

Can I integrate airSlate SignNow with other software for Form 100 processing?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, making it easier to process Form 100. Whether you use CRM systems, project management tools, or cloud storage services, our integrations allow you to streamline your workflow and keep everything organized.

-

How can airSlate SignNow improve the efficiency of handling Form 100?

By using airSlate SignNow, you can signNowly improve the efficiency of handling Form 100. Our platform automates the signing process, reduces paperwork, and minimizes errors, allowing your team to focus on more critical tasks. With features like bulk sending and status tracking, you can manage multiple Form 100 documents effortlessly.

-

What support options are available if I have questions about Form 100?

When you choose airSlate SignNow for your Form 100 needs, you gain access to comprehensive support options. Our customer service team is available via live chat, email, or phone to assist you with any questions. We also provide extensive resources, including tutorials and FAQs, to help you make the most of our platform.

Get more for Form 100

- Human cheek cell lab report introduction form

- Pesky gnats cbt workbook 212661748 form

- Appraisal note format for bank guarantee fully secured by

- Hotel booking pdf form

- Cdl supplemental form app r0112pdf

- Voucher request form

- Late payment notice child care lounge form

- Huntingdon regional fire and rescue gun raffle form

Find out other Form 100

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors