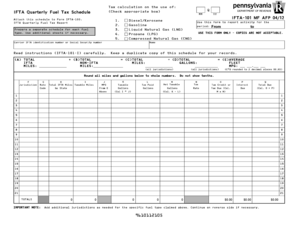

IFTA Quarterly Fuel Tax Schedule IFTA 101 Form

What is the IFTA Quarterly Fuel Tax Schedule IFTA 101

The IFTA Quarterly Fuel Tax Schedule, also known as IFTA 101, is a crucial document for commercial motor carriers operating in multiple jurisdictions. This form is used to report fuel use and calculate taxes owed to various states and provinces under the International Fuel Tax Agreement (IFTA). The IFTA 101 ensures that carriers pay the appropriate fuel taxes based on the miles driven and fuel consumed in each jurisdiction. By consolidating fuel tax reporting, it simplifies compliance for trucking companies operating across state lines.

Steps to Complete the IFTA Quarterly Fuel Tax Schedule IFTA 101

Completing the IFTA 101 involves several key steps:

- Gather necessary data, including total miles driven in each state and fuel purchased.

- Calculate the total fuel consumption and miles for each jurisdiction.

- Determine the tax rates applicable in each state based on the fuel type.

- Fill out the IFTA 101 form with the calculated figures, ensuring accuracy.

- Review the completed form for any discrepancies or missing information.

- Submit the form by the designated filing deadline.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA 101 are critical for compliance. Generally, the forms are due quarterly, with specific deadlines typically falling on the last day of the month following the end of each quarter. For example, the deadlines are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31

It is essential to adhere to these deadlines to avoid penalties and ensure compliance with state regulations.

Required Documents

To complete the IFTA 101, several documents are necessary:

- Fuel purchase receipts showing the amount and type of fuel bought.

- Mileage records detailing the miles driven in each jurisdiction.

- Previous IFTA filings, if applicable, for reference and accuracy.

- Any supporting documentation required by the state in which the form is filed.

Having these documents organized and readily available can streamline the completion process.

Penalties for Non-Compliance

Failing to file the IFTA 101 by the deadline or submitting inaccurate information can result in significant penalties. Common penalties include:

- Late filing penalties that accumulate over time.

- Interest on unpaid taxes, which can increase the total amount owed.

- Potential audits by state authorities, leading to further scrutiny of records.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Digital vs. Paper Version

The IFTA 101 can be completed in both digital and paper formats. Digital versions are often more efficient, allowing for easier calculations and submission. Many states encourage electronic filing, which can expedite processing times and reduce the risk of errors. Paper forms, while still accepted, may require additional time for mailing and processing. Choosing the digital format can provide a more streamlined experience for carriers.

Quick guide on how to complete ifta quarterly fuel tax schedule ifta 101

Complete IFTA Quarterly Fuel Tax Schedule IFTA 101 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle IFTA Quarterly Fuel Tax Schedule IFTA 101 on any device using airSlate SignNow Android or iOS applications and simplify any document-centric task today.

The easiest way to modify and eSign IFTA Quarterly Fuel Tax Schedule IFTA 101 without stress

- Obtain IFTA Quarterly Fuel Tax Schedule IFTA 101 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious searches for forms, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and eSign IFTA Quarterly Fuel Tax Schedule IFTA 101 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta quarterly fuel tax schedule ifta 101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the quarterly fuel tax schedule and why is it important?

The quarterly fuel tax schedule is a timeline established for businesses to report and pay their fuel taxes every three months. This schedule ensures compliance with tax regulations and helps prevent penalties. Understanding this schedule is crucial for fleet operators and logistics companies to maintain financial responsibility.

-

How does airSlate SignNow help manage the quarterly fuel tax schedule?

airSlate SignNow simplifies the management of the quarterly fuel tax schedule by allowing businesses to prepare, sign, and send tax documents electronically. Our platform streamlines the process, reducing errors and ensuring timely submission of tax forms. This efficiency helps businesses focus on their operations rather than paperwork.

-

Are there any costs associated with using airSlate SignNow for quarterly fuel tax filings?

Yes, airSlate SignNow offers a cost-effective pricing structure tailored for businesses of all sizes. Pricing plans vary based on the number of users and features required, making it easy to choose a plan that fits your budget while effectively handling the quarterly fuel tax schedule. We also provide a free trial for you to explore the benefits before committing.

-

What features does airSlate SignNow offer to assist with tax-related documents?

AirSlate SignNow includes features like templates for tax forms, electronic signatures, and automated workflows, which aid in managing your quarterly fuel tax schedule efficiently. Additionally, you can customize documents and track their status, ensuring you meet all deadlines with ease. These features enhance accuracy and save time during tax season.

-

Can airSlate SignNow integrate with accounting software for fuel taxes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing for efficient management of tax data and payments related to the quarterly fuel tax schedule. By syncing your documents and information, these integrations minimize manual data entry and enhance financial accuracy.

-

What are the benefits of using airSlate SignNow for my quarterly fuel tax schedule?

Using airSlate SignNow for your quarterly fuel tax schedule provides numerous benefits, including reduced paperwork, quicker processing times, and improved compliance. The user-friendly platform offers easy document management and sharing, allowing your team to collaborate efficiently. This also leads to lower operational costs and increased productivity.

-

Is training provided for new users managing the quarterly fuel tax schedule?

Yes, airSlate SignNow offers comprehensive training and support for new users to help them understand how to manage their quarterly fuel tax schedule effectively. Our resources include tutorials, webinars, and a dedicated support team to assist with any questions. This ensures that users can fully leverage the platform's features from the start.

Get more for IFTA Quarterly Fuel Tax Schedule IFTA 101

- State form 52802 r6 8 15 cw 2128

- R43 on line 2017 2019 form

- Jonathan govias albertachoralfederation form

- Golden chain award baffidavitb lions of florida lionsofflorida form

- Cable tv application middleburgh telephone form

- Diversion application city of lawrence lawrenceks form

- Small rental property program policy ampamp road2la form

- Superior court of the county of inyo forms and filing

Find out other IFTA Quarterly Fuel Tax Schedule IFTA 101

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online