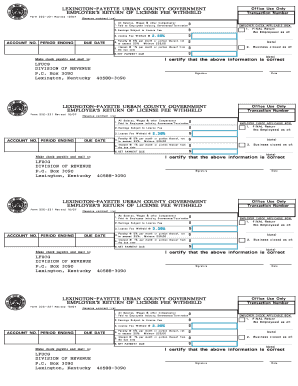

EMPLOYER'S RETURN of LICENSE FEE WITHHELD Form

What is the EMPLOYER'S RETURN OF LICENSE FEE WITHHELD

The EMPLOYER'S RETURN OF LICENSE FEE WITHHELD is a specific form used by employers in the United States to report and remit license fees that have been withheld from employees. This form is essential for ensuring compliance with state and local regulations regarding licensing fees, which may vary based on the industry and location. Employers are responsible for collecting these fees from employees and submitting them to the appropriate authorities.

How to use the EMPLOYER'S RETURN OF LICENSE FEE WITHHELD

Using the EMPLOYER'S RETURN OF LICENSE FEE WITHHELD involves several key steps. First, employers must accurately calculate the total amount of license fees withheld from employees' earnings. Next, they should complete the form with the necessary details, including employee information and the total fees collected. Finally, the completed form must be submitted to the relevant state or local agency by the specified deadline to avoid penalties.

Steps to complete the EMPLOYER'S RETURN OF LICENSE FEE WITHHELD

Completing the EMPLOYER'S RETURN OF LICENSE FEE WITHHELD requires careful attention to detail. Here are the steps to follow:

- Gather all necessary employee information, including names and identification numbers.

- Calculate the total license fees withheld from each employee's paycheck.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check the calculations and information for any errors.

- Submit the form to the appropriate state or local agency, either online or via mail.

Legal use of the EMPLOYER'S RETURN OF LICENSE FEE WITHHELD

The EMPLOYER'S RETURN OF LICENSE FEE WITHHELD must be used in accordance with applicable state and local laws. Employers are legally obligated to withhold the correct amount of fees from employees and report them accurately. Failure to comply with these regulations can result in fines, penalties, or legal action against the employer.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines associated with the EMPLOYER'S RETURN OF LICENSE FEE WITHHELD. These deadlines can vary by state and may be influenced by the frequency of payroll cycles. It is crucial for employers to check with their local regulatory agency to ensure timely submission and avoid potential penalties.

Penalties for Non-Compliance

Non-compliance with the requirements of the EMPLOYER'S RETURN OF LICENSE FEE WITHHELD can lead to significant penalties. These may include fines, interest on unpaid fees, and potential legal repercussions. Employers should prioritize compliance to protect their business and maintain good standing with regulatory authorities.

Quick guide on how to complete employers return of license fee withheld

Complete EMPLOYER'S RETURN OF LICENSE FEE WITHHELD easily on any device

Managing documents online has gained popularity among companies and individuals. It offers a great eco-friendly option to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage EMPLOYER'S RETURN OF LICENSE FEE WITHHELD on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign EMPLOYER'S RETURN OF LICENSE FEE WITHHELD effortlessly

- Obtain EMPLOYER'S RETURN OF LICENSE FEE WITHHELD and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign EMPLOYER'S RETURN OF LICENSE FEE WITHHELD and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employers return of license fee withheld

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EMPLOYER'S RETURN OF LICENSE FEE WITHHELD?

The EMPLOYER'S RETURN OF LICENSE FEE WITHHELD refers to the funds that employers may need to return when certain conditions are met regarding licensing fees. Understanding this concept is crucial for businesses to maintain compliance and avoid penalties. With airSlate SignNow, you can easily manage related documentation for these transactions.

-

How does airSlate SignNow help with EMPLOYER'S RETURN OF LICENSE FEE WITHHELD documentation?

airSlate SignNow provides a streamlined process for creating, signing, and sending documents related to the EMPLOYER'S RETURN OF LICENSE FEE WITHHELD. Our platform ensures that all necessary paperwork is easily accessible and securely managed, simplifying your compliance efforts. This means less time spent on administrative tasks and more focus on growing your business.

-

What are the pricing options for airSlate SignNow in relation to EMPLOYER'S RETURN OF LICENSE FEE WITHHELD transactions?

Our pricing plans are designed to suit various business needs, including those related to EMPLOYER'S RETURN OF LICENSE FEE WITHHELD transactions. We offer flexible monthly and annual subscription options that provide access to all features needed for efficient document management. Additionally, our cost-effective solution assures that compliance is affordable for businesses of all sizes.

-

What features does airSlate SignNow offer for managing EMPLOYER'S RETURN OF LICENSE FEE WITHHELD documents?

airSlate SignNow offers several features to help manage EMPLOYER'S RETURN OF LICENSE FEE WITHHELD documents efficiently. These include eSigning, cloud storage, audit trails, and customizable templates, all designed to enhance your document workflow. Our user-friendly interface ensures that your team can easily navigate the process without needing extensive training.

-

Can airSlate SignNow integrate with other tools for managing EMPLOYER'S RETURN OF LICENSE FEE WITHHELD?

Yes, airSlate SignNow integrates seamlessly with various business tools to help manage EMPLOYER'S RETURN OF LICENSE FEE WITHHELD more effectively. Whether you use CRM systems, accounting software, or project management tools, our integration capabilities simplify workflows and improve efficiency. This means you can keep all related tasks connected and in one place.

-

What are the benefits of using airSlate SignNow for EMPLOYER'S RETURN OF LICENSE FEE WITHHELD?

Using airSlate SignNow for EMPLOYER'S RETURN OF LICENSE FEE WITHHELD provides several benefits, including time savings and improved accuracy in documentation. Our electronic signature platform enables quick turnaround times while maintaining security and compliance. Additionally, businesses can track all transactions, ensuring that nothing falls through the cracks.

-

Is there a trial period available for airSlate SignNow to manage EMPLOYER'S RETURN OF LICENSE FEE WITHHELD?

Yes, airSlate SignNow offers a free trial that allows users to explore all our features related to managing EMPLOYER'S RETURN OF LICENSE FEE WITHHELD. During the trial, you can assess how our solution meets your needs and improves your workflow. This risk-free opportunity helps you make an informed decision before committing to a subscription.

Get more for EMPLOYER'S RETURN OF LICENSE FEE WITHHELD

- Colposcopy report form

- Consent to disclose utility customer data xcel energy form

- Form ad 1048 2015 2019

- M ind bo dy hea rt wholesoldier counseling form tradoc news

- Recital dvd order form recital t shirt order form miss jenniferamp39s

- Notice of commencement bonita springs form

- Daisy tunic amp vest insignia girl scouts dakota horizons gsdakotahorizons form

- The nef application form r250 000 r75 million

Find out other EMPLOYER'S RETURN OF LICENSE FEE WITHHELD

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF