Gift Tax Return Questionnaire FORM 709

What is the Gift Tax Return Questionnaire FORM 709

The Gift Tax Return Questionnaire FORM 709 is a tax form used in the United States to report gifts made during the tax year that exceed the annual exclusion limit. This form is essential for individuals who have made substantial gifts to others, as it helps the IRS track potential gift tax liabilities. The form includes detailed information about the donor, the recipient, and the value of the gifts provided. It is important to note that while the form is primarily for reporting purposes, it can also affect the lifetime gift tax exemption available to the donor.

Steps to complete the Gift Tax Return Questionnaire FORM 709

Completing the Gift Tax Return Questionnaire FORM 709 involves several key steps:

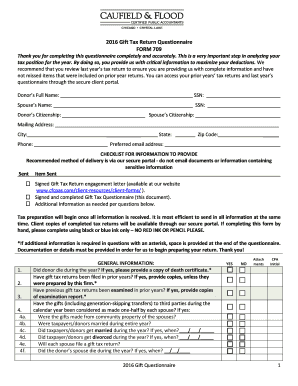

- Gather all necessary information about the gifts made, including dates, values, and recipient details.

- Fill out the personal information section, including the donor's name, address, and Social Security number.

- Detail each gift on the form, ensuring to include the fair market value at the time of the gift.

- Indicate any applicable exclusions, such as gifts to a spouse or for educational or medical expenses.

- Review the completed form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

The deadline for filing the Gift Tax Return Questionnaire FORM 709 is typically April fifteenth of the year following the year in which the gifts were made. If the donor files for an extension on their income tax return, this extension also applies to the gift tax return. However, any gift tax owed must still be paid by the original due date to avoid penalties and interest.

Required Documents

When completing the Gift Tax Return Questionnaire FORM 709, certain documents are necessary to support the information provided. These may include:

- Documentation of the value of the gifts, such as appraisals or receipts.

- Records of any prior gift tax returns filed, if applicable.

- Information about the recipients of the gifts, including their names and addresses.

Form Submission Methods

The Gift Tax Return Questionnaire FORM 709 can be submitted in several ways. Taxpayers have the option to file the form electronically through approved tax software or by mailing a paper copy to the appropriate IRS address. It is important to ensure that the form is sent to the correct location based on the taxpayer's state of residence. For those filing electronically, using a reliable e-filing service can streamline the process and reduce the risk of errors.

Penalties for Non-Compliance

Failure to file the Gift Tax Return Questionnaire FORM 709 when required can result in significant penalties. The IRS may impose a penalty of up to five percent of the tax due for each month the return is late, with a maximum penalty of twenty-five percent. Additionally, if the failure to file is deemed fraudulent, the penalties can increase substantially. It is crucial for taxpayers to understand their obligations to avoid these consequences.

Quick guide on how to complete gift tax return questionnaire form 709

Complete Gift Tax Return Questionnaire FORM 709 effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Gift Tax Return Questionnaire FORM 709 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Gift Tax Return Questionnaire FORM 709 with ease

- Locate Gift Tax Return Questionnaire FORM 709 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of misplaced or lost documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Edit and eSign Gift Tax Return Questionnaire FORM 709 and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gift tax return questionnaire form 709

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a gift tax return 709?

A gift tax return 709 is a federal form required by the IRS to report gifts exceeding the annual exclusion limit. Filing this return helps ensure any taxable gifts are documented correctly and can assist in managing your tax liability related to gifts.

-

Who is required to file a gift tax return 709?

Anyone who gives gifts valued over the annual exclusion amount must file a gift tax return 709. This includes individuals who provide cash or property to others, ensuring that compliance with tax regulations is maintained.

-

What are the costs associated with using airSlate SignNow for my gift tax return 709?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs. By choosing our services for your gift tax return 709, you gain access to an affordable solution that also streamlines the signing process.

-

Can I eSign my gift tax return 709 using airSlate SignNow?

Yes, airSlate SignNow allows you to eSign documents, including your gift tax return 709, easily and securely. Our platform ensures that your signatures are legally compliant and saved for future reference.

-

What are the benefits of using airSlate SignNow for gift tax return 709 filings?

Using airSlate SignNow for your gift tax return 709 provides a simple, efficient way to manage and sign your documents. The platform’s user-friendly interface saves time and ensures accuracy, reducing the stress of tax compliance.

-

Does airSlate SignNow integrate with other accounting software for gift tax returns?

Yes, airSlate SignNow seamlessly integrates with popular accounting software to enhance the filing process for your gift tax return 709. This integration allows for smooth data transfers and improved workflow for your tax-related documents.

-

Is there customer support available for queries related to the gift tax return 709?

Absolutely! airSlate SignNow provides dedicated customer support to assist with your gift tax return 709 and any other related queries. Our team is ready to help you navigate the process and resolve any issues you may encounter.

Get more for Gift Tax Return Questionnaire FORM 709

- Authorization for release of health information montefiore nyack

- Leave without pay request form 1002 doc corporate rfmh

- Failure to provide information may interfere with

- Nyscopba dental insurance form

- Spgg registration form docx

- Update of address and contact details form

- Fremont25 form

- Record of pledges b3cdnnet form

Find out other Gift Tax Return Questionnaire FORM 709

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement