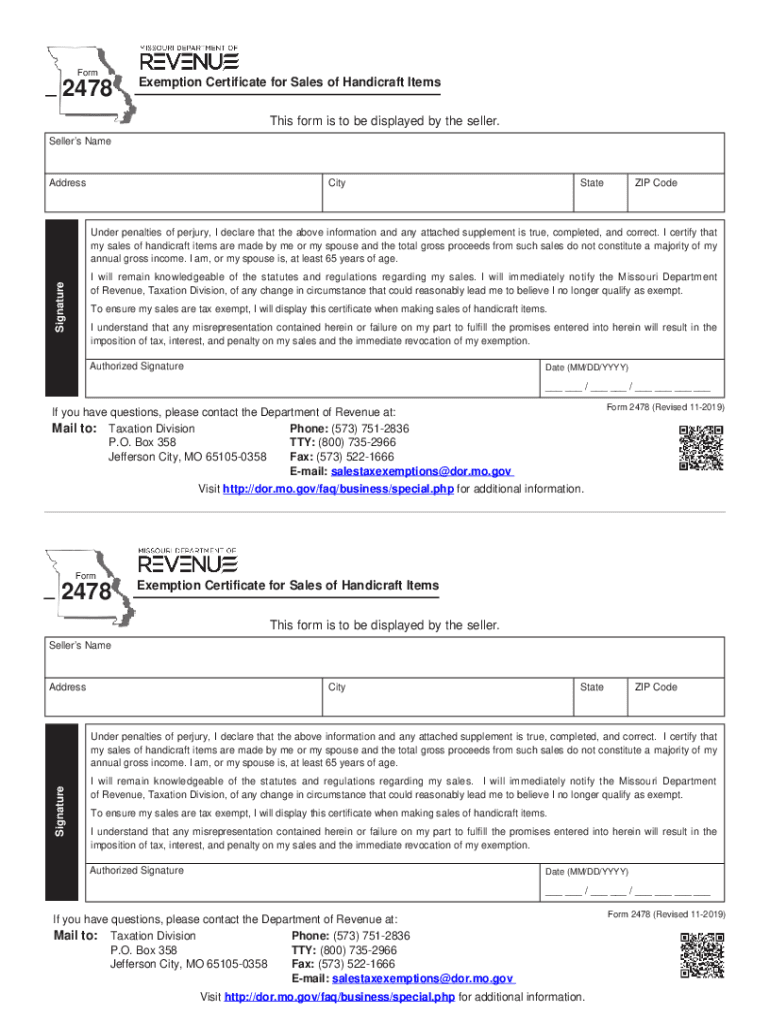

Form 2478 Missouri Department of Revenue

What is the Form 2478 Missouri Department Of Revenue

The Form 2478 is a document utilized by the Missouri Department of Revenue for specific tax-related purposes. This form is primarily associated with the reporting of income and tax liabilities for individuals and businesses operating within the state of Missouri. It serves as a means for taxpayers to disclose relevant financial information to ensure compliance with state tax laws.

How to use the Form 2478 Missouri Department Of Revenue

Using the Form 2478 involves accurately filling out the required fields with pertinent financial data. Taxpayers must ensure that all information is complete and correct to avoid delays or penalties. The form can be used to report income, calculate tax liabilities, and claim any applicable deductions or credits. It is essential to follow the instructions provided with the form to ensure proper submission.

Steps to complete the Form 2478 Missouri Department Of Revenue

Completing the Form 2478 involves several key steps:

- Gather necessary documentation, including income statements and previous tax returns.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income accurately.

- Calculate total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Key elements of the Form 2478 Missouri Department Of Revenue

Key elements of the Form 2478 include personal identification information, income reporting sections, and tax calculation fields. Taxpayers must provide detailed information regarding their income sources, including wages, self-employment earnings, and any other taxable income. Additionally, there are sections for claiming deductions and credits, which can significantly impact the overall tax liability.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2478 typically align with the annual tax filing season. Taxpayers should be aware of the specific due dates, which may vary each year. Generally, the deadline for submission is April fifteenth, unless it falls on a weekend or holiday, in which case it may be extended. It is crucial to stay informed about any changes to these dates to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The Form 2478 can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online submission via the Missouri Department of Revenue's official website.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at local Department of Revenue offices.

Penalties for Non-Compliance

Failure to submit the Form 2478 on time or providing inaccurate information can result in penalties imposed by the Missouri Department of Revenue. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is essential for taxpayers to understand the importance of compliance and to seek assistance if needed to avoid these consequences.

Quick guide on how to complete form 2478 missouri department of revenue

Prepare Form 2478 Missouri Department Of Revenue effortlessly on any device

Online document management has surged in popularity among enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 2478 Missouri Department Of Revenue on any device with airSlate SignNow’s Android or iOS applications and streamline any document-based tasks today.

How to alter and eSign Form 2478 Missouri Department Of Revenue with ease

- Obtain Form 2478 Missouri Department Of Revenue and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your preference. Modify and eSign Form 2478 Missouri Department Of Revenue to ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2478 missouri department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2478 and how can airSlate SignNow help with it?

Form 2478 is a document used for various reporting purposes. airSlate SignNow simplifies the process of filling out and signing form 2478 electronically, allowing businesses to manage their documentation efficiently without the hassle of printing or scanning.

-

What are the pricing options for using airSlate SignNow for form 2478?

airSlate SignNow offers flexible pricing plans that cater to different business needs when handling form 2478. You can choose from a variety of subscription models based on the number of users and features you require, ensuring a cost-effective solution for your document management.

-

Can I integrate airSlate SignNow with other software while handling form 2478?

Yes, airSlate SignNow provides seamless integrations with numerous third-party applications. This allows you to streamline your workflow when managing form 2478 alongside other tools you may already use in your business processes.

-

What features does airSlate SignNow offer to manage form 2478?

airSlate SignNow includes features such as document templates, customizable fields, and a secure eSignature solution for form 2478. These tools enable users to complete documents efficiently while ensuring compliance and security.

-

How does eSigning form 2478 benefit businesses?

eSigning form 2478 through airSlate SignNow accelerates the signing process, allowing businesses to close deals faster. It eliminates the delays of traditional paper methods, enhancing productivity and improving the customer experience.

-

Is there customer support available for users handling form 2478?

Absolutely! airSlate SignNow provides robust customer support for users dealing with form 2478. Whether you need help with technical issues or guidance on best practices, our team is ready to assist you at any time.

-

Are there any security measures for handling form 2478 with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including form 2478. Our platform employs advanced encryption and compliance standards to ensure that your sensitive information remains protected throughout the signing process.

Get more for Form 2478 Missouri Department Of Revenue

- Storm water construction site notice of intent dnr wi form

- Assigned office form

- Sbd 118 department of safety amp professional services wisconsin dsps wi form

- Personal history questionnaire 2015 2018 form

- Tceq 10055 2016 2019 form

- Txr150000 2013 2019 form

- Alarm application pg 1 the city of san antonio form

- City of lubbock block party permit 2015 2019 form

Find out other Form 2478 Missouri Department Of Revenue

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT