150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer Form

What is the 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer

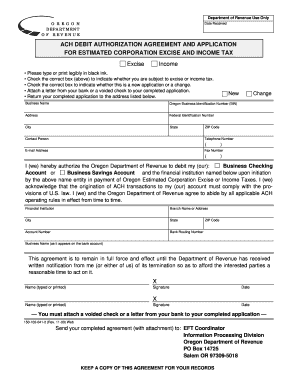

The form 150 102 041, known as the Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer, is a crucial document used by corporations in the United States to report and pay estimated excise and income taxes electronically. This form facilitates the transfer of funds directly from a corporation's bank account to the appropriate tax authority, ensuring timely and accurate tax payments. It is designed to streamline the payment process, reducing the need for paper checks and manual submissions.

How to use the 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer

To effectively use the 150 102 041, corporations must first gather necessary financial information, including estimated tax liabilities for the upcoming period. After completing the form, businesses can initiate an ACH debit transaction through their bank or financial institution. This method allows for direct withdrawal of funds, ensuring that payments are processed securely and efficiently. It is important to verify that all details are accurate to avoid any delays or issues with tax compliance.

Steps to complete the 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer

Completing the 150 102 041 involves several key steps:

- Gather all financial records and estimated tax calculations.

- Fill out the form with accurate information, including the corporation's name, tax identification number, and payment amount.

- Review the form for any errors or omissions.

- Submit the completed form electronically through your bank's ACH service.

- Retain a copy of the submission for your records.

Legal use of the 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer

The legal use of the 150 102 041 is governed by federal and state tax regulations. Corporations are required to file this form to comply with tax obligations, and failure to do so may result in penalties. It is essential for businesses to understand the legal implications of using this form, including adherence to deadlines and accurate reporting of estimated tax liabilities. Consulting with a tax professional can help ensure compliance with all legal requirements.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines associated with the 150 102 041. Typically, estimated tax payments are due quarterly, and it is crucial to submit the form by the designated dates to avoid penalties. These dates may vary depending on the state and the corporation's fiscal year. Keeping a calendar of these deadlines can help ensure timely submissions and maintain compliance with tax regulations.

Required Documents

To complete the 150 102 041, corporations should prepare several documents, including:

- Financial statements showing estimated income and expenses.

- Previous tax returns for reference.

- Any relevant state-specific tax guidelines or forms.

Having these documents ready will facilitate a smoother completion process and ensure accuracy in reporting estimated tax liabilities.

Quick guide on how to complete 150 102 041 estimated corporation excise amp income ach debit electronic funds transfer

Effortlessly complete 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Manage 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer on any device using airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

How to modify and eSign 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer with ease

- Obtain 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to store your changes.

- Choose how you would like to share your form, via email, SMS, or an invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 150 102 041 estimated corporation excise amp income ach debit electronic funds transfer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer?

The 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer is a convenient method for corporations to make estimated tax payments electronically. By using this feature, businesses can streamline their financial processes and reduce the risk of payment errors. It offers a secure and efficient way to manage corporate taxes online.

-

How does airSlate SignNow facilitate the 150 102 041 payment process?

AirSlate SignNow provides an easy-to-use platform that simplifies the 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer. Our solution allows users to securely send and eSign required documentation without hassles, ensuring timely payments and compliance with tax regulations. This efficiency ultimately saves businesses both time and money.

-

What are the benefits of using airSlate SignNow for the 150 102 041 payment?

Using airSlate SignNow for the 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer offers numerous benefits including enhanced security, reduced paperwork, and increased efficiency. Our platform ensures that your payments and documents are securely processed, allowing you to focus on your core business activities. Simplifying this process can lead to signNow savings on time and costs.

-

Is there a fee associated with using the 150 102 041 ACH Debit feature?

AirSlate SignNow offers competitive pricing for its services, including the 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer. While users may incur standard transaction fees, our platform ensures that you receive signNow value through improved efficiency and reduced administrative overhead. Detailed pricing can be found on our website.

-

Can I integrate airSlate SignNow with accounting software for the 150 102 041 transfer?

Yes, airSlate SignNow can be seamlessly integrated with various accounting software systems to enhance your 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer process. This integration allows for automatic updates and synchronization of financial data, ensuring accurate record-keeping. You can easily manage your corporate tax payments along with your overall financial operations.

-

What security measures are in place for the 150 102 041 ACH Debit transactions?

AirSlate SignNow prioritizes your security with advanced measures for the 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer. We utilize encryption protocols, secure data storage, and multi-factor authentication to protect sensitive information. This commitment to security helps businesses feel confident about processing their tax payments online.

-

How long does it take for the 150 102 041 payment to process?

Typically, transactions for the 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer are processed within 1-3 business days. However, processing times may vary based on your bank and the timing of the transaction. It's important to plan ahead to ensure that your payments are submitted on time to avoid penalties.

Get more for 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer

Find out other 150 102 041, Estimated Corporation Excise & Income ACH Debit Electronic Funds Transfer

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form