Tax Relief for SpousesInternal Revenue Service Form

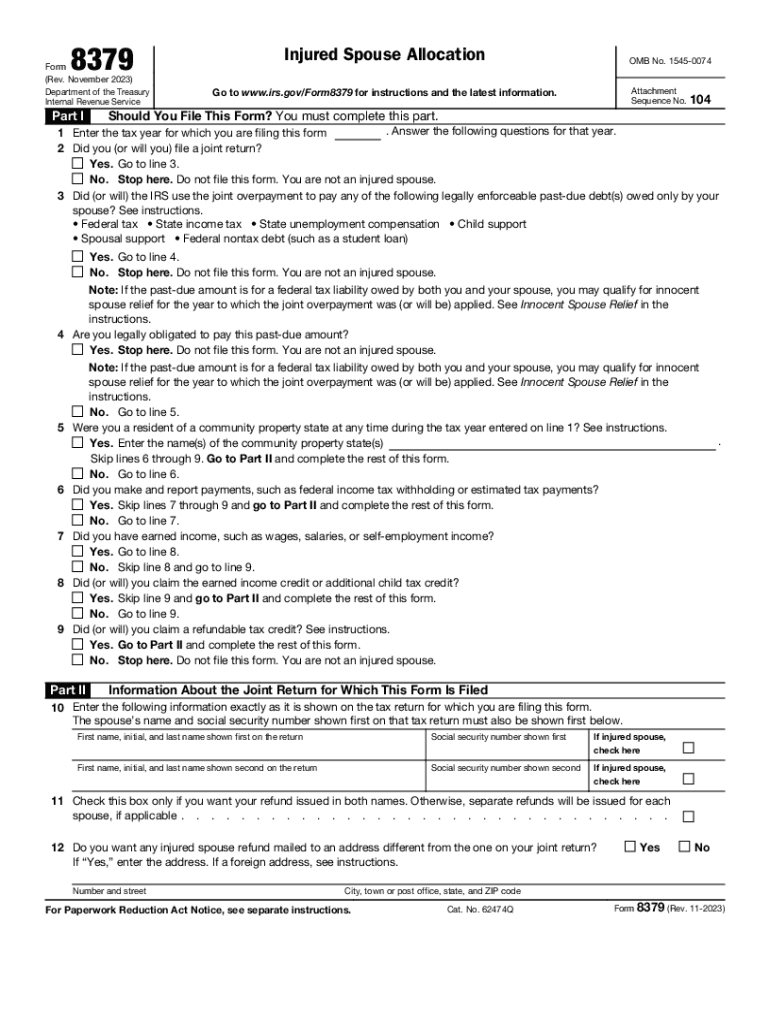

What is the injured spouse form?

The injured spouse form, officially known as IRS Form 8379, is a tax form used by individuals who are married but filing jointly. This form allows a spouse to request their share of a tax refund when the other spouse has outstanding debts, such as federal tax liabilities, student loans, or child support. By submitting this form, the injured spouse can protect their portion of the refund from being applied to these debts, ensuring they receive the funds they are entitled to.

Eligibility criteria for filing Form 8379

To qualify for filing the injured spouse form, certain conditions must be met:

- Both spouses must file a joint tax return.

- The injured spouse must have reported income on the joint return.

- The refund must be due to the injured spouse's income, tax payments, or credits.

- The other spouse must have a debt that is subject to offset, such as unpaid federal taxes or child support.

Steps to complete Form 8379

Filling out the injured spouse form involves several straightforward steps:

- Obtain a copy of IRS Form 8379, which can be downloaded as a fillable PDF.

- Provide your personal information, including your name, Social Security number, and address.

- Fill in your spouse's information in the designated section.

- Detail the income and tax payments you made that contribute to the refund.

- Sign and date the form, ensuring all information is accurate before submission.

Form submission methods

Once Form 8379 is completed, it can be submitted in various ways:

- Online: If you e-file your tax return, you can include Form 8379 as part of your submission.

- By mail: If you are filing a paper return, attach Form 8379 to your return and send it to the appropriate IRS address.

- In-person: You may also bring the completed form to your local IRS office for submission.

Required documents for filing

To successfully file the injured spouse form, you will need several documents:

- Your completed joint tax return.

- Documentation of any income you earned, such as W-2s or 1099s.

- Records of tax payments made, including withholding and estimated payments.

- Any notices from the IRS regarding offsets or debts owed by your spouse.

IRS guidelines for Form 8379

The IRS provides specific guidelines for completing and submitting the injured spouse form. It is important to follow these instructions closely to avoid delays in processing:

- Ensure all information is accurate and complete.

- File the form as soon as possible to expedite the refund process.

- Keep copies of all documents submitted for your records.

Quick guide on how to complete tax relief for spousesinternal revenue service

Complete Tax Relief For SpousesInternal Revenue Service seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Tax Relief For SpousesInternal Revenue Service on any device using the airSlate SignNow Android or iOS applications and streamline any document-based task today.

The easiest way to modify and eSign Tax Relief For SpousesInternal Revenue Service with ease

- Obtain Tax Relief For SpousesInternal Revenue Service and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight important sections of the documents or mask sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your adjustments.

- Choose how you want to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign Tax Relief For SpousesInternal Revenue Service and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax relief for spousesinternal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 8379 fillable and how can I use it?

A form 8379 fillable is an electronic version of the IRS form that allows you to claim an injured spouse allocation. You can complete it easily using airSlate SignNow, which provides an intuitive interface for entering your information. Leveraging this fillable form can save you time and reduce the likelihood of errors.

-

How does airSlate SignNow handle form 8379 fillable submissions?

With airSlate SignNow, filling out a form 8379 fillable is straightforward. You can fill in the required fields, sign electronically, and submit your completed form directly from the platform. This seamless process enhances efficiency and ensures your documents are submitted correctly.

-

Is there a cost associated with using the form 8379 fillable feature in airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to features like the form 8379 fillable. With subscription options tailored to different business needs, you can choose the plan that best fits your budget and operational requirements.

-

What features are included with the airSlate SignNow form 8379 fillable?

The form 8379 fillable in airSlate SignNow comes with a variety of helpful features, including electronic signatures, document tracking, and secure storage. Additionally, you can easily customize your forms to meet your specific needs, making the process even more efficient.

-

Can I integrate airSlate SignNow with other applications for using form 8379 fillable?

Yes, airSlate SignNow allows integration with numerous third-party applications, enhancing your workflow. You can connect with platforms like Google Drive, Salesforce, and more to streamline the process of filling out your form 8379 fillable, ensuring better collaboration and efficiency.

-

What are the benefits of using airSlate SignNow for my form 8379 fillable?

Using airSlate SignNow for your form 8379 fillable provides multiple benefits, including time savings, reduced paperwork, and enhanced security. The ability to complete, sign, and store your documents electronically helps you focus on your core business activities without getting bogged down in administration.

-

Is the form 8379 fillable legally binding when signed through airSlate SignNow?

Yes, the form 8379 fillable signed through airSlate SignNow is legally binding. The platform complies with e-signature laws, ensuring that your electronic signatures on official documents hold the same legal weight as traditional signatures. This guarantees that your submitted forms will be accepted by the IRS.

Get more for Tax Relief For SpousesInternal Revenue Service

Find out other Tax Relief For SpousesInternal Revenue Service

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed