Annual IRS Unemployment Tax Forms Confirm FUTA

Understanding the Annual IRS Unemployment Tax Forms

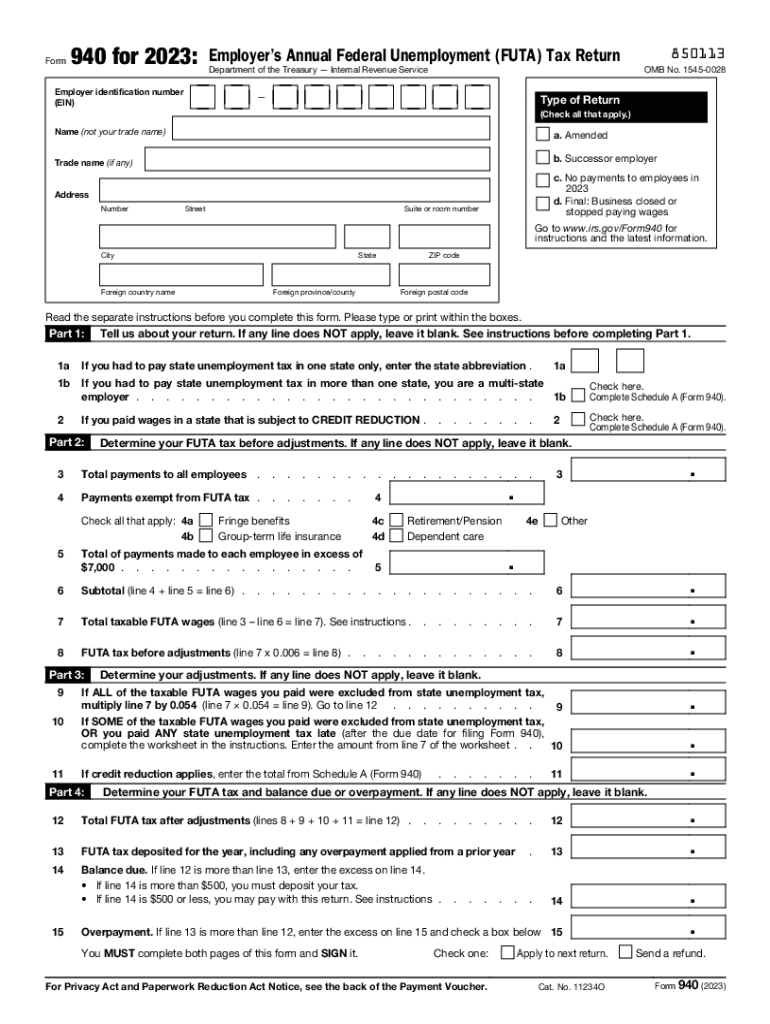

The Annual IRS Unemployment Tax Forms, specifically the IRS Form 940, are essential for employers in the United States. This form is used to report and pay the Federal Unemployment Tax Act (FUTA) tax, which funds unemployment benefits. Employers must file this form annually if they meet certain criteria, such as having paid $1,500 or more in wages during any calendar quarter or having had at least one employee for some part of a day in any 20 or more weeks during the current or preceding calendar year.

Steps to Complete the Annual IRS Unemployment Tax Forms

Completing the IRS Form 940 involves several key steps:

- Gather necessary information, including total wages paid and any state unemployment tax credits.

- Fill out the form accurately, ensuring that all sections are completed, including the calculation of FUTA tax owed.

- Review the form for any errors or omissions before submission.

- Choose a submission method: electronically through approved software or by mailing a paper form to the IRS.

Filing Deadlines and Important Dates

Employers must be aware of the filing deadlines for the IRS Form 940. The form is due by January 31 of the following year for the tax year being reported. If you are paying FUTA tax in quarterly installments, the due dates for those payments are April 30, July 31, October 31, and January 31. Late filings may incur penalties, so timely submission is crucial.

Penalties for Non-Compliance

Failure to file the IRS Form 940 on time can result in significant penalties. The IRS imposes a penalty of five percent of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25 percent. Additionally, if the form is not filed at all, the IRS may impose further penalties and interest on the unpaid tax amount.

Key Elements of the Annual IRS Unemployment Tax Forms

Key elements of the IRS Form 940 include:

- Employer Identification Number (EIN): A unique number assigned to businesses for tax purposes.

- Total wages paid: The total amount of wages subject to FUTA tax.

- State unemployment tax credits: Any credits that can reduce the FUTA tax liability.

- Final tax calculation: The total FUTA tax owed after applying any credits.

Obtaining the Annual IRS Unemployment Tax Forms

The IRS Form 940 can be obtained directly from the IRS website or through tax preparation software. Employers can also request a paper form by contacting the IRS. It is important to ensure that you are using the correct version of the form for the applicable tax year, as forms may change from year to year.

Quick guide on how to complete annual irs unemployment tax forms confirm futa

Complete Annual IRS Unemployment Tax Forms Confirm FUTA seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly with no delays. Handle Annual IRS Unemployment Tax Forms Confirm FUTA on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Annual IRS Unemployment Tax Forms Confirm FUTA with ease

- Locate Annual IRS Unemployment Tax Forms Confirm FUTA and click on Get Form to begin.

- Take advantage of the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and eSign Annual IRS Unemployment Tax Forms Confirm FUTA and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annual irs unemployment tax forms confirm futa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the annual pricing structure for airSlate SignNow?

The annual pricing for airSlate SignNow offers signNow savings compared to monthly subscriptions. By opting for the annual plan, businesses can benefit from predictable costs and reduced expenses over the year. This plan is ideal for organizations looking to maximize their budget while ensuring seamless document signing capabilities.

-

What features are included in the annual subscription of airSlate SignNow?

The annual subscription of airSlate SignNow includes a comprehensive suite of features designed to streamline document management. Users gain access to unlimited eSigning, templates, document tracking, and advanced security options. This ensures that businesses have all the necessary tools for efficient and secure document workflows throughout the year.

-

How does airSlate SignNow enhance business productivity on an annual basis?

By using airSlate SignNow on an annual basis, businesses can greatly enhance their productivity through automated workflows and quick document turnaround times. The platform reduces the time spent on paperwork, allowing teams to focus on more strategic tasks. Additionally, the ease of use ensures that employees can swiftly adopt the solution without extensive training.

-

Are there any discounts for committing to an annual plan with airSlate SignNow?

Yes, airSlate SignNow offers attractive discounts for customers who commit to an annual plan. These discounts can lead to substantial savings compared to the monthly payment option. By selecting the annual option, users can optimize their expenditure while benefiting from a reliable and user-friendly document signing solution.

-

Can airSlate SignNow integrate with other software on an annual basis?

Absolutely! The annual plan of airSlate SignNow allows seamless integration with various third-party applications, enhancing its functionality. Integrations with platforms like Google Drive, Salesforce, and Dropbox enable businesses to streamline workflows and improve collaboration. This versatility in integrations helps users maintain a cohesive operational environment year-round.

-

Is there a limit to the number of documents I can sign annually with airSlate SignNow?

No, there is no limit to the number of documents you can sign annually with airSlate SignNow, making it an excellent choice for businesses with high document volume. The annual subscription provides unlimited access to eSigning, allowing teams to manage their documents without the worry of surpassing quotas. This flexibility supports continuous business operations regardless of demand.

-

What are the benefits of using airSlate SignNow's annual plan for small businesses?

The annual plan of airSlate SignNow offers a host of benefits specifically for small businesses, including cost savings and features designed for scalability. By committing to an annual subscription, small businesses can manage expenses better while accessing powerful eSigning tools. This solution is tailored to support growth without compromising on document security or user-friendliness.

Get more for Annual IRS Unemployment Tax Forms Confirm FUTA

- Ia form 2015

- Ia form 2017

- Iowa 8453 ind 2013 2019 form

- Iowa sales tax exemption certificate energy used in processing or form

- Energy used in processing of agriculture form

- Iowa sales tax exemption certificate energy used in processing or 6964540 form

- Iowa form contractor 2013

- Iowa form contractor 2016 2019

Find out other Annual IRS Unemployment Tax Forms Confirm FUTA

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online