INDIVIDUAL UNIQUE FORM Feb 20 19 Pmd

Understanding Form 482 in Puerto Rico

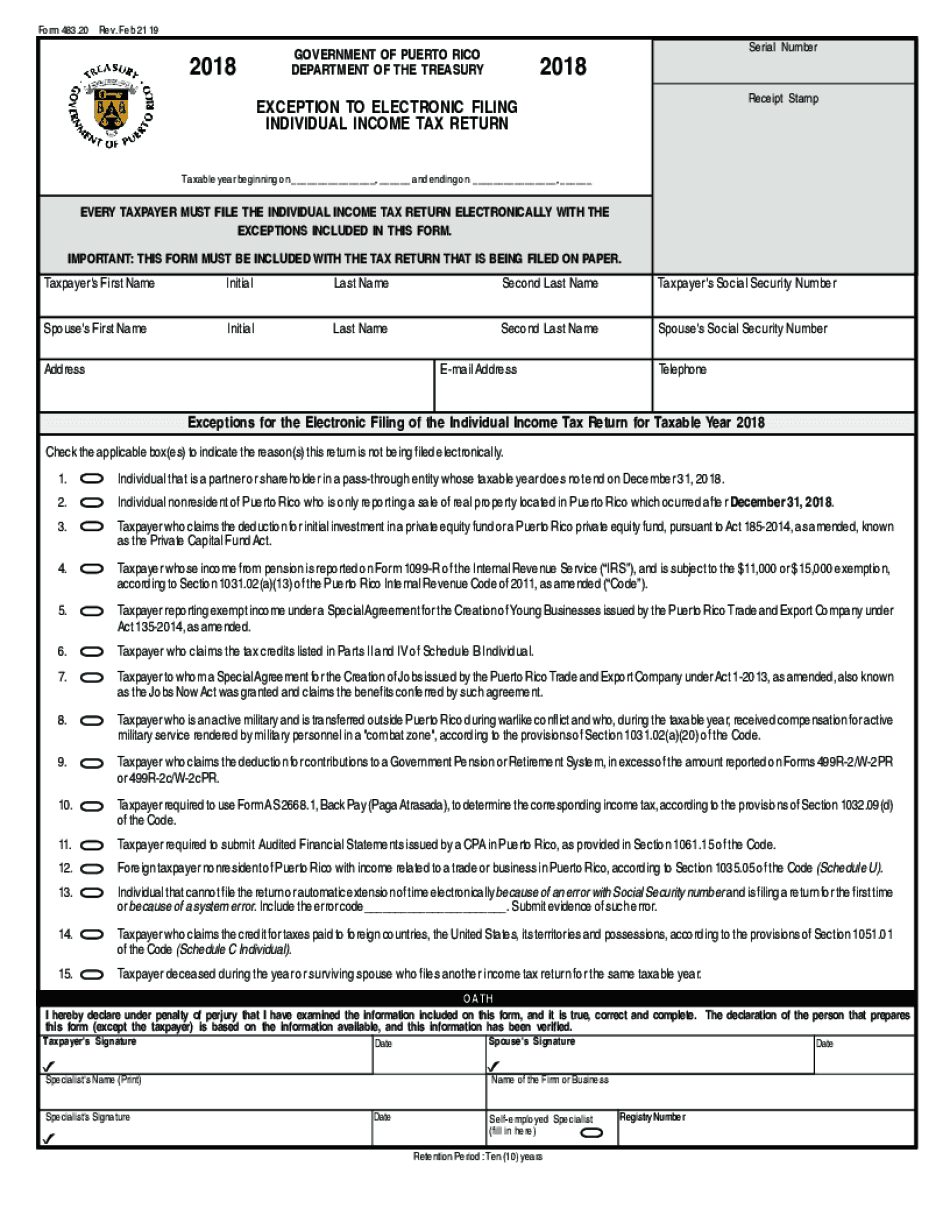

Form 482, also known as the Puerto Rico tax return form, is a crucial document for individuals and businesses reporting their income and tax obligations to the Puerto Rico Department of Treasury. This form is specifically designed for residents and entities operating within Puerto Rico, ensuring compliance with local tax laws. It is essential for accurate reporting and can affect tax liability significantly.

Steps to Complete Form 482

Completing Form 482 involves several key steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary documentation, including income statements, previous tax returns, and deductions.

- Fill Out Personal Information: Enter your name, address, and social security number or tax identification number at the top of the form.

- Report Income: Accurately report all sources of income, including wages, dividends, and business earnings.

- Claim Deductions and Credits: Identify and include any applicable deductions and tax credits that may reduce your taxable income.

- Review and Verify: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the Form: File the completed form by the designated deadline, either electronically or via mail.

Legal Use of Form 482

Form 482 serves a legal purpose in the context of Puerto Rican tax law. It is mandated for individuals and entities to accurately report their income and fulfill their tax obligations. Failure to file this form can result in penalties, including fines or legal action. Understanding the legal implications of this form is essential for compliance and to avoid potential issues with the Puerto Rico Department of Treasury.

Filing Deadlines for Form 482

Timely submission of Form 482 is critical to avoid penalties. The typical filing deadline for individual taxpayers is April 15 of the following year, aligning with the federal tax deadline. However, specific circumstances, such as extensions or special provisions for businesses, may alter these dates. It is advisable to stay informed about any changes to deadlines announced by the Puerto Rico Department of Treasury.

Required Documents for Form 482

When preparing to file Form 482, certain documents are necessary to ensure a complete and accurate submission:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any notices or correspondence from the Puerto Rico Department of Treasury

Examples of Using Form 482

Form 482 can be utilized in various scenarios, including:

- An individual filing for their personal income tax after receiving a W-2 from their employer.

- A self-employed individual reporting business income and claiming deductions for expenses incurred during the tax year.

- A business entity filing to report corporate income and taxes owed to the Puerto Rico government.

Quick guide on how to complete individual unique form feb 20 19 pmd

Effortlessly prepare INDIVIDUAL UNIQUE FORM Feb 20 19 pmd on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious substitute to conventional printed and signed papers, allowing you to locate the right template and securely save it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage INDIVIDUAL UNIQUE FORM Feb 20 19 pmd on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign INDIVIDUAL UNIQUE FORM Feb 20 19 pmd with ease

- Locate INDIVIDUAL UNIQUE FORM Feb 20 19 pmd and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Choose your preferred method of submission for your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign INDIVIDUAL UNIQUE FORM Feb 20 19 pmd and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individual unique form feb 20 19 pmd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 482 Puerto Rico and why is it important?

Form 482 Puerto Rico is a crucial document required for tax purposes in Puerto Rico. It serves to report certain income and ensures compliance with local tax regulations. Understanding its importance can help businesses avoid penalties and streamline their financial processes.

-

How can airSlate SignNow help with Form 482 Puerto Rico?

airSlate SignNow simplifies the process of managing Form 482 Puerto Rico by enabling users to easily create, edit, and sign the document electronically. This cloud-based solution enhances collaboration and ensures all parties can access the form anytime, anywhere. Its user-friendly interface makes it accessible for all businesses.

-

What features does airSlate SignNow offer for handling Form 482 Puerto Rico?

airSlate SignNow offers several features tailored to handling Form 482 Puerto Rico, including customizable templates, automated reminders, and secure document storage. These functionalities enhance efficiency by reducing the time spent on paperwork while ensuring that your documents are compliant with regulations.

-

Is there a cost associated with using airSlate SignNow for Form 482 Puerto Rico?

Yes, there is a subscription fee to use airSlate SignNow, but it offers a cost-effective solution compared to traditional paper-based processes. The pricing plans are designed to cater to businesses of all sizes, ensuring that you can access the necessary features for managing Form 482 Puerto Rico efficiently.

-

Are there integration options available with airSlate SignNow for Form 482 Puerto Rico?

Absolutely! airSlate SignNow provides seamless integrations with various other applications, enabling you to sync your data effortlessly. This means you can integrate accounting software, CRMs, and other management tools to streamline the process of handling Form 482 Puerto Rico and maintain organized records.

-

What benefits does airSlate SignNow provide when dealing with Form 482 Puerto Rico?

Using airSlate SignNow for Form 482 Puerto Rico offers numerous benefits, including increased speed in document processing and enhanced security for sensitive information. Furthermore, businesses can reduce paper usage and improve their overall efficiency, allowing for a focus on core operations rather than manual paperwork.

-

Can I track the status of my Form 482 Puerto Rico documents with airSlate SignNow?

Yes, airSlate SignNow provides the ability to track your Form 482 Puerto Rico documents in real-time. You can see when the document is viewed, signed, or if any actions are pending, which ensures transparency in the entire process and helps you manage workflows effectively.

Get more for INDIVIDUAL UNIQUE FORM Feb 20 19 pmd

- Class 2 residential structural permit form

- Change of zoning applicationnew form

- Pay your bill city of decatur il form

- 2745 29th street s form

- Fillable online llc unit transfer agreement form fax email print

- Memorial hospital capital campaign pledge card newhospital mhtlc form

- State of illinois department of financial amp professional regulationillinois department of financial and professional form

- Student medical information amp emergency form each corpuschristisaints

Find out other INDIVIDUAL UNIQUE FORM Feb 20 19 pmd

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form