Form 512 E Oklahoma Return of Organization Exempt from Income Tax

What is the Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

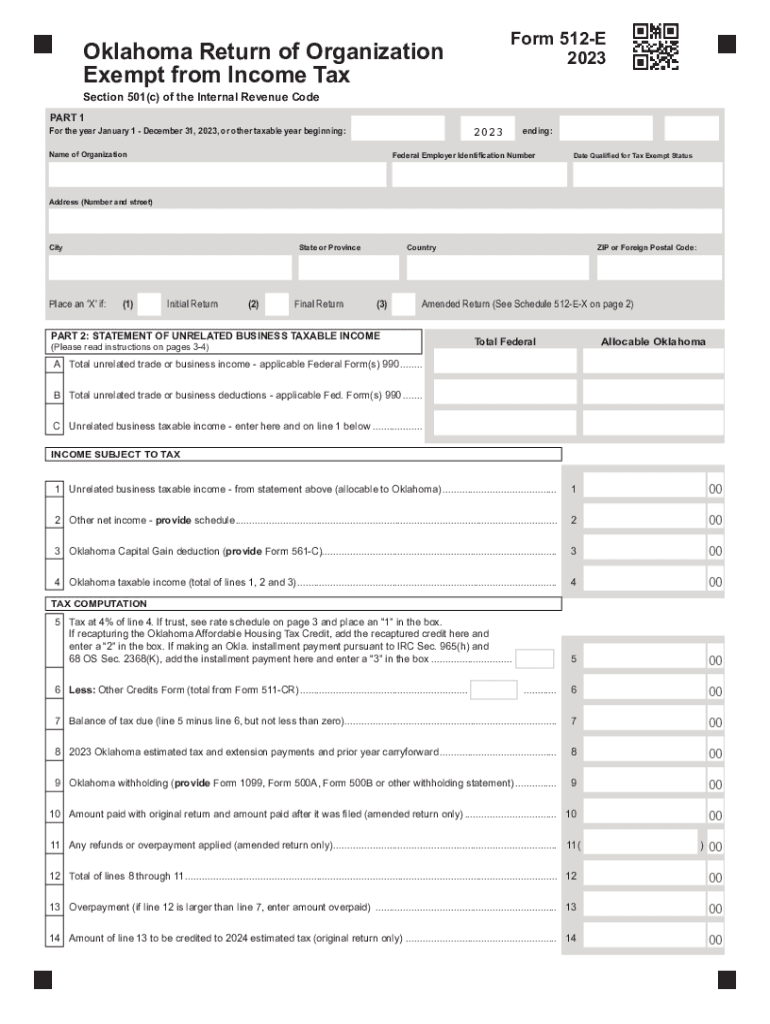

The Form 512 E is a specific tax document used in Oklahoma for organizations that qualify as exempt from income tax. This form is primarily designed for entities such as non-profits, charitable organizations, and certain governmental units that do not generate taxable income. By filing this form, organizations can formally declare their exempt status and comply with state tax regulations. Understanding the purpose of the Form 512 E is crucial for maintaining compliance and ensuring that the organization retains its tax-exempt status.

How to use the Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

Using the Form 512 E involves several straightforward steps. First, organizations must gather all necessary information regarding their income, expenses, and activities for the tax year. Next, the form must be accurately filled out, providing details such as the organization’s name, address, and federal employer identification number (EIN). It is essential to ensure that all information is complete and accurate to avoid delays or issues with processing. Once the form is completed, it should be submitted according to the guidelines provided by the Oklahoma Tax Commission, either electronically or via mail.

Steps to complete the Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

Completing the Form 512 E requires attention to detail. Here are the key steps:

- Gather financial records, including income statements and expense reports.

- Obtain the latest version of the Form 512 E from the Oklahoma Tax Commission.

- Fill out the form, ensuring all required fields are completed, including the organization's name and EIN.

- Detail any exempt income and expenses accurately.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline, either electronically or by mail.

Key elements of the Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

Several key elements are essential when filling out the Form 512 E. These include:

- Organization Information: This includes the legal name, address, and EIN.

- Exempt Income: A detailed account of income that is exempt from taxation.

- Expenses: Documenting expenses related to the organization’s exempt activities.

- Signature: The form must be signed by an authorized representative of the organization.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines associated with the Form 512 E. Typically, the form is due on the fifteenth day of the fourth month following the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due by April 15. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with state tax laws.

Eligibility Criteria

To qualify for filing the Form 512 E, organizations must meet specific eligibility criteria. Generally, this includes being recognized as a non-profit entity under federal tax law, having a valid EIN, and primarily engaging in activities that are exempt from income tax. Organizations should review their status annually to ensure continued eligibility and compliance with both state and federal regulations.

Quick guide on how to complete form 512 e oklahoma return of organization exempt from income tax

Complete Form 512 E Oklahoma Return Of Organization Exempt From Income Tax effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers a sustainable alternative to conventional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, alter, and electronically sign your documents swiftly without delays. Handle Form 512 E Oklahoma Return Of Organization Exempt From Income Tax on any device using airSlate SignNow Android or iOS applications and streamline any document-related operation today.

The easiest way to modify and electronically sign Form 512 E Oklahoma Return Of Organization Exempt From Income Tax without hassle

- Find Form 512 E Oklahoma Return Of Organization Exempt From Income Tax and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow meets all your document management needs in a few clicks from the device of your choice. Modify and electronically sign Form 512 E Oklahoma Return Of Organization Exempt From Income Tax and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 512 e oklahoma return of organization exempt from income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ok 512e feature in airSlate SignNow?

The ok 512e feature in airSlate SignNow allows users to efficiently manage and access their documents while ensuring compliance with e-signature laws. This feature enhances the overall document workflow, enabling businesses to remain agile and responsive.

-

How does airSlate SignNow support mobile users with the ok 512e feature?

With the ok 512e feature, airSlate SignNow provides a robust mobile application that allows users to eSign and send documents on-the-go. This ensures that users can manage their document signing processes seamlessly, no matter where they are.

-

What are the pricing plans available for airSlate SignNow with the ok 512e feature?

airSlate SignNow offers competitive pricing plans that include the ok 512e feature, making it accessible for businesses of all sizes. Each plan is designed to provide flexibility and scalability, catering to diverse organizational needs.

-

What are the benefits of using the ok 512e feature in airSlate SignNow?

The ok 512e feature signNowly streamlines the document management process, reducing time spent on paperwork. Additionally, it enhances security and compliance, allowing businesses to operate more efficiently and confidently.

-

Can airSlate SignNow integrate with other software applications when using the ok 512e feature?

Yes, the ok 512e feature in airSlate SignNow allows for seamless integration with a variety of software applications. This enables businesses to create a connected ecosystem that improves workflow efficiency and productivity.

-

Does airSlate SignNow with the ok 512e feature comply with e-signature regulations?

Absolutely! The ok 512e feature ensures that all eSignatures process through airSlate SignNow comply with local and international e-signature regulations, providing users with peace of mind regarding legal compliance and document validity.

-

What types of documents can be signed using the ok 512e feature?

You can use the ok 512e feature in airSlate SignNow to sign various types of documents, including contracts, agreements, and forms. This versatility allows users to handle all their signing needs within a singular platform.

Get more for Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

Find out other Form 512 E Oklahoma Return Of Organization Exempt From Income Tax

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online