Form 709 United States Gift and Generation Skipping Transfer Tax Return

What is the Form 709 United States Gift and Generation Skipping Transfer Tax Return

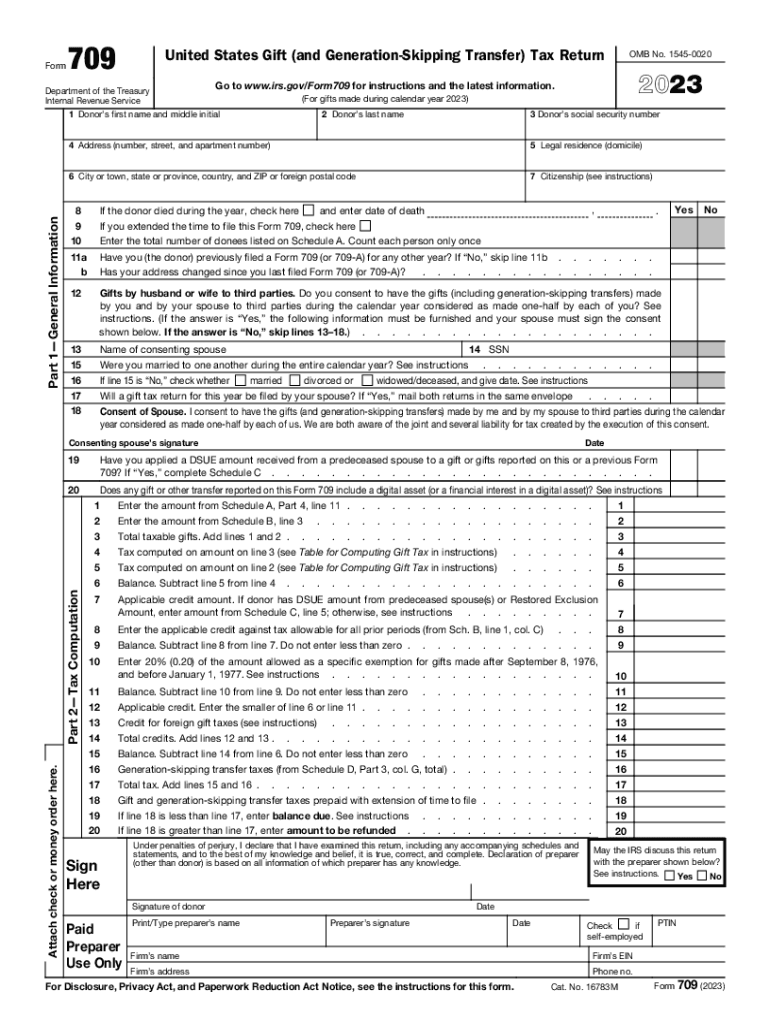

The Form 709 is the official document used to report gifts made during the tax year that exceed the annual exclusion limit. This form is essential for taxpayers who have made gifts to individuals or entities that fall under the IRS guidelines for gift and generation-skipping transfer taxes. The IRS requires this form to assess any potential tax liability associated with these gifts. Understanding the purpose of Form 709 is crucial for compliance with federal tax laws.

Steps to complete the Form 709 United States Gift and Generation Skipping Transfer Tax Return

Completing Form 709 involves several key steps:

- Gather Information: Collect details about the gifts made, including the recipient's information and the value of each gift.

- Determine Exclusions: Identify any gifts that qualify for the annual exclusion, which allows you to exclude a certain amount from taxable gifts.

- Fill Out the Form: Accurately complete all sections of the form, including information about the donor and the gifts.

- Calculate Tax Liability: If applicable, calculate any gift tax owed based on the total value of taxable gifts.

- Review and Sign: Ensure all information is correct before signing and dating the form.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 709. It is important to familiarize yourself with these rules to ensure compliance. Key guidelines include:

- Filing requirements for gifts exceeding the annual exclusion limit.

- Instructions on how to report gifts made to spouses, charities, and other entities.

- Details on the lifetime gift tax exemption and its implications for future gifts.

Filing Deadlines / Important Dates

Form 709 must be filed by April 15 of the year following the year in which the gifts were made. If you need additional time, you can file for an extension, but this does not extend the time to pay any gift tax owed. It is essential to mark your calendar with these important dates to avoid penalties.

Examples of using the Form 709 United States Gift and Generation Skipping Transfer Tax Return

Understanding how to use Form 709 can be enhanced by examining real-life scenarios:

- A parent gifts $20,000 to their child in one year. The first $15,000 qualifies for the annual exclusion, while the remaining $5,000 must be reported on Form 709.

- A grandparent contributes to a 529 college savings plan for a grandchild, exceeding the annual exclusion limit. This transaction requires reporting on Form 709.

Required Documents

To complete Form 709, certain documents and information are necessary:

- Details of each gift, including the recipient's name and relationship to the donor.

- Valuation of the gifts at the time they were given.

- Documentation supporting any claims for exclusions or deductions.

Quick guide on how to complete form 709 united states gift and generation skipping transfer tax return

Prepare Form 709 United States Gift and Generation Skipping Transfer Tax Return seamlessly on any device

Digital document management has become increasingly prevalent among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without delays. Manage Form 709 United States Gift and Generation Skipping Transfer Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form 709 United States Gift and Generation Skipping Transfer Tax Return with ease

- Find Form 709 United States Gift and Generation Skipping Transfer Tax Return and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all information carefully and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 709 United States Gift and Generation Skipping Transfer Tax Return and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 709 united states gift and generation skipping transfer tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a gift tax return?

A gift tax return is an IRS form that must be filed when a person gifts an amount over the annual exclusion limit to an individual. This return ensures compliance with tax regulations and provides a way to report those gifts if they exceed the threshold. Filing a gift tax return is essential for keeping accurate records of your taxable gifts.

-

When do I need to file a gift tax return?

You need to file a gift tax return if you give someone more than the annual exclusion amount, which is adjusted annually for inflation. This includes gifts of cash or property that exceed the limit. It's crucial to file this return before the tax deadline, usually on April 15th, to avoid penalties.

-

How does airSlate SignNow facilitate the gift tax return process?

airSlate SignNow streamlines the workflow for preparing and submitting your gift tax return by providing easy document management and eSignature capabilities. Our platform allows you to prepare necessary documents digitally, making it simple to gather signatures and share completed forms securely. This ensures that your gift tax return is finalized efficiently.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features like template creation, cloud storage, and real-time collaboration to manage your tax documents efficiently. These tools allow you to create a standard gift tax return template, store previous returns, and collaborate with tax professionals seamlessly. This simplifies the process and helps ensure accuracy.

-

Is airSlate SignNow cost-effective for small businesses needing to file gift tax returns?

Yes, airSlate SignNow provides a cost-effective solution with flexible pricing plans suitable for small businesses that may need to file gift tax returns. Our platform eliminates the need for paper and physical storage, reducing costs associated with traditional methods. With our subscription model, you can choose the plan that fits your budget.

-

Can airSlate SignNow integrate with other accounting software for filing gift tax returns?

Absolutely! airSlate SignNow easily integrates with various accounting software solutions, which can help in the preparation and filing of your gift tax return. By integrating these tools, you can streamline the import of financial data and ensure that your tax returns are accurate and complete, allowing for seamless filing.

-

What are the benefits of using airSlate SignNow for eSigning my gift tax return?

Using airSlate SignNow to eSign your gift tax return provides convenience and speed, allowing you to finalize documents anytime and anywhere. Our secure eSignature process ensures that your documents are legally binding and protected. This means you can focus on your tax compliance instead of getting bogged down by paperwork.

Get more for Form 709 United States Gift and Generation Skipping Transfer Tax Return

Find out other Form 709 United States Gift and Generation Skipping Transfer Tax Return

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free