Illinois State Taxes and Income Tax Form

Understanding Illinois State Taxes and Income Tax

Illinois state taxes encompass various tax types, including income tax, property tax, and sales tax. The Illinois income tax is a flat rate tax applied to individual and corporate income. Residents of Illinois are required to file their income tax returns annually, reporting all income earned within the state. The state tax rate for individuals is currently set at four point nine five percent. Understanding these taxes is essential for compliance and financial planning.

Steps to Complete Illinois State Taxes and Income Tax

Completing your Illinois income tax return involves several key steps:

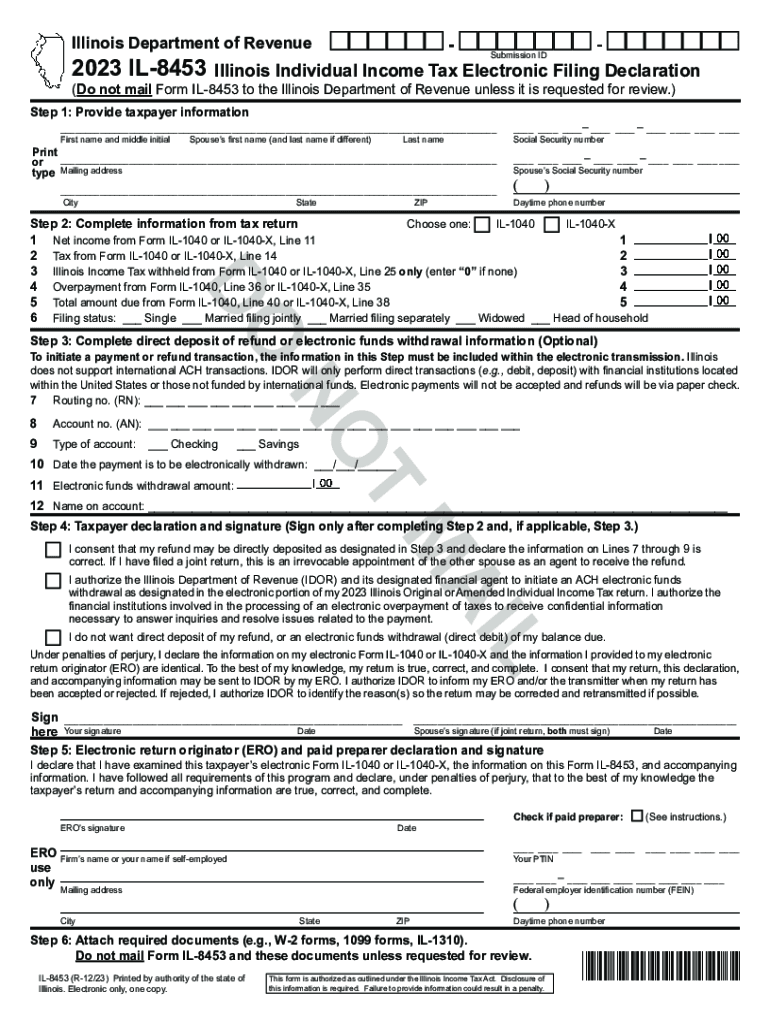

- Gather all necessary documents, including W-2 forms, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and deductions.

- Complete the appropriate tax forms, such as the IL-1040 for individual income tax.

- Calculate your total income, deductions, and credits to determine your tax liability.

- File your return electronically or by mail before the deadline, which is typically April fifteenth.

Required Documents for Illinois State Taxes

When preparing to file your Illinois income tax return, it is important to have the following documents ready:

- W-2 forms from employers, detailing your annual earnings.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Any relevant schedules or additional forms that may apply to your specific tax situation.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial to avoid penalties. The standard deadline for filing your Illinois income tax return is April fifteenth. If you need additional time, you can request an extension, which typically grants an extra six months to file. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Digital vs. Paper Version of Illinois Tax Forms

Filing your Illinois income tax can be done either digitally or via paper forms. The digital version offers several advantages, including faster processing times and immediate confirmation of receipt. Additionally, electronic filing often allows for automatic calculations, minimizing errors. Paper forms, while still accepted, may take longer to process and require mailing, which can lead to delays.

Penalties for Non-Compliance with Illinois Tax Laws

Failing to comply with Illinois tax laws can result in significant penalties. Common penalties include fines for late filing, late payment, and inaccuracies in reporting income. The state may also impose interest on unpaid taxes. It is essential to file your return accurately and on time to avoid these financial repercussions.

Eligibility Criteria for Filing Illinois Income Tax

Eligibility for filing an Illinois income tax return generally includes any individual who earns income within the state. This includes residents, part-year residents, and non-residents who have Illinois-source income. Specific income thresholds may apply, and it is advisable to review these criteria annually, as they can change based on state regulations.

Quick guide on how to complete illinois state taxes and income tax

Complete Illinois State Taxes And Income Tax effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all necessary tools to create, edit, and eSign your documents quickly without holdups. Manage Illinois State Taxes And Income Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign Illinois State Taxes And Income Tax without breaking a sweat

- Locate Illinois State Taxes And Income Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose your preferred method of submitting your form, be it via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign Illinois State Taxes And Income Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois state taxes and income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Illinois electronic filing and how does it work with airSlate SignNow?

Illinois electronic filing refers to the online process of submitting documents electronically to the state of Illinois. With airSlate SignNow, users can eSign and send their documents securely and efficiently, ensuring they comply with Illinois e-filing requirements. Our platform simplifies the entire process, making it easier for businesses to manage their submissions.

-

What features does airSlate SignNow offer for Illinois electronic filing?

airSlate SignNow provides several features tailored for Illinois electronic filing, including customizable templates, advanced eSignature options, and secure document storage. Additionally, users can track the status of their submitted documents, making it easy to manage electronic filings in one place. These features enhance productivity and streamline the filing process.

-

Is airSlate SignNow cost-effective for businesses handling Illinois electronic filing?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing Illinois electronic filing. With competitive pricing plans, users can choose a package that fits their needs and budget. This affordability, combined with our robust features, ensures that you can effectively manage your e-filing without breaking the bank.

-

Can airSlate SignNow integrate with other software for Illinois electronic filing?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing for easier documentation and workflow management. Whether you're using accounting software, CRM systems, or cloud storage solutions, our platform supports integration to simplify your Illinois electronic filing process.

-

What are the benefits of using airSlate SignNow for Illinois electronic filing?

Using airSlate SignNow for Illinois electronic filing offers numerous benefits, including enhanced efficiency, time savings, and increased compliance. Our intuitive interface allows users to navigate the e-filing process with ease, reducing the chances of errors. Additionally, the electronic signature feature ensures that documents are signed and sent in a timely manner.

-

How secure is airSlate SignNow for Illinois electronic filing?

Security is a top priority at airSlate SignNow, especially for Illinois electronic filing. Our platform utilizes advanced encryption methods to protect your documents and personal information during the entire filing process. With industry-standard security protocols in place, users can trust that their data is safe and confidential.

-

Can I track my Illinois electronic filing status with airSlate SignNow?

Yes, airSlate SignNow allows users to easily track the status of their Illinois electronic filings. You can monitor whether documents have been successfully sent, viewed, or signed, providing transparency throughout the process. This feature helps ensure that you stay informed about your filing status at all times.

Get more for Illinois State Taxes And Income Tax

- Partner instruction 2015 form

- Partner instruction 2014 form

- Form 1041 schedule k 1 instructions 2013

- Schedule b 1 2016 form

- Schedule b 1 2016 2018 2019 form

- Certificate of authority for llc business link north carolina form

- Maricopa county az title companies form

- Mobile food establishment permit application maricopa form

Find out other Illinois State Taxes And Income Tax

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document