Form 3596 Paid Preparer's Due Diligence Checklist for California Earned Income Tax Credit

Understanding the Form 3596 Due Diligence Checklist for California Earned Income Tax Credit

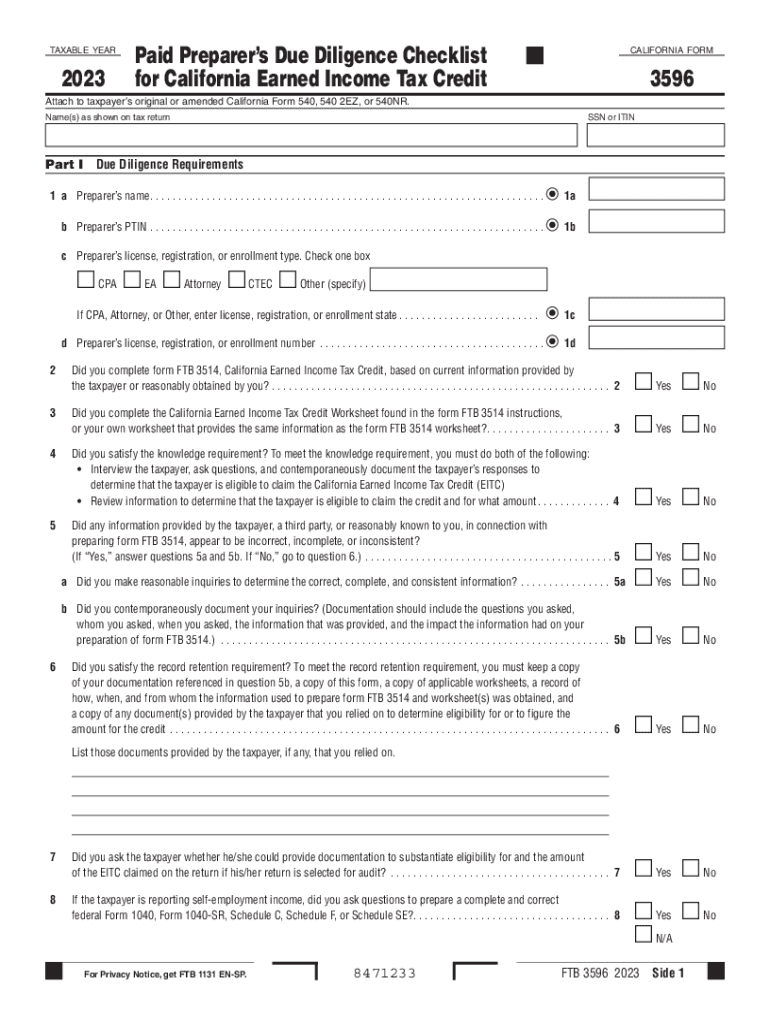

The Form 3596, also known as the Paid Preparer's Due Diligence Checklist, is essential for tax preparers in California who assist clients claiming the Earned Income Tax Credit (EITC). This form ensures that preparers meet the due diligence requirements set by the IRS and the California Franchise Tax Board. It helps verify that clients qualify for the credit, which can significantly reduce their tax liability. By using this checklist, tax professionals can ensure compliance and protect themselves from potential penalties associated with improper claims.

Steps to Complete the Form 3596 Checklist

Completing the Form 3596 involves several key steps to ensure thorough due diligence. First, tax preparers should gather all necessary documentation from clients, including income statements and identification. Next, they must review the client's eligibility for the EITC by checking income thresholds and filing status. After confirming eligibility, preparers fill out the checklist, ensuring all questions are answered accurately. Finally, the completed form should be signed by both the preparer and the client, maintaining a record for future reference.

Key Elements of the Form 3596 Due Diligence Checklist

The Form 3596 includes various sections that address specific requirements for due diligence. Key elements include:

- Verification of taxpayer identification numbers.

- Assessment of income sources and amounts.

- Confirmation of filing status and number of dependents.

- Documentation of any claims made for the EITC.

Each section is designed to ensure that preparers collect sufficient information to substantiate the EITC claim, thereby reducing the risk of errors or audits.

Legal Use of the Form 3596 in California

The Form 3596 is legally required for tax preparers in California who assist clients with EITC claims. Failure to complete this checklist can result in penalties imposed by the IRS and the California Franchise Tax Board. Tax preparers must ensure that they understand the legal implications of the form and maintain compliance with both federal and state regulations. This legal framework protects both the taxpayer and the preparer, ensuring that claims are valid and substantiated.

Obtaining the Form 3596 Checklist

Tax preparers can obtain the Form 3596 from the California Franchise Tax Board's official website or through authorized tax preparation software. It is essential to ensure that the most current version of the form is used, as updates may occur annually. Additionally, preparers should familiarize themselves with any accompanying instructions to ensure proper completion and adherence to legal requirements.

IRS Guidelines for Due Diligence

The IRS provides specific guidelines that tax preparers must follow when completing the Form 3596. These guidelines emphasize the importance of verifying all information provided by clients, documenting the due diligence process, and ensuring that all eligibility criteria for the EITC are met. Adhering to these guidelines helps prevent potential audits and penalties, fostering a trustworthy relationship between the preparer and their clients.

Quick guide on how to complete form 3596 paid preparers due diligence checklist for california earned income tax credit

Complete Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without complications. Manage Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit with ease

- Find Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit and then click Get Form to start.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and then click on the Done button to finalize your updates.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3596 paid preparers due diligence checklist for california earned income tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a due diligence checklist and why is it important?

A due diligence checklist is a comprehensive tool used to assess and organize information during the due diligence process. It is important because it helps businesses identify potential risks and establish the viability of a transaction. Utilizing a due diligence checklist ensures that all necessary documentation is reviewed and mitigates possible issues.

-

How can airSlate SignNow assist with my due diligence checklist?

airSlate SignNow streamlines the process of managing your due diligence checklist by allowing you to send and eSign documents securely. This boosts efficiency and collaboration among your team members and stakeholders. With airSlate SignNow, you can easily track progress and ensure all checklist items are completed.

-

Is airSlate SignNow suitable for businesses of all sizes in managing a due diligence checklist?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, making it an ideal solution for managing a due diligence checklist. Whether you're a startup or a large corporation, our platform can scale to meet your needs, ensuring effective document management.

-

What features of airSlate SignNow enhance my due diligence checklist process?

Some key features of airSlate SignNow that enhance your due diligence checklist process include secure eSigning, document templates, and real-time collaboration. These tools simplify communication and make it easier to keep track of all documents required for your due diligence checklist, ensuring a smoother experience.

-

Is there a free trial for using airSlate SignNow with my due diligence checklist?

Yes, airSlate SignNow offers a free trial that allows users to explore its features for managing a due diligence checklist. During this trial, you can fully assess how our platform meets your document management needs without any financial commitment. This is a great way to see firsthand how airSlate SignNow can streamline your processes.

-

What integrations does airSlate SignNow offer for enhancing my due diligence checklist?

airSlate SignNow offers integrations with popular tools and platforms, which can signNowly enhance your due diligence checklist process. These integrations allow you to seamlessly connect with CRM systems, cloud storage services, and project management tools to ensure all aspects of your checklist are covered. This connectivity increases efficiency and simplifies your workflow.

-

How does airSlate SignNow ensure the security of my due diligence checklist documents?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption and authentication methods. This ensures that all information related to your due diligence checklist is protected from unauthorized access. We are committed to providing a safe environment for businesses to manage their important documents.

Get more for Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit

Find out other Form 3596 Paid Preparer's Due Diligence Checklist For California Earned Income Tax Credit

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template