Note Electronic Copies of Payee Statements Due February 28, 2018

What is the Note Electronic Copies Of Payee Statements Due February 28

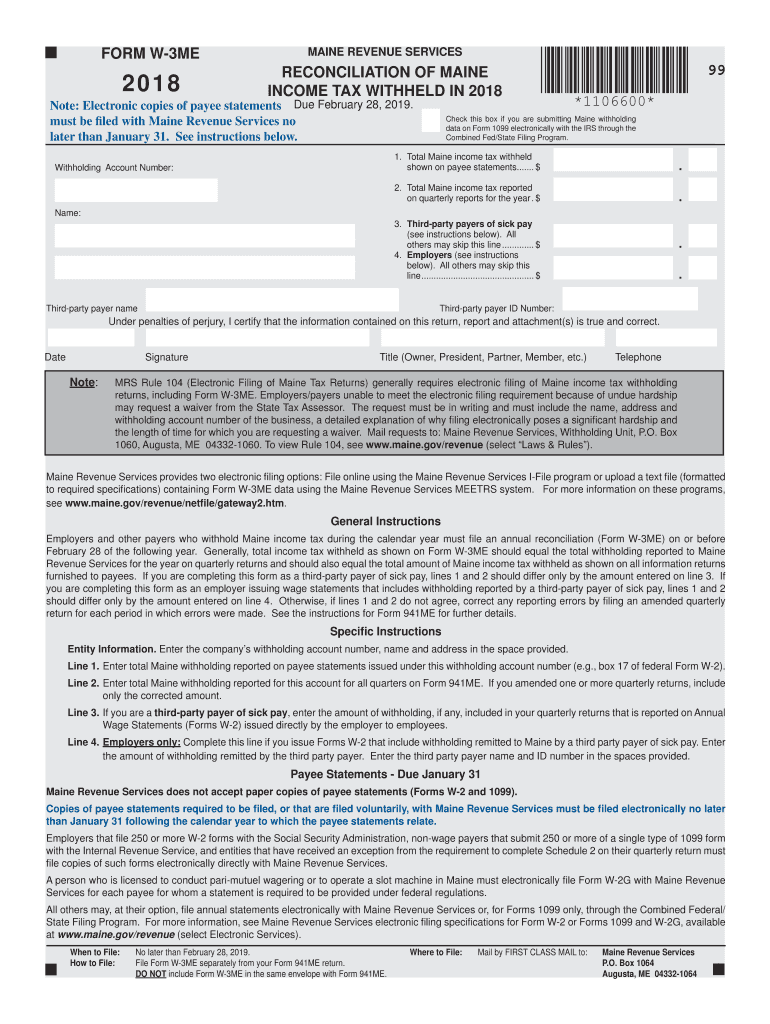

The Note Electronic Copies Of Payee Statements Due February 28 is a critical document used in the United States for tax reporting purposes. This form is designed to provide electronic copies of payee statements, which are essential for both individuals and businesses to report income accurately. The due date of February 28 aligns with the IRS requirements for filing, ensuring that payees receive their statements in a timely manner to facilitate their tax preparations. Understanding this form is crucial for compliance with federal tax regulations.

How to use the Note Electronic Copies Of Payee Statements Due February 28

Using the Note Electronic Copies Of Payee Statements Due February 28 involves a straightforward process. First, ensure you have the correct information regarding payees, including their names, addresses, and taxpayer identification numbers. Next, access the appropriate electronic filing system that supports this form. Fill out the required fields accurately and review the information for any errors. Once completed, submit the form electronically by the February 28 deadline. This method not only streamlines the filing process but also ensures that you meet IRS guidelines effectively.

Steps to complete the Note Electronic Copies Of Payee Statements Due February 28

Completing the Note Electronic Copies Of Payee Statements Due February 28 requires careful attention to detail. Follow these steps:

- Gather all necessary information about each payee, including their full name and address.

- Obtain the taxpayer identification number for each payee.

- Access the electronic filing platform that supports this form.

- Input the payee information into the designated fields of the form.

- Review the completed form for accuracy and completeness.

- Submit the form electronically by the February 28 deadline.

Legal use of the Note Electronic Copies Of Payee Statements Due February 28

The legal use of the Note Electronic Copies Of Payee Statements Due February 28 is governed by IRS regulations. This form is recognized as a valid method for reporting income, provided it is completed accurately and submitted on time. The IRS has expanded the acceptance of electronic signatures on this form, enhancing its legal standing. It is essential for users to ensure compliance with all relevant tax laws and regulations when utilizing this form to avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Note Electronic Copies Of Payee Statements Due February 28 are crucial for compliance. The primary deadline is February 28 of each year, which is the last day to submit electronic copies of payee statements. Missing this deadline can result in penalties and complications with tax reporting. It is advisable to set reminders well in advance to ensure timely submission and to stay informed about any changes in IRS regulations regarding filing dates.

Penalties for Non-Compliance

Failure to comply with the requirements for the Note Electronic Copies Of Payee Statements Due February 28 can lead to significant penalties. The IRS imposes fines for late submissions, inaccuracies, or failure to file altogether. These penalties can accumulate quickly, affecting both individuals and businesses financially. To mitigate the risk of penalties, it is essential to adhere strictly to filing deadlines and ensure that all information submitted is accurate and complete.

Quick guide on how to complete note electronic copies of payee statements due february 28 2019

Your assistance manual on how to prepare your Note Electronic Copies Of Payee Statements Due February 28,

If you’re wondering how to generate and submit your Note Electronic Copies Of Payee Statements Due February 28,, here are some brief pointers on how to make tax filing simpler.

To begin, you simply need to set up your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an extremely intuitive and robust document solution that enables you to edit, create, and finalize your income tax documents with ease. With its editor, you can alternate between text, check boxes, and eSignatures and return to modify responses as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and easy sharing.

Adhere to the steps below to finalize your Note Electronic Copies Of Payee Statements Due February 28, within minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to access your Note Electronic Copies Of Payee Statements Due February 28, in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Examine your document and amend any mistakes.

- Preserve changes, print your copy, forward it to your recipient, and download it to your device.

Use this manual to file your taxes digitally with airSlate SignNow. Keep in mind that submitting a paper form may increase return errors and delay reimbursements. Certainly, before e-filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct note electronic copies of payee statements due february 28 2019

Create this form in 5 minutes!

How to create an eSignature for the note electronic copies of payee statements due february 28 2019

How to create an electronic signature for the Note Electronic Copies Of Payee Statements Due February 28 2019 online

How to make an eSignature for your Note Electronic Copies Of Payee Statements Due February 28 2019 in Chrome

How to create an electronic signature for signing the Note Electronic Copies Of Payee Statements Due February 28 2019 in Gmail

How to create an electronic signature for the Note Electronic Copies Of Payee Statements Due February 28 2019 right from your mobile device

How to create an eSignature for the Note Electronic Copies Of Payee Statements Due February 28 2019 on iOS

How to generate an electronic signature for the Note Electronic Copies Of Payee Statements Due February 28 2019 on Android devices

People also ask

-

What are Note Electronic Copies Of Payee Statements Due February 28, and how do they work?

Note Electronic Copies Of Payee Statements Due February 28, are digital versions of important financial statements that require electronic submission. These statements can be securely sent and eSigned using airSlate SignNow, ensuring compliance with submission deadlines. By utilizing our platform, businesses can streamline the process of creating and sharing these documents.

-

How can airSlate SignNow help with Note Electronic Copies Of Payee Statements Due February 28, submissions?

airSlate SignNow provides an intuitive platform allowing users to easily create, manage, and eSign Note Electronic Copies Of Payee Statements Due February 28,. Our tools help automate workflows, ensuring that documents are sent on time while adhering to regulatory requirements. This makes the entire submission process efficient and stress-free.

-

Are there any costs associated with using airSlate SignNow for Note Electronic Copies Of Payee Statements Due February 28,?

Yes, there are pricing plans available for using airSlate SignNow for Note Electronic Copies Of Payee Statements Due February 28,. Our pricing is competitive and offers flexible options based on user needs and volume of documents. We provide a cost-effective solution that can save businesses time and money.

-

What features does airSlate SignNow offer for handling Note Electronic Copies Of Payee Statements Due February 28,?

airSlate SignNow offers a comprehensive set of features for handling Note Electronic Copies Of Payee Statements Due February 28,. This includes custom templates, bulk sending, integration with popular tools, and secure storage. Our user-friendly interface makes it easy to manage documents efficiently.

-

Can airSlate SignNow integrate with other software for Note Electronic Copies Of Payee Statements Due February 28,?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage Note Electronic Copies Of Payee Statements Due February 28,. Whether you use CRM, accounting tools, or project management software, our platform can connect with them to enhance your workflow.

-

What benefits can I expect from using airSlate SignNow for Note Electronic Copies Of Payee Statements Due February 28, submissions?

Using airSlate SignNow for Note Electronic Copies Of Payee Statements Due February 28, submissions offers numerous benefits including increased efficiency, reduced turnaround time, and enhanced document security. You can track the status of documents in real-time, ensuring timely compliance. This leads to better management of financial records.

-

Is it safe to use airSlate SignNow for sending Note Electronic Copies Of Payee Statements Due February 28,?

Yes, it is safe to use airSlate SignNow for sending Note Electronic Copies Of Payee Statements Due February 28,. Our platform employs advanced encryption and security measures to protect sensitive information. You can confidently manage your documents, knowing they are secure and compliant with regulations.

Get more for Note Electronic Copies Of Payee Statements Due February 28,

- Direct deposit form neighborhood credit union

- Consent for evaluation form

- Salsa judging sheet form

- Schenker commercial invoice ismrm form

- Annuitants may choose to have their monthly payments electronically deposited to a federally insured checking or form

- Morane hills state park archery deer permit application form

- Donation form national kidney foundation of illinois nkfi

- Esppsrp referral form chicago public schools

Find out other Note Electronic Copies Of Payee Statements Due February 28,

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement