DTT AFFIDAVIT County of San Mateo TRANSFER TAX Form

Understanding the DTT Affidavit for Transfer Tax in San Mateo County

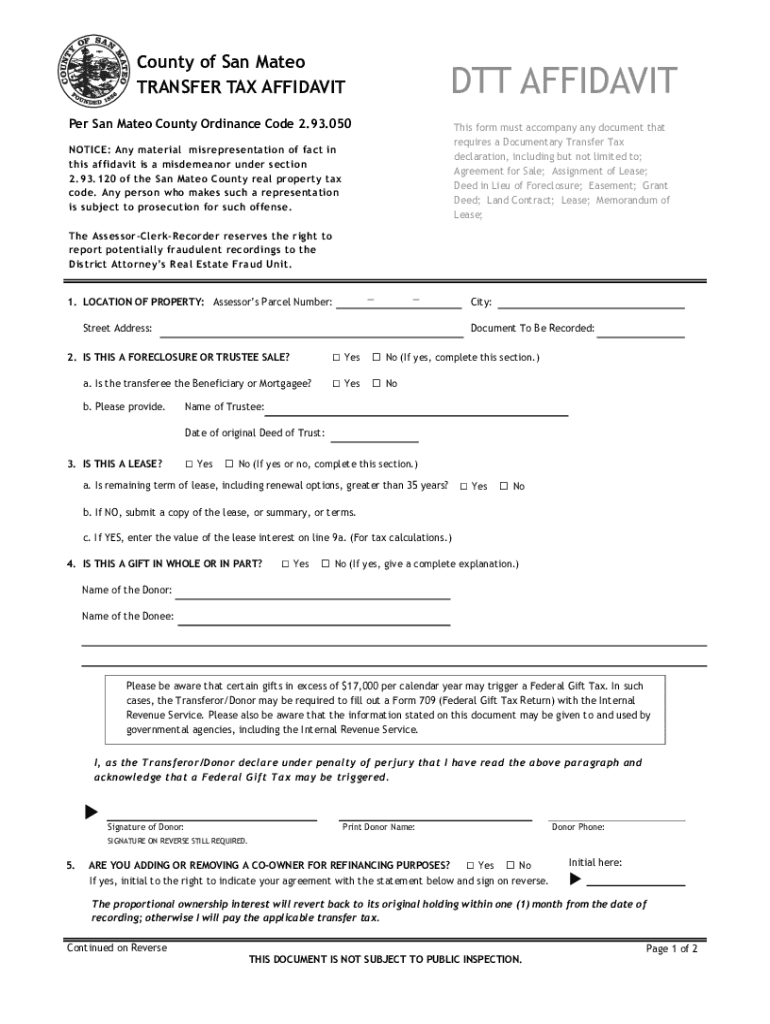

The DTT Affidavit, specifically for San Mateo County, serves as a crucial document in the context of transfer taxes. This affidavit is required when real estate is sold or transferred, ensuring that the appropriate taxes are assessed and collected. The DTT helps to clarify the circumstances of the transfer, allowing for proper tax calculations based on the property's value and the nature of the transaction.

In the context of California's transfer tax laws, the DTT Affidavit plays a significant role in compliance and reporting. It is essential for both buyers and sellers to understand the implications of this document, as it can affect the overall cost of the transaction and potential liabilities.

Steps to Complete the DTT Affidavit

Completing the DTT Affidavit involves several important steps to ensure accuracy and compliance with local regulations. Begin by gathering necessary information, including details about the property, the parties involved in the transaction, and any applicable exemptions or deductions.

Next, fill out the DTT form with precise information. Be sure to include the property's legal description, the sale price, and the names of the buyer and seller. Once completed, review the affidavit for any errors or omissions. It is advisable to consult with a legal or tax professional if there are any uncertainties regarding the information required.

Finally, submit the completed DTT Affidavit to the appropriate county office, either in person or via mail, depending on local submission guidelines.

Required Documents for the DTT Affidavit

To successfully file the DTT Affidavit, certain documents are necessary. These typically include:

- The completed DTT Affidavit form.

- Proof of identity for both the buyer and seller, such as a driver's license or passport.

- Documentation of the property transaction, including the purchase agreement or deed.

- Any additional forms required for exemptions or specific tax considerations.

Having these documents ready will streamline the filing process and help ensure compliance with local tax regulations.

Legal Use of the DTT Affidavit

The DTT Affidavit is legally binding and must be filled out accurately to avoid potential penalties. It serves as a declaration of the transfer of property and the associated tax responsibilities. Misrepresentation or failure to file the affidavit can lead to legal repercussions, including fines or additional tax assessments.

Understanding the legal implications of the DTT Affidavit is essential for both parties involved in the transaction. It is advisable to keep a copy of the submitted affidavit for personal records and future reference.

Eligibility Criteria for the DTT Affidavit

Eligibility to file the DTT Affidavit generally applies to any party involved in a real estate transaction within San Mateo County. This includes individuals, businesses, and entities transferring property ownership. Specific exemptions may apply based on the nature of the transaction, such as transfers between family members or certain types of corporate transactions.

It is important to review the eligibility criteria carefully to ensure compliance and to determine if any exemptions may apply, which could reduce the overall tax burden.

Filing Deadlines for the DTT Affidavit

Filing deadlines for the DTT Affidavit are crucial to avoid penalties. Typically, the affidavit must be submitted at the time of the property transfer, often coinciding with the closing date of the sale. Failing to file on time can result in additional fees or interest on unpaid taxes.

It is advisable to check with the local county office for specific deadlines and any changes to filing requirements that may occur throughout the year.

Quick guide on how to complete dtt affidavit county of san mateo transfer tax

Effortlessly Complete DTT AFFIDAVIT County Of San Mateo TRANSFER TAX on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without hindrances. Manage DTT AFFIDAVIT County Of San Mateo TRANSFER TAX seamlessly on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign DTT AFFIDAVIT County Of San Mateo TRANSFER TAX with Ease

- Locate DTT AFFIDAVIT County Of San Mateo TRANSFER TAX and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether through email, text message (SMS), invite link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electonically sign DTT AFFIDAVIT County Of San Mateo TRANSFER TAX to ensure exceptional communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtt affidavit county of san mateo transfer tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dtt in the context of airSlate SignNow?

Dtt stands for Document Task Tracking, a feature within airSlate SignNow that allows users to monitor the status of their documents. With dtt, businesses can easily see when documents are sent, opened, and signed, ensuring a streamlined workflow and improved efficiency.

-

How much does airSlate SignNow cost with dtt features?

The pricing for airSlate SignNow varies depending on the plan you choose, but all plans include access to the dtt feature. You can select from several packages that cater to different business sizes and needs, making it a cost-effective solution for document management.

-

What are the key benefits of using dtt in airSlate SignNow?

Utilizing dtt in airSlate SignNow offers numerous advantages, such as real-time visibility into document status and improved collaboration among team members. This feature helps businesses save time, reduce errors, and ultimately enhance customer satisfaction.

-

Can I integrate dtt with other software applications?

Yes, airSlate SignNow allows for seamless integrations with various software tools, enabling you to enhance the dtt capabilities. You can connect your document workflows with CRM, ERP, and other applications to create a more unified business process.

-

Is dtt user-friendly for non-technical users?

Absolutely! The dtt feature in airSlate SignNow is designed with user-friendliness in mind, allowing non-technical users to easily track documents without any hassle. The intuitive interface ensures that any team member can navigate the system and obtain necessary insights with minimal training.

-

How does dtt improve document security?

Dtt in airSlate SignNow enhances document security by providing secure tracking and access controls. With this feature, you can ensure that only authorized personnel are able to view or edit documents, adding an extra layer of protection to your sensitive information.

-

What support options are available for using dtt?

airSlate SignNow offers comprehensive support for all users, including those utilizing dtt. You have access to a variety of resources such as live chat, email support, and an extensive knowledge base that can help you quickly resolve any questions or issues you may encounter.

Get more for DTT AFFIDAVIT County Of San Mateo TRANSFER TAX

Find out other DTT AFFIDAVIT County Of San Mateo TRANSFER TAX

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form