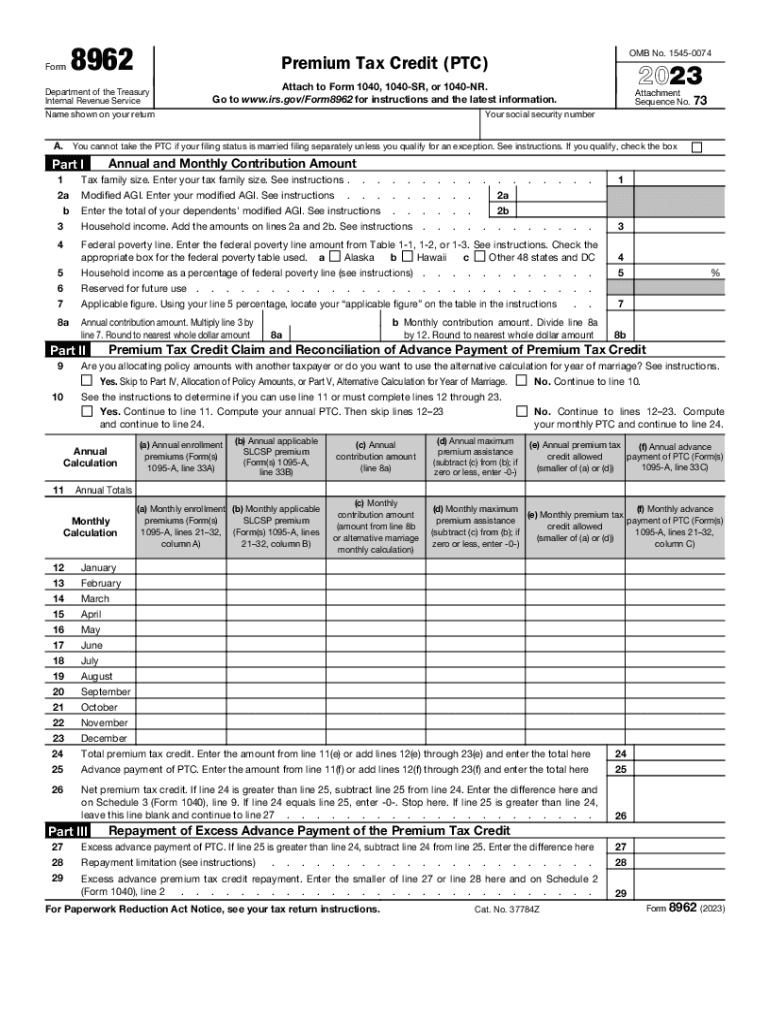

Form 8962 Premium Tax Credit PTC

What is the Form 8962 Premium Tax Credit (PTC)

The Form 8962, also known as the Premium Tax Credit (PTC), is a crucial document used by taxpayers to calculate and claim the premium tax credit. This credit is designed to help eligible individuals and families afford health insurance coverage purchased through the Health Insurance Marketplace. The form determines the amount of premium tax credit a taxpayer is entitled to based on their household income and family size, which can significantly reduce the cost of health insurance premiums.

How to use the Form 8962 Premium Tax Credit (PTC)

To effectively use the Form 8962, taxpayers must first gather relevant information, including their modified adjusted gross income (MAGI), the number of individuals in their household, and the premiums paid for health insurance coverage. The form requires taxpayers to report this information accurately to determine eligibility for the premium tax credit. After completing the form, it must be submitted with the taxpayer's annual income tax return to the IRS.

Steps to complete the Form 8962 Premium Tax Credit (PTC)

Completing the Form 8962 involves several key steps:

- Gather necessary documents, including Form 1095-A, which provides information about the health insurance coverage.

- Calculate your household size and modified adjusted gross income (MAGI).

- Fill out the form by entering required information, including the premiums paid and the applicable percentages based on your income.

- Review the calculations to ensure accuracy before submitting the form.

Eligibility Criteria for the Form 8962 Premium Tax Credit (PTC)

Eligibility for the premium tax credit is determined by several factors. Taxpayers must meet the following criteria:

- Have a household income between one hundred and four hundred percent of the federal poverty level.

- Be enrolled in a qualified health plan through the Health Insurance Marketplace.

- Not be eligible for other types of minimum essential coverage, such as Medicaid or Medicare.

Required Documents for the Form 8962 Premium Tax Credit (PTC)

To complete the Form 8962, taxpayers need specific documents, including:

- Form 1095-A, which details the health insurance coverage obtained through the Marketplace.

- Income statements, such as W-2 forms or 1099 forms, to verify modified adjusted gross income.

- Information about household members to accurately report household size.

Filing Deadlines / Important Dates for the Form 8962 Premium Tax Credit (PTC)

Taxpayers must be aware of important deadlines when filing the Form 8962. Generally, the deadline for filing individual income tax returns, including Form 8962, is April fifteenth of each year. If taxpayers require additional time, they may file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties.

Quick guide on how to complete form 8962 premium tax credit ptc

Prepare Form 8962 Premium Tax Credit PTC seamlessly on any device

Online document management has gained traction with companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without holdups. Manage Form 8962 Premium Tax Credit PTC on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Form 8962 Premium Tax Credit PTC effortlessly

- Find Form 8962 Premium Tax Credit PTC and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Mark relevant sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with a few clicks from any device you choose. Alter and eSign Form 8962 Premium Tax Credit PTC and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8962 premium tax credit ptc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8962 and why do I need it?

Form 8962 is a crucial document used to calculate the premium tax credit that may help you lower your health insurance costs under the Affordable Care Act. You need this form to claim your credit during tax filing, ensuring compliance with federal regulations while maximizing potential savings.

-

How can airSlate SignNow help me manage Form 8962?

airSlate SignNow simplifies the process of managing Form 8962 by allowing you to send, sign, and store your tax documents securely. With our easy-to-use platform, you can complete Form 8962 electronically, making it faster and more efficient to handle your tax paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 8962?

Yes, airSlate SignNow offers a range of pricing plans to suit different business needs, including options for individuals handling Form 8962. The cost is competitive and designed to provide value by streamlining your document management process.

-

What features does airSlate SignNow offer for electronic signing of Form 8962?

airSlate SignNow provides a variety of features for electronic signing of Form 8962, including a user-friendly interface, customizable signing workflows, and in-app notifications. These features ensure that you can efficiently manage your documents and obtain signatures without delays.

-

Can I integrate airSlate SignNow with other applications for Form 8962 management?

Yes, airSlate SignNow supports integration with numerous applications, making it easy to manage Form 8962 alongside your other business tools. This integration helps streamline your workflow, ensuring your financial and tax-related documents are easily accessible.

-

What are the benefits of using airSlate SignNow for Form 8962?

The main benefits of using airSlate SignNow for Form 8962 include improved efficiency, increased security for sensitive information, and a straightforward user experience. By utilizing our platform, you can ensure accurate completion and timely submission of your tax documents.

-

Is airSlate SignNow secure for handling sensitive tax documents like Form 8962?

Absolutely! airSlate SignNow prioritizes security and compliance, employing encryption and other protective measures to safeguard sensitive documents like Form 8962. You can trust that your tax information is secure while using our platform.

Get more for Form 8962 Premium Tax Credit PTC

- Utah residential first mortgage notification 2015 2018 form

- Scc759 921 2015 2018 form

- Scc759 921 2013 form

- Home permit application 2015 2019 form

- Notification for underground storage tanks usts 7530 3 notification for underground storage tanks usts 7530 3 form

- 7530 3 notification for underground storage tanks form

- Final revised feb townofstowevt form

- Wa approved training 2013 2019 form

Find out other Form 8962 Premium Tax Credit PTC

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word