Personal Income Tax Forms PA Department of Revenue

Understanding the Pennsylvania Personal Income Tax Forms

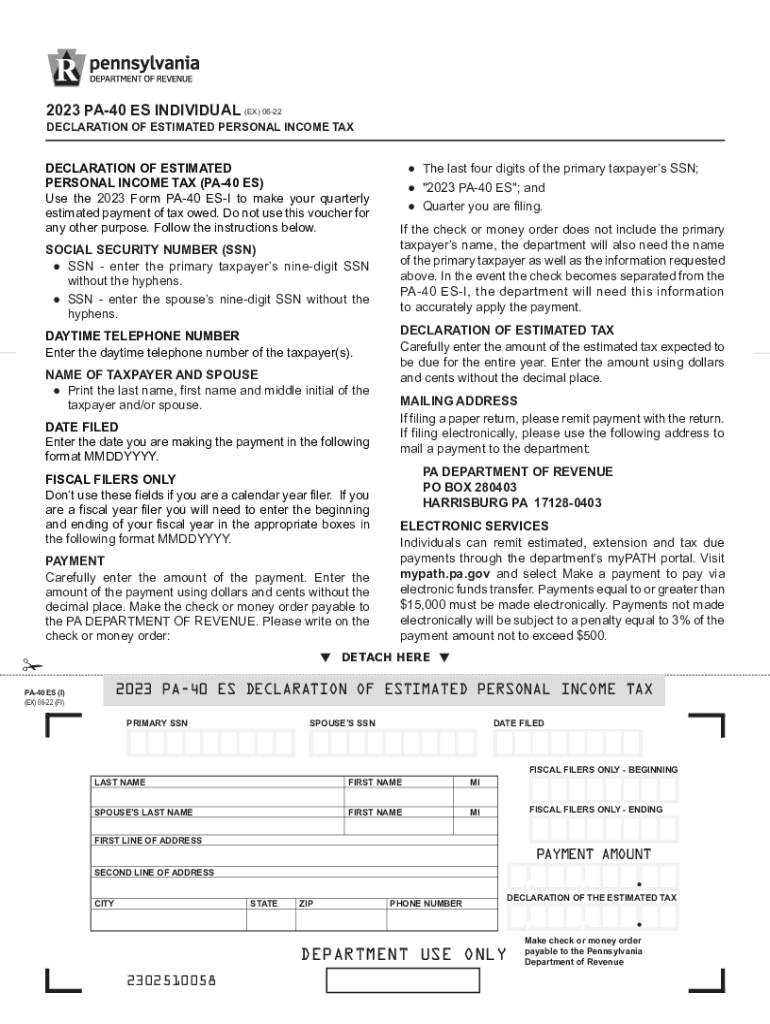

The Pennsylvania Department of Revenue provides various personal income tax forms, including the 2023 PA 40 tax form. This form is essential for residents and non-residents earning income in Pennsylvania. It is used to report income, calculate tax liability, and claim any applicable credits or deductions. Understanding the purpose and requirements of the PA 40 form is crucial for accurate tax reporting and compliance with state tax laws.

How to Complete the 2023 PA 40 Tax Form

Completing the 2023 PA 40 tax form involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, accurately enter your income information on the form. Be sure to include any deductions and credits you may qualify for, such as the Pennsylvania earned income tax credit. Finally, review the form for accuracy before submitting it to ensure compliance with Pennsylvania tax regulations.

Obtaining the 2023 PA 40 Tax Form

The 2023 PA 40 tax form can be obtained directly from the Pennsylvania Department of Revenue's website. It is available in a printable PDF format, allowing taxpayers to fill it out by hand or electronically. Additionally, many tax preparation services and software programs offer access to the form, making it easier for individuals to complete their tax filings accurately and efficiently.

Filing Deadlines for the 2023 PA 40 Tax Form

Taxpayers must be aware of the filing deadlines associated with the 2023 PA 40 tax form. Typically, the deadline for filing personal income tax returns in Pennsylvania is April 15. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is important to file on time to avoid penalties and interest on any taxes owed.

Submitting the 2023 PA 40 Tax Form

There are several methods for submitting the 2023 PA 40 tax form. Taxpayers can file electronically through approved e-filing services, which can expedite processing times and reduce the risk of errors. Alternatively, the form can be mailed to the appropriate address provided by the Pennsylvania Department of Revenue. In-person submissions are also an option at designated tax offices, though this may require an appointment.

Key Elements of the 2023 PA 40 Tax Form

The 2023 PA 40 tax form includes several key elements that taxpayers must complete. These elements typically consist of personal identification information, income details, deductions, and credits. Additionally, taxpayers must calculate their total tax liability and any payments made throughout the year. Understanding these components is essential for accurate completion and compliance with state tax laws.

Penalties for Non-Compliance with the 2023 PA 40 Tax Form

Failing to file the 2023 PA 40 tax form by the deadline can result in significant penalties. The Pennsylvania Department of Revenue imposes fines for late filings and may charge interest on any unpaid taxes. It is crucial for taxpayers to adhere to filing requirements to avoid these penalties and ensure they remain in good standing with state tax authorities.

Quick guide on how to complete personal income tax forms pa department of revenue 632608091

Effortlessly Prepare Personal Income Tax Forms PA Department Of Revenue on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Personal Income Tax Forms PA Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Personal Income Tax Forms PA Department Of Revenue with Ease

- Obtain Personal Income Tax Forms PA Department Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or mask sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require you to print new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Personal Income Tax Forms PA Department Of Revenue and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal income tax forms pa department of revenue 632608091

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 pa 40 tax form?

The 2023 pa 40 tax form is the official Pennsylvania State income tax return that residents must file annually. This form is essential for reporting income, calculating tax liabilities, and claiming credits. Understanding how to properly complete the 2023 pa 40 tax form can help you avoid errors and ensure timely filing.

-

How can airSlate SignNow assist in filing the 2023 pa 40 tax form?

AirSlate SignNow offers a comprehensive solution that enables users to easily create, send, and eSign documents, including tax forms like the 2023 pa 40. Our user-friendly interface streamlines the process, making it efficient to gather necessary signatures and approve documentation swiftly. This can greatly reduce the time taken to complete and file the 2023 pa 40 tax form.

-

What are the pricing options for using airSlate SignNow to manage the 2023 pa 40 tax form?

AirSlate SignNow provides a variety of pricing plans to suit different needs, starting with a free trial for first-time users. Paid plans offer more features such as additional templates and advanced integrations, which can be invaluable when managing documents like the 2023 pa 40 tax form. Review the pricing options to find the package that fits your budget and needs.

-

Are there any integrations available with airSlate SignNow for tax preparation tools related to the 2023 pa 40 tax form?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software, helping you efficiently manage the 2023 pa 40 tax form and other documents. With these integrations, you can automatically populate necessary fields and reduce manual data entry. This connection ensures that your workflow is smooth and efficient.

-

What features make airSlate SignNow ideal for handling the 2023 pa 40 tax form?

AirSlate SignNow offers features such as document templates, eSignature capabilities, and real-time tracking, which are all crucial for handling the 2023 pa 40 tax form. These features allow for efficient document creation, easy signature collection, and maintaining a clear record of interactions. This can signNowly streamline the tax filing process for users.

-

Is airSlate SignNow secure for filing sensitive documents like the 2023 pa 40 tax form?

Absolutely, airSlate SignNow employs industry-leading security measures to protect all documents, including the 2023 pa 40 tax form. Our platform uses encryption to safeguard user data and ensures compliance with various regulations. You can trust that your sensitive information will remain secure throughout the signing and filing process.

-

Can I access my completed 2023 pa 40 tax form anytime with airSlate SignNow?

Yes, once you complete and file your 2023 pa 40 tax form using airSlate SignNow, you can access it at any time through your account. Our cloud-based solution ensures all your documents are stored securely and are easily retrievable. This feature allows for convenient access to your tax documents whenever needed.

Get more for Personal Income Tax Forms PA Department Of Revenue

Find out other Personal Income Tax Forms PA Department Of Revenue

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document