How Do I Get a Sales Tax Exemption for a Non Profit Form

Understanding Sales Tax Exemption for Nonprofits in Pennsylvania

In Pennsylvania, nonprofit organizations may qualify for a sales tax exemption, allowing them to purchase goods and services without paying sales tax. This exemption is crucial for nonprofits as it helps them allocate more resources toward their missions. To qualify, organizations must be recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code and must apply for the appropriate exemption certificate.

Steps to Obtain a Sales Tax Exemption for Nonprofits

The process for obtaining a sales tax exemption in Pennsylvania involves several key steps:

- Verify your organization’s eligibility by ensuring it meets IRS requirements for tax-exempt status.

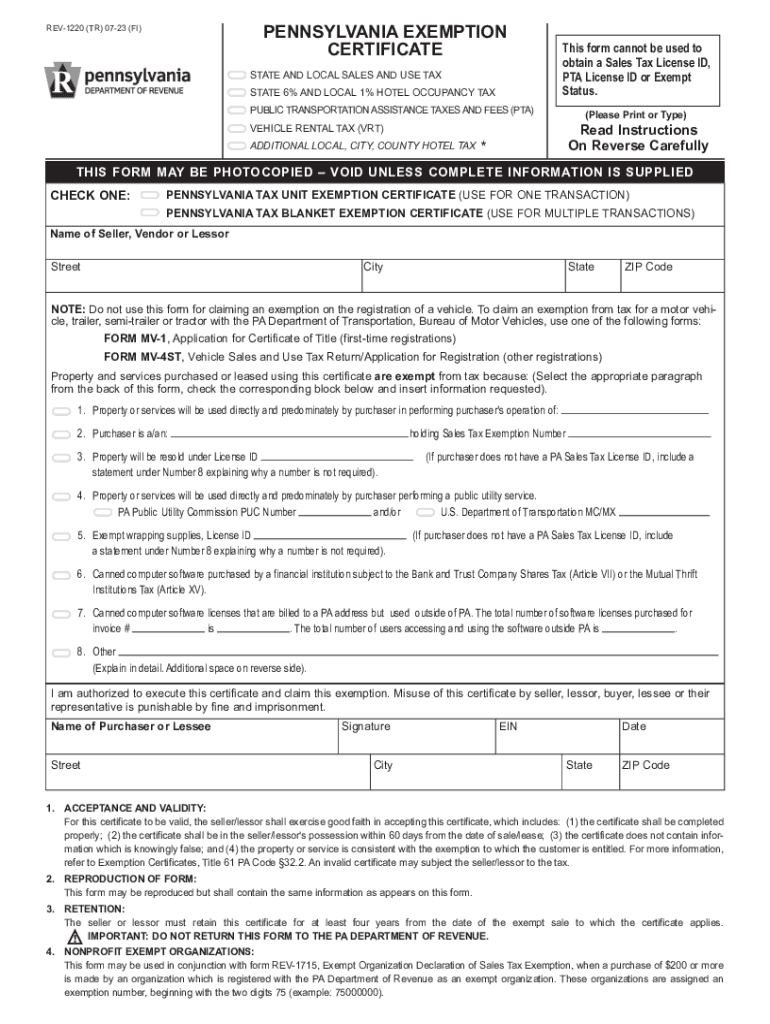

- Complete the Pennsylvania Exemption Certificate (REV-1220) to apply for the sales tax exemption.

- Submit the completed REV-1220 form to the Pennsylvania Department of Revenue.

- Once approved, retain the exemption certificate for future purchases and provide copies to vendors as needed.

Required Documents for Sales Tax Exemption Application

To successfully apply for a sales tax exemption, nonprofits must prepare and submit specific documents, including:

- A copy of the IRS determination letter confirming tax-exempt status.

- The completed REV-1220 form, which includes organizational details and purpose.

- Any additional documentation that supports the nonprofit's mission and activities.

Legal Use of the Sales Tax Exemption Certificate

Once a nonprofit organization receives its sales tax exemption certificate, it is essential to understand its legal use. The certificate allows the organization to purchase goods and services without incurring sales tax. However, it should only be used for items directly related to the nonprofit's exempt activities. Misuse of the exemption certificate can lead to penalties and the potential loss of tax-exempt status.

Filing Deadlines and Important Dates

Nonprofits should be aware of key deadlines associated with the sales tax exemption application process. While there are no specific deadlines for submitting the REV-1220 form, it is advisable to apply as soon as the organization is established and recognized by the IRS. Keeping track of any changes in state regulations or renewal requirements is also important to maintain compliance.

Eligibility Criteria for Sales Tax Exemption

To qualify for a sales tax exemption in Pennsylvania, organizations must meet specific eligibility criteria, including:

- Being a nonprofit organization recognized under Section 501(c)(3) of the Internal Revenue Code.

- Engaging in activities that serve a public benefit, such as charitable, educational, or religious purposes.

- Maintaining accurate records of all purchases made under the exemption.

Quick guide on how to complete how do i get a sales tax exemption for a non profit

Prepare How Do I Get A Sales Tax Exemption For A Non profit effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage How Do I Get A Sales Tax Exemption For A Non profit across any platform using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign How Do I Get A Sales Tax Exemption For A Non profit seamlessly

- Locate How Do I Get A Sales Tax Exemption For A Non profit and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow takes care of your document management needs in mere clicks from any device you prefer. Edit and eSign How Do I Get A Sales Tax Exemption For A Non profit and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how do i get a sales tax exemption for a non profit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rev pa in the context of airSlate SignNow?

Rev pa refers to the revenue per account in the context of airSlate SignNow. It is a key metric that helps businesses understand the value generated from each account. By utilizing airSlate SignNow, businesses can enhance their document workflows, ultimately increasing their rev pa.

-

How does airSlate SignNow help improve rev pa?

airSlate SignNow streamlines the process of sending and eSigning documents, which boosts efficiency and reduces turnaround times. By improving the speed and accuracy of document handling, businesses can increase customer satisfaction and retention, contributing to a higher rev pa.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs. These plans are designed to provide cost-effective solutions while maximizing the benefits of features that can signNowly enhance your rev pa. You can choose a plan that aligns with your usage and expected ROI.

-

What key features of airSlate SignNow can help with document management?

Some key features of airSlate SignNow include customizable templates, secure eSignature capabilities, and real-time collaboration tools. These features streamline document management processes, thereby enhancing productivity and potentially boosting your rev pa.

-

Can airSlate SignNow integrate with other business tools?

Yes, airSlate SignNow can seamlessly integrate with popular business tools like Salesforce, Google Workspace, and Microsoft Office. This integration capability allows businesses to enhance their workflow and improve their rev pa by eliminating manual errors and saving time.

-

What benefits does airSlate SignNow offer to small businesses?

For small businesses, airSlate SignNow offers an affordable and user-friendly solution to manage document workflows effectively. By minimizing administrative burdens and enhancing efficiency, small businesses can focus on growth strategies that positively affect their rev pa.

-

Is airSlate SignNow compliant with legal standards?

Absolutely! airSlate SignNow complies with all major legal standards, including eSignature legislation like ESIGN and UETA. This compliance ensures that your documents are legally binding, instilling trust in your customers and helping to improve your rev pa.

Get more for How Do I Get A Sales Tax Exemption For A Non profit

- Board of behavioral sciences order of adoption the board of bbs ca form

- Untitled city of vista form

- Cdow refund license 2018 2019 form

- Ucc 1 filing colorado 2007 2019 form

- School fire drill checklist 2014 2019 form

- Govsdecert form

- Miami dade county council pta forms 2016 2019

- Form ben 001 florida retirement system ftp

Find out other How Do I Get A Sales Tax Exemption For A Non profit

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself