For Information Regarding IFTA Reporting, Call 505 827 0392 or Toll 888 MVD CVB1 or 888 683 2821

Understanding the New Mexico IFTA Quarterly Tax Return

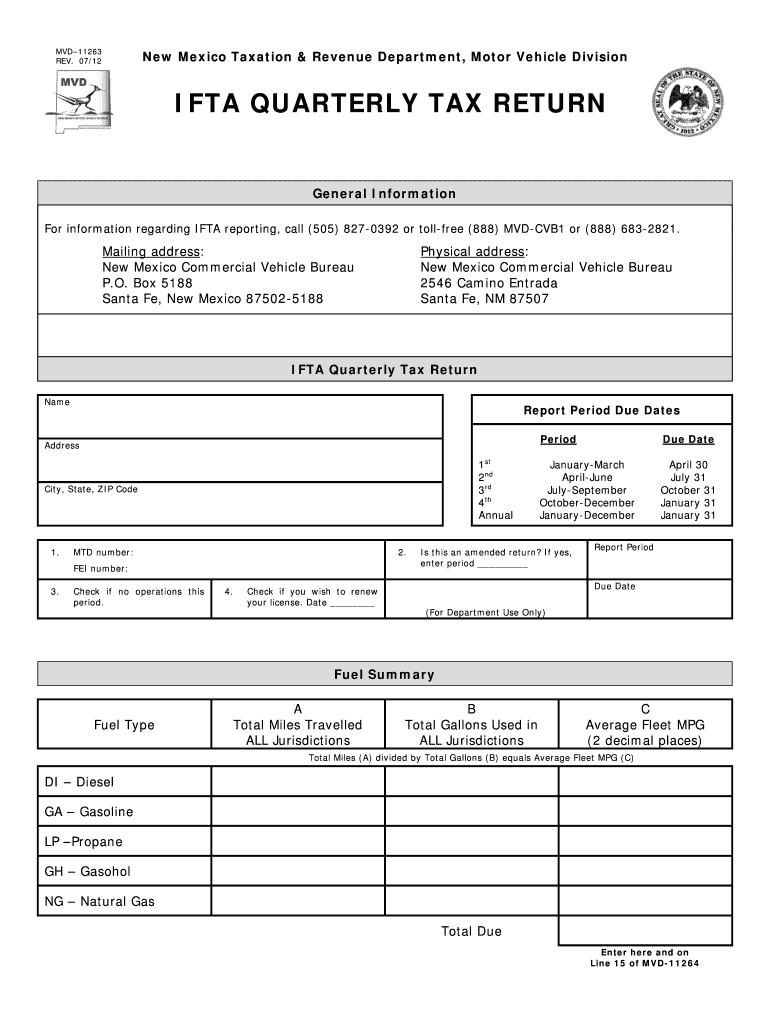

The New Mexico IFTA quarterly tax return is a crucial document for businesses that operate commercial vehicles across state lines. This return is used to report fuel consumption and calculate the taxes owed to various jurisdictions. It is essential for maintaining compliance with the International Fuel Tax Agreement (IFTA), which simplifies the reporting of fuel use by motor carriers operating in multiple states.

Filing Deadlines for IFTA Returns

Businesses must adhere to specific deadlines when filing the New Mexico IFTA quarterly tax return. Typically, the returns are due on the last day of the month following the end of each quarter. The quarters are defined as follows:

- First Quarter: January 1 - March 31, due April 30

- Second Quarter: April 1 - June 30, due July 31

- Third Quarter: July 1 - September 30, due October 31

- Fourth Quarter: October 1 - December 31, due January 31

Late submissions may result in penalties, so it is important to stay on schedule.

Required Documents for Filing

To complete the New Mexico IFTA quarterly tax return, businesses need to gather several key documents. These typically include:

- Fuel purchase receipts

- Mileage records for each jurisdiction

- Previous IFTA returns for reference

Having these documents organized will facilitate a smoother filing process and help ensure accuracy.

Submitting the IFTA Return

Businesses can submit the New Mexico IFTA quarterly tax return through various methods, including online submissions, mail, or in-person delivery to the appropriate state office. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt.

Penalties for Non-Compliance

Failure to file the New Mexico IFTA quarterly tax return on time can lead to significant penalties. These may include fines based on the amount of tax owed, as well as interest on any unpaid taxes. It is crucial for businesses to understand these consequences and prioritize timely submissions to avoid unnecessary costs.

State-Specific Rules for IFTA Reporting

New Mexico has specific regulations that govern how the IFTA quarterly tax return should be completed and submitted. Familiarizing yourself with these state-specific rules can help ensure compliance and avoid errors. It is advisable to consult the New Mexico Motor Vehicle Division (MVD) for the most current guidelines and requirements.

Quick guide on how to complete for information regarding ifta reporting call 505 827 0392 or toll 888 mvd cvb1 or 888 683 2821

Complete For Information Regarding IFTA Reporting, Call 505 827 0392 Or Toll 888 MVD CVB1 Or 888 683 2821 easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents rapidly without delays. Handle For Information Regarding IFTA Reporting, Call 505 827 0392 Or Toll 888 MVD CVB1 Or 888 683 2821 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign For Information Regarding IFTA Reporting, Call 505 827 0392 Or Toll 888 MVD CVB1 Or 888 683 2821 with ease

- Obtain For Information Regarding IFTA Reporting, Call 505 827 0392 Or Toll 888 MVD CVB1 Or 888 683 2821 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional hand-written signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign For Information Regarding IFTA Reporting, Call 505 827 0392 Or Toll 888 MVD CVB1 Or 888 683 2821 and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for information regarding ifta reporting call 505 827 0392 or toll 888 mvd cvb1 or 888 683 2821

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new mexico ifta quarterly tax return?

The New Mexico IFTA quarterly tax return is a report filed by interstate motor carriers to report their fuel usage. This return ensures that the correct amount of fuel taxes is paid to the state of New Mexico and allows for credits for fuel purchased in other jurisdictions.

-

How can airSlate SignNow help with filing the new mexico ifta quarterly tax return?

AirSlate SignNow streamlines the process of preparing and submitting the New Mexico IFTA quarterly tax return. Our platform allows you to electronically sign and send important documents, ensuring your tax return is filed accurately and on time without hassle.

-

What are the costs associated with filing the new mexico ifta quarterly tax return using airSlate SignNow?

The cost to use airSlate SignNow varies based on the subscription plan you choose. Our plans are designed to be cost-effective and cater to businesses of all sizes, making it easy to manage the administrative tasks related to the New Mexico IFTA quarterly tax return.

-

Are there any features that specifically assist with the new mexico ifta quarterly tax return?

Yes, airSlate SignNow offers features such as document templates, reminders, and secure cloud storage that specifically assist with the New Mexico IFTA quarterly tax return. These tools simplify the preparation process and keep all your documents organized and accessible.

-

Can I integrate airSlate SignNow with other software for my new mexico ifta quarterly tax return?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your New Mexico IFTA quarterly tax return alongside your other financial tasks. This integration helps streamline your workflow and reduces the chance of errors.

-

What are the benefits of using airSlate SignNow for the new mexico ifta quarterly tax return?

Using airSlate SignNow for your New Mexico IFTA quarterly tax return provides multiple benefits, including time-saving automation, enhanced accuracy, and improved document tracking. Our platform ensures that you can complete your tax responsibilities smoothly, free from confusion and complications.

-

How does airSlate SignNow ensure the security of my new mexico ifta quarterly tax return?

AirSlate SignNow prioritizes the security of your documents by utilizing encryption and compliance with data protection regulations. When you file your New Mexico IFTA quarterly tax return through our platform, you can trust that your sensitive information is kept safe and confidential.

Get more for For Information Regarding IFTA Reporting, Call 505 827 0392 Or Toll 888 MVD CVB1 Or 888 683 2821

- Memorandum to depository broward county clerk of court form

- Sample motion for post conviction relief florida form

- Florida family law rules of procedure form 12902c family law financial affidavit 1003

- Georgia continuance form

- Deviation addendum form new york child support

- Civildomestic bench trial calendar gwinnett county courts form

- Disclosure statement wisconsinillinois child support border form

- In the circuit court of cook county illinois county 50195170 form

Find out other For Information Regarding IFTA Reporting, Call 505 827 0392 Or Toll 888 MVD CVB1 Or 888 683 2821

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document