KANSAS DEPARTMENT of REVENUE Decedent Refund Claim 2019-2026

What is the Kansas Department of Revenue Decedent Refund Claim

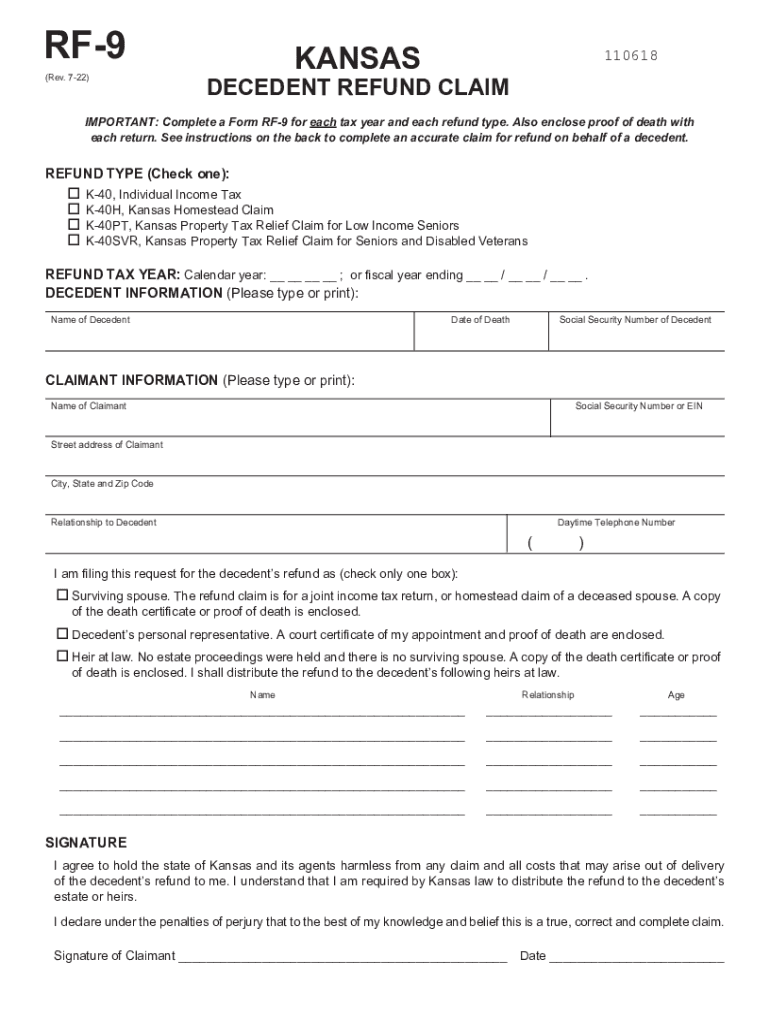

The Kansas Department of Revenue Decedent Refund Claim, commonly referred to as the Kansas RF-9, is a form used to request a refund of state income tax that was withheld from a deceased individual's income. This form is essential for the estate of the decedent to reclaim any overpaid taxes, ensuring that the rightful beneficiaries receive the appropriate financial restitution. The RF-9 form serves as a formal request to the state government, detailing the circumstances of the decedent's tax situation.

Steps to Complete the Kansas Department of Revenue Decedent Refund Claim

Completing the Kansas RF-9 form involves several key steps:

- Gather all necessary documents, including the decedent's tax returns, W-2 forms, and any relevant financial statements.

- Fill out the Kansas RF-9 form accurately, providing the decedent's personal information, tax identification number, and details about the refund being claimed.

- Include any supporting documentation that substantiates the claim, such as proof of tax withholding.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the Kansas Department of Revenue, either online, by mail, or in person, as per the guidelines.

Required Documents for the Kansas RF-9 Form

When submitting the Kansas RF-9 form, it is crucial to include specific documents to support the claim:

- The decedent's final tax return or copies of W-2 forms showing tax withholdings.

- A copy of the death certificate to verify the decedent's passing.

- Any documentation that demonstrates the eligibility for the refund, such as proof of overpayment.

Form Submission Methods

The Kansas RF-9 form can be submitted through various methods, providing flexibility for claimants:

- Online: Claimants can fill out and submit the form electronically through the Kansas Department of Revenue's website.

- By Mail: The completed form can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Individuals may also choose to deliver the form directly to a local Department of Revenue office.

Eligibility Criteria for the Kansas RF-9 Form

To qualify for filing the Kansas RF-9 form, certain criteria must be met:

- The individual must be deceased, and the claim must be filed by an authorized representative of the estate.

- There must be evidence of tax withholding from the decedent's income that exceeds their tax liability.

- The claim should be filed within the designated time frame set by the Kansas Department of Revenue to ensure eligibility.

Key Elements of the Kansas RF-9 Form

Understanding the key components of the Kansas RF-9 form is essential for accurate completion:

- Decedent Information: This section requires details about the deceased, including name, address, and Social Security number.

- Claim Amount: Applicants must specify the total amount of tax refund being requested.

- Signature: The form must be signed by the authorized representative, affirming the accuracy of the information provided.

Quick guide on how to complete kansas department of revenue decedent refund claim

Prepare KANSAS DEPARTMENT OF REVENUE Decedent Refund Claim seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, edit, and electronically sign your documents swiftly without delays. Manage KANSAS DEPARTMENT OF REVENUE Decedent Refund Claim on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign KANSAS DEPARTMENT OF REVENUE Decedent Refund Claim effortlessly

- Find KANSAS DEPARTMENT OF REVENUE Decedent Refund Claim and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Modify and eSign KANSAS DEPARTMENT OF REVENUE Decedent Refund Claim and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas department of revenue decedent refund claim

Create this form in 5 minutes!

How to create an eSignature for the kansas department of revenue decedent refund claim

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Kansas RF9 revenue and how does it relate to airSlate SignNow?

Kansas RF9 revenue refers to a specific revenue generation model utilized by businesses in Kansas. With airSlate SignNow, you can easily manage documents and contracts that relate to Kansas RF9 revenue, ensuring that your business remains compliant while maximizing efficiency.

-

How does airSlate SignNow help streamline processes associated with Kansas RF9 revenue?

airSlate SignNow streamlines the management of documents related to Kansas RF9 revenue by providing a user-friendly e-signature solution. This allows businesses to quickly send, receive, and store legally binding documents, reducing unnecessary delays in revenue collection.

-

What are the pricing options for using airSlate SignNow for Kansas RF9 revenue?

airSlate SignNow offers flexible pricing plans designed to accommodate various business sizes, making it accessible for companies focused on Kansas RF9 revenue. You can choose a plan based on your document needs, ensuring you only pay for the features that matter most to your business.

-

Are there specific features in airSlate SignNow that support Kansas RF9 revenue management?

Yes, airSlate SignNow includes features like customizable templates, automated reminders, and detailed tracking that signNowly enhance management of Kansas RF9 revenue. These tools help businesses ensure timely transactions and maintain thorough documentation.

-

Can I integrate airSlate SignNow with other tools for Kansas RF9 revenue management?

Absolutely! airSlate SignNow integrates seamlessly with popular platforms that aid in managing Kansas RF9 revenue, such as CRM and accounting software. This integration helps streamline your workflow and improves overall productivity.

-

What benefits can businesses expect when using airSlate SignNow for Kansas RF9 revenue?

Using airSlate SignNow for Kansas RF9 revenue provides numerous benefits, including time savings, improved workflow, and enhanced security for document handling. Businesses can see increased efficiency in transaction processing, ultimately boosting their revenue potential.

-

Is airSlate SignNow compliant with regulations related to Kansas RF9 revenue?

Yes, airSlate SignNow is compliant with legal standards and regulations, ensuring all documents related to Kansas RF9 revenue are handled securely. This Compliance is crucial for businesses aiming to uphold legal integrity while managing their revenue streams.

Get more for KANSAS DEPARTMENT OF REVENUE Decedent Refund Claim

- Lethbridge econ 102 test bank form

- Media consent form

- Foothill de anza colleges form

- Apc letter of appeal st marys college of maryland smcm form

- Time conflict enrollment petition form csun

- Facility use bapplicationb south kitsap school district skitsap wednet form

- 2018 2019 parent wage verification worksheet form

- Special enrollment form salve regina university

Find out other KANSAS DEPARTMENT OF REVENUE Decedent Refund Claim

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile