File or Amend My ReturnWashington Department of Revenue 2020

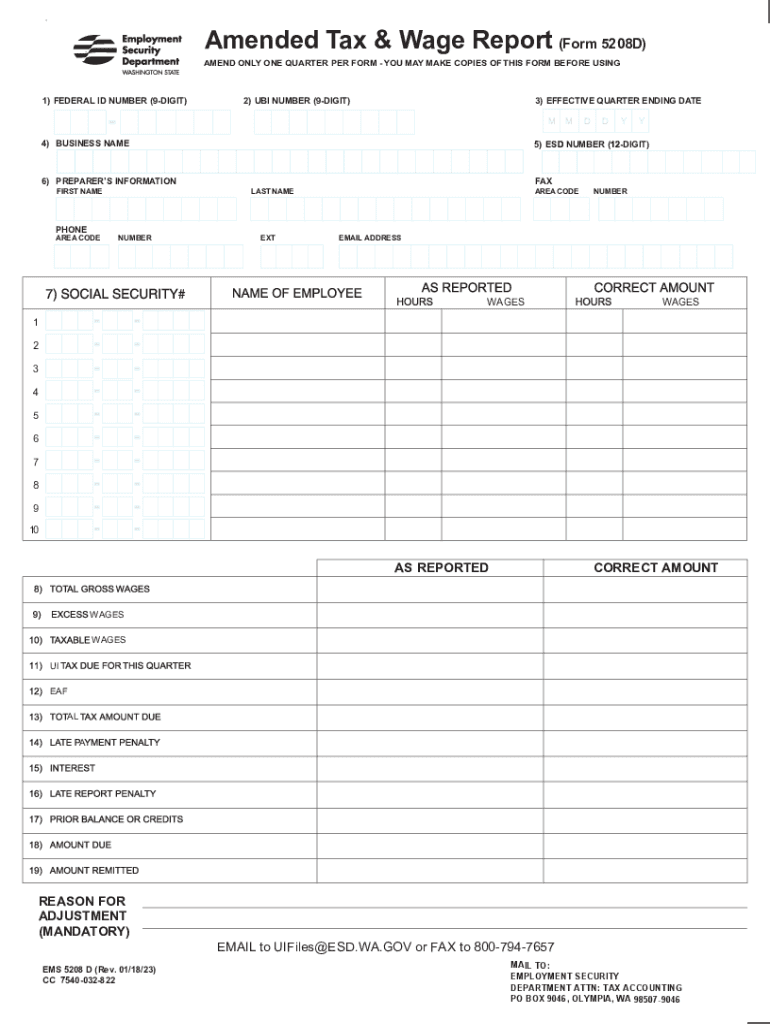

Understanding the Form 5208

The Form 5208 is a crucial document used for reporting amended tax wages in Washington State. This form allows taxpayers to correct previously filed wage reports, ensuring accurate tax calculations and compliance with state regulations. It is essential for individuals and businesses that need to amend their tax filings due to errors or changes in income reporting.

Steps to Complete the Form 5208

Completing the Form 5208 involves several key steps:

- Gather necessary information, including your original tax filings and any supporting documentation.

- Fill in the required fields on the form, ensuring accuracy to avoid delays.

- Double-check all entries for correctness, especially figures related to wages and taxes withheld.

- Sign and date the form to validate your submission.

Required Documents for Filing Form 5208

When preparing to file the Form 5208, it is important to have the following documents on hand:

- Your original tax wage report.

- Any relevant pay stubs or wage statements that support the amendments.

- Documentation of any changes that necessitated the amendment, such as corrected W-2 forms.

Form Submission Methods

The Form 5208 can be submitted through various methods to accommodate different preferences:

- Online: Utilize the Washington Department of Revenue's online portal for electronic submission.

- Mail: Send the completed form to the appropriate address as indicated in the instructions.

- In-Person: Visit a local Department of Revenue office for direct submission.

Penalties for Non-Compliance

Failure to file the Form 5208 or inaccuracies in reporting can result in penalties. These may include:

- Fines imposed by the Washington Department of Revenue.

- Interest on unpaid taxes due to late filing.

- Potential audits or further investigations into tax compliance.

Eligibility Criteria for Form 5208

To be eligible to file the Form 5208, taxpayers must meet specific criteria, including:

- Having previously filed a tax wage report that requires correction.

- Being a resident or having business operations in Washington State.

- Ensuring that the amendments are made within the designated time frame set by the Department of Revenue.

Quick guide on how to complete file or amend my returnwashington department of revenue

Effortlessly Prepare File Or Amend My ReturnWashington Department Of Revenue on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, providing access to the necessary forms and secure online storage. airSlate SignNow equips you with all the resources required to swiftly create, modify, and electronically sign your documents without delays. Handle File Or Amend My ReturnWashington Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

Edit and eSign File Or Amend My ReturnWashington Department Of Revenue with Ease

- Obtain File Or Amend My ReturnWashington Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select signNow sections of the documents or redact sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign tool, which requires just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your edits.

- Choose how you'd like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Alter and eSign File Or Amend My ReturnWashington Department Of Revenue and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct file or amend my returnwashington department of revenue

Create this form in 5 minutes!

How to create an eSignature for the file or amend my returnwashington department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 5208 form and how is it used?

The form 5208 form is a specific document used for tax purposes, typically related to state or federal filings. It is essential for businesses to ensure compliance and accurate reporting. Using airSlate SignNow, you can easily eSign and submit the form 5208 form securely online.

-

How does airSlate SignNow simplify the completion of the form 5208 form?

airSlate SignNow simplifies the process by providing templates for the form 5208 form, allowing users to fill out necessary fields electronically. This digital approach saves time and reduces the risk of errors. Additionally, you can share and collaborate with others seamlessly.

-

What are the pricing options for using airSlate SignNow for the form 5208 form?

airSlate SignNow offers a variety of pricing plans designed to meet the needs of different business sizes. Whether you are a small startup or an established enterprise, you can find a plan that suits your budget while efficiently managing the form 5208 form and other documents.

-

Can I integrate airSlate SignNow with other software while handling the form 5208 form?

Yes, airSlate SignNow provides integration capabilities with various applications, enabling you to work efficiently with the form 5208 form. Whether it's CRM systems, cloud storage, or accounting software, integration helps streamline your workflows and improve document management.

-

What security features are included when eSigning the form 5208 form with airSlate SignNow?

When you eSign the form 5208 form using airSlate SignNow, your data is protected with industry-standard encryption. We prioritize your privacy and security with features such as two-factor authentication and detailed audit trails, ensuring that your documents remain safe.

-

How can airSlate SignNow enhance collaboration on the form 5208 form?

With airSlate SignNow, collaboration on the form 5208 form is made easy by allowing multiple users to access and sign documents simultaneously. You can track changes, leave comments, and ensure all stakeholders are involved in the process, enhancing overall efficiency.

-

Is customer support available for users of the form 5208 form in airSlate SignNow?

Absolutely! Our dedicated customer support team is available to assist users with any queries related to the form 5208 form and the overall eSigning process. Whether you need help navigating the platform or understanding features, we're here to provide guidance.

Get more for File Or Amend My ReturnWashington Department Of Revenue

Find out other File Or Amend My ReturnWashington Department Of Revenue

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms

- Sign Missouri Rental property lease agreement Mobile

- Sign Missouri Rental property lease agreement Safe

- Sign West Virginia Rental lease agreement forms Safe

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract