Instructions for Form 8959 Instructions for Form 8959, Additional Medicare Tax

Understanding Form 8959 and Additional Medicare Tax

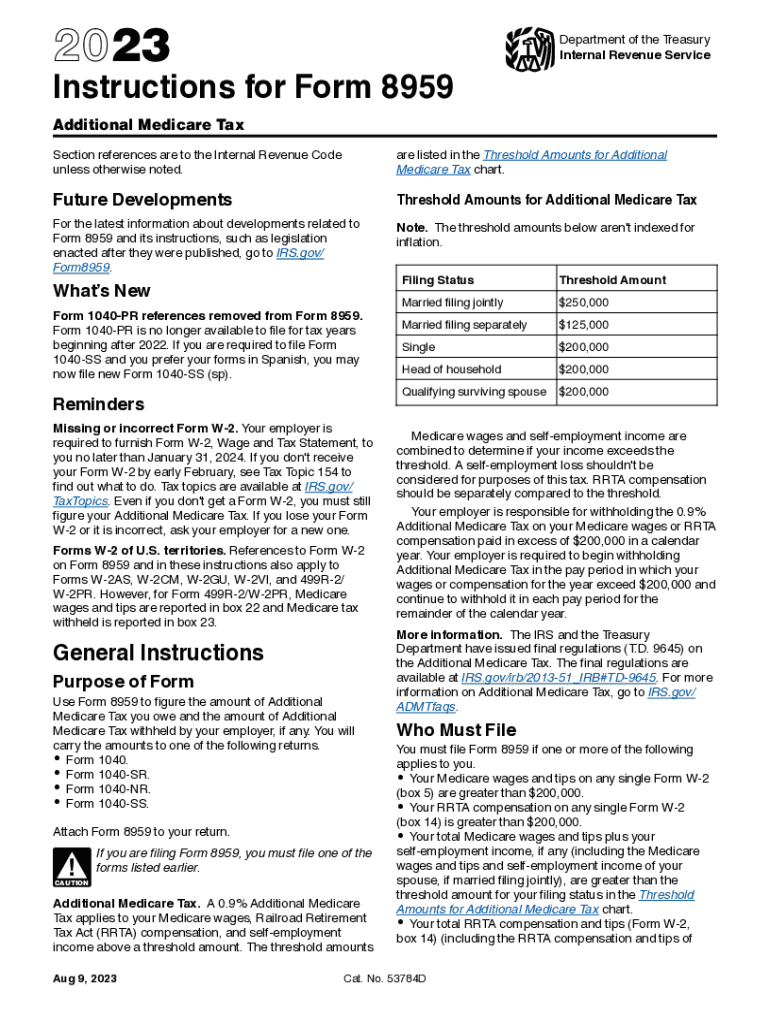

Form 8959 is used to report the Additional Medicare Tax, which applies to high-income earners. This tax is an extra charge that individuals must pay on wages, compensation, and self-employment income exceeding a certain threshold. For single filers, the threshold is two hundred thousand dollars, while for married couples filing jointly, it is two hundred fifty thousand dollars. It is important to understand the implications of this tax, as it can affect your overall tax liability.

Steps to Complete Form 8959

Completing Form 8959 involves several key steps:

- Gather necessary income information, including wages and self-employment income.

- Determine if your income exceeds the threshold for Additional Medicare Tax.

- Fill out the form by entering your total wages, compensation, and self-employment income.

- Calculate the Additional Medicare Tax owed by applying the appropriate tax rate to the income over the threshold.

- Review the form for accuracy before submission.

Obtaining Form 8959

Form 8959 can be obtained directly from the IRS website. It is available for download in PDF format, allowing you to print it for completion. Additionally, tax preparation software often includes this form, making it easier to fill out as part of your overall tax filing process. Ensure you have the most recent version of the form to comply with current tax regulations.

IRS Guidelines for Form 8959

The IRS provides specific guidelines for completing Form 8959. These include instructions on how to calculate your Additional Medicare Tax liability and the necessary information to report. It is essential to follow these guidelines closely to avoid errors that could lead to penalties or additional taxes owed. The IRS also updates these guidelines periodically, so checking for the latest instructions is advisable.

Filing Deadlines for Form 8959

Form 8959 must be filed along with your annual income tax return. The typical deadline for filing your tax return is April fifteenth of the following year. If you need additional time, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties. Being aware of these deadlines is crucial for timely compliance.

Penalties for Non-Compliance with Form 8959

Failure to file Form 8959 when required can result in penalties from the IRS. These penalties may include fines for late filing or failure to pay the Additional Medicare Tax owed. Additionally, interest may accrue on any unpaid taxes, increasing the total amount owed over time. It is important to understand these consequences to ensure compliance and avoid unnecessary financial burdens.

Quick guide on how to complete instructions for form 8959 instructions for form 8959 additional medicare tax

Complete Instructions For Form 8959 Instructions For Form 8959, Additional Medicare Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Instructions For Form 8959 Instructions For Form 8959, Additional Medicare Tax on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Instructions For Form 8959 Instructions For Form 8959, Additional Medicare Tax with ease

- Locate Instructions For Form 8959 Instructions For Form 8959, Additional Medicare Tax and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details, then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Form 8959 Instructions For Form 8959, Additional Medicare Tax and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8959 instructions for form 8959 additional medicare tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8959 and why do I need it?

Form 8959 is used to report Additional Medicare Tax for individuals with a high income. You need this form to ensure you are compliant with tax laws and to avoid penalties. Using airSlate SignNow to eSign Form 8959 simplifies the process and keeps your documents secure.

-

How does airSlate SignNow help with Form 8959 processing?

airSlate SignNow allows you to easily fill out and eSign Form 8959 online, streamlining the filing process. The user-friendly interface ensures that even those unfamiliar with tax forms can complete it without hassle. Plus, our platform saves your documents for easy access and future reference.

-

Is airSlate SignNow secure for handling Form 8959?

Absolutely! airSlate SignNow uses advanced encryption and security measures to protect sensitive information in your Form 8959. We comply with industry standards to ensure your eSigned documents are safe from unauthorized access.

-

What is the pricing for using airSlate SignNow for Form 8959?

airSlate SignNow offers various pricing plans that are cost-effective for businesses of all sizes. You can choose a subscription that fits your needs, whether you need it for occasional eSigning or regular use for documents like Form 8959. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for Form 8959?

Yes, airSlate SignNow offers integrations with various applications to enhance your workflow. This means you can easily import data from your accounting software directly into Form 8959, making the process even more efficient. Explore our integration options for seamless compatibility.

-

What features does airSlate SignNow provide for enhancing Form 8959 completion?

airSlate SignNow sets itself apart with features like template creation, real-time tracking, and reminders for signing. These tools help you stay organized and ensure that your Form 8959 is completed on time. Our solution simplifies what could be a complex process.

-

Is there a mobile app for completing Form 8959 using airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to complete and eSign Form 8959 from anywhere. This flexibility is perfect for busy professionals who need to manage documents on the go. Download the app for easy access to your documents and eSigning capabilities.

Get more for Instructions For Form 8959 Instructions For Form 8959, Additional Medicare Tax

Find out other Instructions For Form 8959 Instructions For Form 8959, Additional Medicare Tax

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License