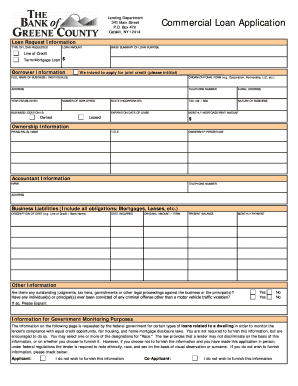

Commercial Loan Application the Bank of Greene County Form

Understanding the Commercial Loan Application at The Bank Of Greene County

The Commercial Loan Application at The Bank Of Greene County is a crucial document used by businesses seeking financial assistance. This application collects essential information about the business, its financial status, and the purpose of the loan. It is designed to help the bank assess the creditworthiness of the applicant and determine the best loan options available. Completing this application accurately is vital for a smooth approval process.

Key Elements of the Commercial Loan Application

When filling out the Commercial Loan Application, several key elements must be included:

- Business Information: This includes the legal name, address, and type of business entity (e.g., LLC, Corporation).

- Financial Statements: Applicants must provide recent financial statements, including balance sheets and income statements, to demonstrate financial health.

- Loan Purpose: A clear explanation of how the loan will be used is necessary, whether for purchasing equipment, expanding operations, or other business needs.

- Personal Guarantees: Personal information from business owners may be required to secure the loan, including credit history and personal financial statements.

Steps to Complete the Commercial Loan Application

Completing the Commercial Loan Application involves several steps to ensure accuracy and completeness:

- Gather Required Documents: Collect all necessary financial documents, business licenses, and identification.

- Fill Out the Application: Carefully complete each section of the application, ensuring all information is accurate.

- Review the Application: Double-check all entries for errors or omissions before submission.

- Submit the Application: Send the completed application to The Bank Of Greene County through the preferred submission method.

Eligibility Criteria for the Commercial Loan Application

To qualify for a commercial loan through The Bank Of Greene County, applicants must meet specific eligibility criteria:

- The business must be legally registered and operational.

- Applicants should have a solid credit history, both personally and for the business.

- Financial statements must demonstrate the ability to repay the loan.

- The purpose of the loan should align with the bank's lending policies.

Form Submission Methods for the Commercial Loan Application

Applicants can submit the Commercial Loan Application through various methods:

- Online Submission: Many businesses prefer to complete and submit the application online for convenience.

- Mail: The application can be printed and sent via postal mail to the bank's address.

- In-Person Submission: Applicants can also visit a local branch of The Bank Of Greene County to submit their application directly.

Legal Use of the Commercial Loan Application

The Commercial Loan Application is a legally binding document. By submitting this application, the applicant agrees to provide truthful information and understands the consequences of misrepresentation. The bank uses this information to evaluate the risk associated with lending, and any discrepancies can lead to denial of the loan or legal repercussions.

Quick guide on how to complete commercial loan application the bank of greene county

Accomplish [SKS] smoothly on any device

Digital document management has gained traction among businesses and individuals. It serves as a fantastic environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Administer [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Alter and eSign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Commercial Loan Application The Bank Of Greene County

Create this form in 5 minutes!

How to create an eSignature for the commercial loan application the bank of greene county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Commercial Loan Application The Bank Of Greene County?

The Commercial Loan Application The Bank Of Greene County is a streamlined process designed for businesses seeking financial assistance. This application allows you to submit your request efficiently while ensuring all required documentation is handled digitally.

-

How does airSlate SignNow enhance the Commercial Loan Application The Bank Of Greene County?

airSlate SignNow simplifies the Commercial Loan Application The Bank Of Greene County by enabling electronic signatures and document sharing. This not only speeds up the application process but also provides a safer, more reliable method to handle sensitive financial documents.

-

What are the pricing options for using airSlate SignNow with the Commercial Loan Application The Bank Of Greene County?

airSlate SignNow offers various pricing plans tailored to different business needs, all designed to support the Commercial Loan Application The Bank Of Greene County. Choose from monthly or annual subscriptions that provide cost-effective solutions for eSigning and document management.

-

What benefits does airSlate SignNow provide for the Commercial Loan Application The Bank Of Greene County?

Using airSlate SignNow for the Commercial Loan Application The Bank Of Greene County provides numerous benefits such as increased efficiency, reduced paperwork, and improved tracking. These advantages ensure a smooth application experience for both businesses and the bank.

-

Can I integrate airSlate SignNow with other platforms for the Commercial Loan Application The Bank Of Greene County?

Yes, airSlate SignNow supports various integrations with popular business tools, enhancing the experience for the Commercial Loan Application The Bank Of Greene County. This seamless integration allows you to connect your existing workflows and manage documents more efficiently.

-

Is airSlate SignNow secure for the Commercial Loan Application The Bank Of Greene County?

Absolutely, airSlate SignNow prioritizes security, ensuring that the Commercial Loan Application The Bank Of Greene County is processed safely. With advanced encryption and compliance with industry standards, your sensitive information is well-protected throughout the entire application process.

-

How long does it take to complete the Commercial Loan Application The Bank Of Greene County using airSlate SignNow?

The duration to complete the Commercial Loan Application The Bank Of Greene County using airSlate SignNow can vary but is signNowly shorter compared to traditional methods. With eSigning and streamlined document management, most applications can be completed within a matter of days.

Get more for Commercial Loan Application The Bank Of Greene County

- Faa student volunteer service program form

- Bol form lakeville motor

- Application for a visa for a long stay in greece photo this application form is of charge 1 2 3 4 5 6 7 8 9 surname family

- Lidl pdf online form

- Death certificate template form

- 596uu com form

- Measures integrals and martingales 2nd edition pdf form

- Phila form 82 311b

Find out other Commercial Loan Application The Bank Of Greene County

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy