ST 809 I 311 Tax Ny Form

What is the ST 809 I 311 Tax Ny

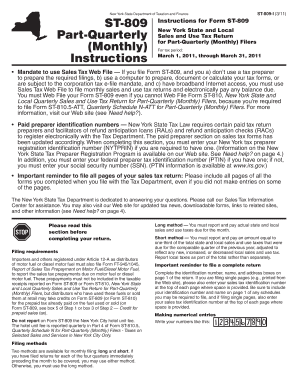

The ST 809 I 311 Tax Ny is a tax form used in New York State for specific tax-related purposes. It is primarily utilized by businesses and individuals to report certain tax information to the state government. This form is essential for ensuring compliance with state tax laws and regulations, helping to accurately assess tax liabilities and entitlements. Understanding the purpose and requirements of this form is crucial for anyone involved in tax reporting in New York.

How to use the ST 809 I 311 Tax Ny

Using the ST 809 I 311 Tax Ny involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information relevant to the tax year in question. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is important to review the instructions provided with the form to avoid any mistakes. Once completed, the form can be submitted according to the specified methods, which may include online submission, mailing, or in-person delivery.

Steps to complete the ST 809 I 311 Tax Ny

Completing the ST 809 I 311 Tax Ny requires a systematic approach. Follow these steps:

- Gather all necessary documents, such as income statements, prior tax returns, and any relevant financial records.

- Obtain the latest version of the ST 809 I 311 Tax Ny form from the New York State Department of Taxation and Finance.

- Fill out the form carefully, ensuring all information is accurate and complete.

- Double-check your entries for any errors or omissions.

- Submit the completed form by the designated deadline through your chosen submission method.

Required Documents

When completing the ST 809 I 311 Tax Ny, certain documents are essential to ensure accurate reporting. These may include:

- Income statements or W-2 forms that detail your earnings for the tax year.

- Prior year tax returns for reference and consistency.

- Receipts and records of any deductions or credits you plan to claim.

- Any additional forms or schedules required by the New York State Department of Taxation and Finance.

Legal use of the ST 809 I 311 Tax Ny

The ST 809 I 311 Tax Ny must be used in accordance with New York State tax laws. It is legally binding and serves as an official document to report tax information. Failing to use this form correctly can lead to penalties or issues with your tax filings. It is important to understand the legal implications of submitting this form and to ensure compliance with all state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the ST 809 I 311 Tax Ny are crucial for compliance. Typically, the form must be submitted by the tax deadline, which is usually April 15 for individuals. However, specific deadlines may vary based on the type of taxpayer or the nature of the tax being reported. It is advisable to check the New York State Department of Taxation and Finance website for the most current deadlines and any potential extensions that may apply.

Quick guide on how to complete st 809 i 311 tax ny

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can obtain the right template and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your document, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ST 809 I 311 Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the st 809 i 311 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ST 809 I 311 Tax Ny?

The ST 809 I 311 Tax Ny is a form required for businesses in New York to claim partial tax exemption for purchases. It's essential for ensuring accurate tax reporting and maintaining compliance with New York state tax regulations. By using airSlate SignNow, completing and submitting this form becomes a seamless process.

-

How can airSlate SignNow help with ST 809 I 311 Tax Ny?

airSlate SignNow offers an intuitive platform for eSigning and managing the ST 809 I 311 Tax Ny document. Our solution helps you streamline the signing process, ensuring that all necessary parties can sign remotely and securely. This minimizes delays and keeps your tax filings on schedule.

-

Is there a cost associated with using airSlate SignNow for ST 809 I 311 Tax Ny?

Yes, airSlate SignNow offers competitive pricing plans designed to fit various business needs. Our affordable options allow users to manage the ST 809 I 311 Tax Ny form efficiently without breaking the budget. Explore our pricing page to find the plan that best suits you.

-

What features does airSlate SignNow offer for managing ST 809 I 311 Tax Ny?

airSlate SignNow provides users with features such as customizable templates, eSigning, and document tracking specifically for the ST 809 I 311 Tax Ny. These features simplify the process of sending, signing, and storing important tax documents securely and efficiently.

-

Can I integrate airSlate SignNow with other software for ST 809 I 311 Tax Ny?

Absolutely! airSlate SignNow supports integrations with various business applications, making it easy to incorporate the ST 809 I 311 Tax Ny process into your existing workflows. This connectivity helps enhance productivity and ensures all your tools work seamlessly together.

-

What are the benefits of using airSlate SignNow for my ST 809 I 311 Tax Ny submissions?

Using airSlate SignNow for your ST 809 I 311 Tax Ny form submissions allows for quicker turnaround times and improved accuracy. The platform helps eliminate paperwork errors and simplifies the submission process, making it a highly beneficial choice for busy professionals.

-

Is airSlate SignNow secure for handling sensitive information related to ST 809 I 311 Tax Ny?

Yes, airSlate SignNow is designed with security in mind, ensuring that all documents, including the ST 809 I 311 Tax Ny, are handled safely. We employ advanced encryption and compliance measures to protect your sensitive data throughout the signing process.

Get more for ST 809 I 311 Tax Ny

- Out of state registration renewal form oklahoma okbar

- Extended kyc hdfc form

- Dshs child care application forms

- Alabama uniform incident offense report form

- Social history questionnaire form

- Uf health financial assistance application form

- Iso 7150 1 pdf form

- Redevalorizar preposition grammar study preposition timeplacemovement form

Find out other ST 809 I 311 Tax Ny

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now