An in Depth Look at VA Loan Requirements and Guidelines Form

Understanding VA Loan Requirements

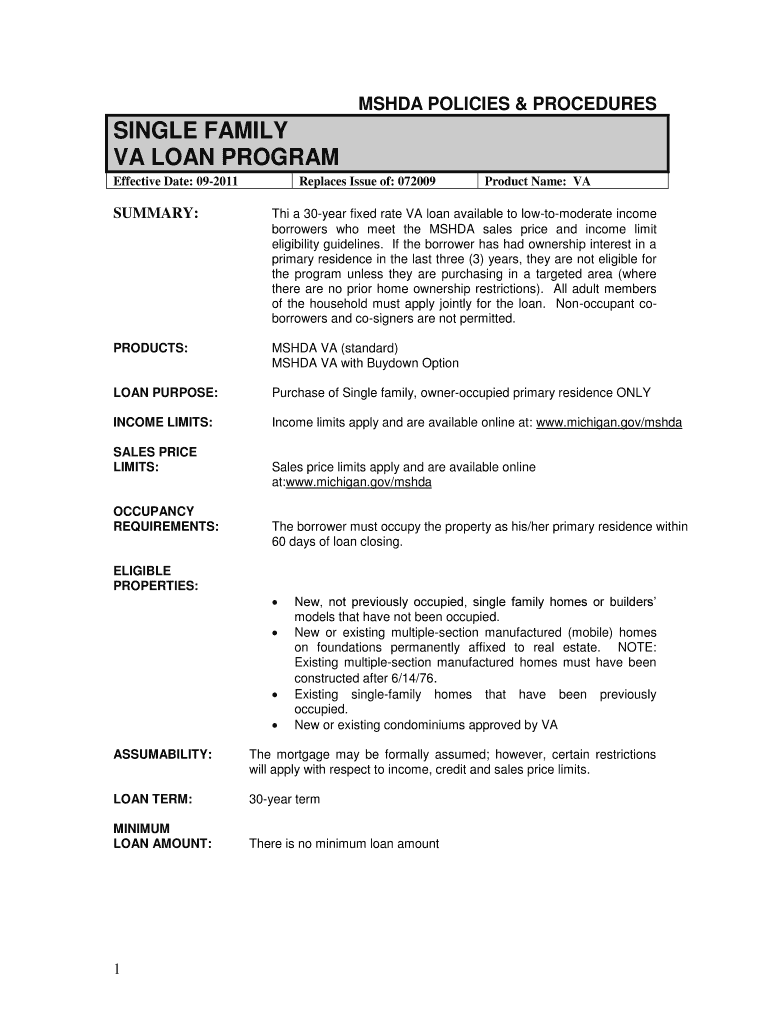

The VA loan program is designed to assist eligible veterans, active-duty service members, and certain members of the National Guard and Reserves in obtaining home financing. To qualify, applicants must meet specific criteria, including service requirements and creditworthiness. Generally, veterans must have served a minimum period, which can vary based on the time frame of service. Additionally, applicants should have a satisfactory credit score, typically around 620 or higher, although some lenders may allow lower scores under certain circumstances. Income verification and debt-to-income ratios are also crucial factors in the approval process.

Eligibility Criteria for VA Loans

To be eligible for a VA loan, applicants must meet certain service requirements. This includes having served in the active military, naval, or air service and being discharged under conditions other than dishonorable. The length of service varies; for instance, veterans who served during wartime may have different requirements compared to those who served during peacetime. Additionally, surviving spouses of veterans who died in service or due to a service-related condition may also qualify for VA loans, provided they meet specific criteria.

Required Documentation for VA Loan Applications

When applying for a VA loan, several documents are necessary to verify eligibility and financial status. Key documents typically include:

- Certificate of Eligibility (COE) to confirm military service

- Proof of income, such as pay stubs or tax returns

- Credit report to assess creditworthiness

- Bank statements for asset verification

- Employment verification letter from current employer

Gathering these documents in advance can streamline the application process and help ensure a smoother experience.

Application Process for VA Loans

The application process for a VA loan involves several steps. First, applicants should obtain their Certificate of Eligibility (COE) through the VA website or by working with a lender. Next, they will need to complete a loan application with a VA-approved lender, providing all required documentation. After submitting the application, the lender will review the information and may request additional details. Once approved, the lender will issue a loan estimate, detailing the terms and costs associated with the loan. Finally, after closing, the borrower will receive the funds to purchase their home.

Key Elements of VA Loan Guidelines

VA loan guidelines include several important elements that borrowers should understand. One significant feature is the absence of a down payment requirement, which allows eligible borrowers to finance the full purchase price of the home. Additionally, VA loans do not require private mortgage insurance (PMI), which can save borrowers money over the life of the loan. However, there is a funding fee that varies based on the down payment amount and whether the borrower has used a VA loan before. Understanding these elements can help borrowers make informed decisions about their home financing options.

State-Specific Rules for VA Loans

While VA loan guidelines are generally consistent across the United States, specific rules may vary by state. For example, some states have additional benefits for veterans, such as property tax exemptions or additional funding fee waivers. It is essential for borrowers to research their state’s regulations and benefits related to VA loans. Consulting with a local VA-approved lender can provide valuable insights into state-specific advantages and requirements.

Quick guide on how to complete an in depth look at va loan requirements and guidelines

Effortlessly Prepare [SKS] on Any Device

Digital document management has become widely accepted by businesses and individuals alike. It offers a flawless, eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with everything you require to create, modify, and eSign your documents swiftly and without delays. Manage [SKS] on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric procedure today.

How to Alter and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools at your disposal to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using features that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose your delivery method for the form: via email, SMS, invite link, or download it to your computer.

Eliminate the worry of losing or misplacing files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in mere clicks from any device you prefer. Modify and eSign [SKS] and guarantee efficient communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to An In Depth Look At VA Loan Requirements And Guidelines

Create this form in 5 minutes!

How to create an eSignature for the an in depth look at va loan requirements and guidelines

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic VA loan requirements?

An In Depth Look At VA Loan Requirements And Guidelines shows that basic requirements include military service eligibility, a valid Certificate of Eligibility (COE), and sufficient income to cover mortgage payments. Additionally, borrowers must meet credit score criteria, although VA loans are typically more flexible than conventional loans.

-

How does credit score affect VA loan eligibility?

According to An In Depth Look At VA Loan Requirements And Guidelines, while there is no specific minimum credit score, most lenders prefer a score of at least 620. Higher credit scores can lead to better interest rates and more favorable lending terms, making it beneficial for potential borrowers to maintain a healthy credit profile.

-

What is the funding fee for a VA loan?

As outlined in An In Depth Look At VA Loan Requirements And Guidelines, the VA funding fee typically ranges from 1.4% to 3.6% of the loan amount, depending on military service and down payment. This fee can be financed into the loan, ensuring no upfront costs for the borrower, which can make home buying more affordable.

-

Are there any income requirements for VA loans?

An In Depth Look At VA Loan Requirements And Guidelines emphasizes that there are no specific income limits; rather, lenders assess steady income and debt-to-income ratios. Borrowers should demonstrate the ability to repay the loan, allowing many service members and veterans to qualify regardless of their income level.

-

What types of properties are eligible for VA loans?

As detailed in An In Depth Look At VA Loan Requirements And Guidelines, VA loans can be used to purchase single-family homes, condos, and multi-unit properties (up to four units). However, the property must be the primary residence of the borrower, ensuring that VA benefits are utilized for actual living situations.

-

Can I refinance my current mortgage with a VA loan?

Indeed, An In Depth Look At VA Loan Requirements And Guidelines states that veterans can refinance through the VA Streamline Refinance (IRRRL) program, which allows for quick refinancing with minimal documentation. This program can help reduce monthly payments and streamline the refinancing process.

-

What are the benefits of choosing a VA loan?

As highlighted in An In Depth Look At VA Loan Requirements And Guidelines, VA loans offer several benefits, including 0% down payment, no monthly mortgage insurance, and competitive interest rates. These advantages make VA loans a valuable option for eligible veterans and service members looking to purchase a home.

Get more for An In Depth Look At VA Loan Requirements And Guidelines

- American association of tissue banks selfassessment toolaudit report star tissue distribution intermediary based on the 13th form

- Pre teen cell phone contract form

- Gmc rev 6 form

- Bl garza middle school bbrandempowermentbbcomb form

- Untermietvertragzwischenmietvertrag deutschland kostenlos vertrag fr untermiete zwischenmiete wohnen auf zeit form

- Practitioners written orderparent consent form

- Adult sports team roster form

- Special waste profile form town of windsor

Find out other An In Depth Look At VA Loan Requirements And Guidelines

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online