Instructions for Rollover Contribution Form

Understanding Instructions for Rollover Contribution

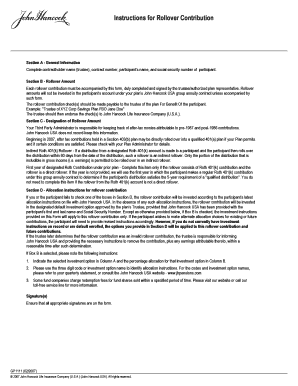

The Instructions for Rollover Contribution provide detailed guidance on how to transfer funds from one retirement account to another without incurring tax penalties. This process is crucial for individuals looking to consolidate their retirement savings or change their investment strategy while maintaining tax-deferred status. The instructions outline the eligibility criteria, necessary documentation, and the steps to ensure a smooth rollover process.

Steps to Complete the Instructions for Rollover Contribution

Completing the Instructions for Rollover Contribution involves several key steps:

- Review eligibility requirements to ensure your account qualifies for a rollover.

- Gather necessary documents, including account statements and identification.

- Complete the rollover request form, providing accurate information about both the current and new accounts.

- Submit the form to your financial institution, either online or via mail, as specified in the instructions.

- Confirm the transfer with both institutions to ensure the funds are moved correctly.

Required Documents for Rollover Contribution

To successfully complete a rollover contribution, certain documents are required. These typically include:

- Your current retirement account statement.

- Identification documents, such as a driver's license or Social Security card.

- The completed rollover request form provided by the receiving institution.

- Any additional forms required by your current account provider.

IRS Guidelines for Rollover Contributions

The Internal Revenue Service (IRS) sets forth specific guidelines governing rollover contributions. Key points include:

- Funds must be transferred within sixty days to avoid tax penalties.

- Only one rollover can occur per twelve-month period for each account.

- Direct rollovers, where funds are transferred directly between institutions, are not subject to the sixty-day rule.

Eligibility Criteria for Rollover Contributions

Eligibility for rollover contributions generally includes the following criteria:

- The account must be a qualified retirement plan, such as a 401(k) or an IRA.

- You must be the account holder or a beneficiary entitled to the funds.

- The rollover must involve similar types of accounts to maintain tax advantages.

Form Submission Methods for Rollover Contribution

There are various methods to submit your rollover contribution form:

- Online submission through your financial institution's website, which may offer a faster processing time.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at a local branch, if applicable, for immediate assistance.

Quick guide on how to complete instructions for rollover contribution

Complete [SKS] effortlessly on any device

Web-based document management has become popular with businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Use the tools available to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Rollover Contribution

Create this form in 5 minutes!

How to create an eSignature for the instructions for rollover contribution

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic Instructions For Rollover Contribution?

The Instructions For Rollover Contribution involve detailing how to transfer funds from one retirement account to another without incurring penalties. Typically, you must fill out a rollover form provided by your new account provider and ensure your current provider sends the funds directly. Make sure to follow the instructions carefully to maintain your tax advantages.

-

Are there any fees associated with using airSlate SignNow for Rollover Contribution?

airSlate SignNow offers a cost-effective solution for managing your documentation, including those related to Instructions For Rollover Contribution. Standard pricing plans are available, and there are often no hidden fees, allowing you to send and eSign documents efficiently. Always check the pricing page for the latest information and any promotional offers.

-

What features does airSlate SignNow provide to facilitate Rollover Contributions?

airSlate SignNow includes features such as customizable templates and document collaboration, which simplify the process of collecting Instructions For Rollover Contribution. Users can easily create, edit, and sign necessary documents online, ensuring compliance and streamlining communication between all parties involved.

-

How does airSlate SignNow ensure the security of Rollover Contribution documents?

Security is a top priority for airSlate SignNow, especially when handling Instructions For Rollover Contribution. The platform employs encryption methods to protect data, and it complies with industry standards to ensure confidentiality and integrity while documents are being shared or signed.

-

Can I integrate airSlate SignNow with other tools for Rollover Contributions?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms that can enhance your Rollover Contribution processes. This includes accounting software, CRM systems, and cloud storage solutions, allowing you to manage Instructions For Rollover Contribution efficiently and in more streamlined workflows.

-

Is there customer support available for questions about Rollover Contributions?

Absolutely! airSlate SignNow provides comprehensive customer support to assist with any questions regarding Instructions For Rollover Contribution. You can access a variety of resources, including FAQs, tutorials, and live chat support to ensure you're never left in the dark during your document management process.

-

How can airSlate SignNow help speed up the Rollover Contribution process?

By using airSlate SignNow, you'll find that the Instructions For Rollover Contribution can be completed much faster due to the platform's user-friendly interface and quick document turnaround times. eSigning eliminates the need for physical signatures and mailing, allowing you to finalize transactions more efficiently than traditional methods.

Get more for Instructions For Rollover Contribution

Find out other Instructions For Rollover Contribution

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement