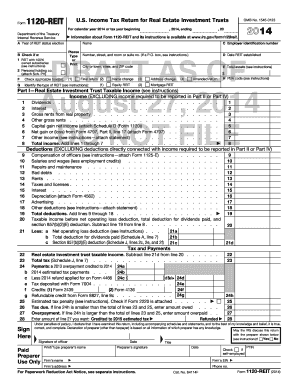

Form 1120 REIT Internal Revenue Service

What is Form 1120 REIT?

Form 1120 REIT is a tax form used by Real Estate Investment Trusts (REITs) to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for REITs, which are companies that own, operate, or finance income-producing real estate. By filing this form, REITs can maintain their tax-advantaged status, which allows them to avoid paying federal income tax on the income they distribute to shareholders, provided they meet specific requirements.

How to Obtain Form 1120 REIT

Form 1120 REIT can be obtained through the IRS website, where it is available for download in PDF format. Additionally, the form can be requested by contacting the IRS directly. It is important to ensure that you are using the most current version of the form, as updates may occur annually. Businesses should also consider consulting with a tax professional to ensure compliance with all requirements when obtaining and completing the form.

Steps to Complete Form 1120 REIT

Completing Form 1120 REIT involves several key steps:

- Gather all necessary financial information, including income, expenses, and distributions.

- Fill out the identification section, providing the REIT's name, address, and Employer Identification Number (EIN).

- Report income from various sources, including rental income and capital gains.

- Detail deductions, such as operating expenses and depreciation.

- Calculate the taxable income and determine the amount of distributions made to shareholders.

- Complete any additional schedules required for specific deductions or credits.

- Review the completed form for accuracy before submission.

Key Elements of Form 1120 REIT

Form 1120 REIT includes several critical components that must be accurately reported:

- Income Section: This section requires detailed reporting of all income sources, including rents and dividends.

- Deductions: Deductions for expenses related to property management, maintenance, and other operational costs must be documented.

- Distributions: The form requires an account of distributions made to shareholders, which is crucial for maintaining REIT status.

- Tax Calculation: The form includes calculations to determine the REIT's taxable income and any applicable tax credits.

IRS Guidelines for Form 1120 REIT

The IRS provides specific guidelines for completing and filing Form 1120 REIT. These guidelines include instructions on eligibility criteria for REIT status, the types of income that can be reported, and the necessary documentation to support claims made on the form. Adhering to these guidelines is essential to ensure compliance and avoid potential penalties. It is advisable for REITs to consult the IRS instructions directly or seek professional tax advice to navigate the complexities of the form.

Filing Deadlines for Form 1120 REIT

The filing deadline for Form 1120 REIT is typically the fifteenth day of the fourth month following the end of the REIT's tax year. For most REITs operating on a calendar year basis, this means the form is due by April fifteenth. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is crucial for REITs to be aware of these deadlines to avoid late filing penalties and ensure timely compliance with IRS regulations.

Quick guide on how to complete form 1120 reit internal revenue service

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to confirm your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 REIT Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form 1120 reit internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 REIT and why is it important for businesses?

Form 1120 REIT is a tax form required by the Internal Revenue Service for Real Estate Investment Trusts (REITs). It is vital for businesses to properly file this form to avoid penalties and ensure compliance with tax regulations. Understanding how to correctly fill out Form 1120 REIT can signNowly impact a REIT's tax obligations and operational efficiency.

-

How does airSlate SignNow facilitate the eSigning of Form 1120 REIT?

airSlate SignNow streamlines the eSigning process for Form 1120 REIT by providing an easy-to-use platform where users can send documents for signatures. With features like customizable templates and secure storage, businesses can manage their Form 1120 REIT submissions efficiently while ensuring compliance with Internal Revenue Service requirements.

-

What pricing plans are available for using airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to businesses of all sizes, from startups to large enterprises. Each plan provides access to essential features for eSigning documents, including Form 1120 REIT. By selecting the plan that best fits your needs, you can maximize the value you get from efficient compliance management.

-

Can airSlate SignNow integrate with other applications for tax management?

Yes, airSlate SignNow offers integrations with various applications to enhance your tax management processes. This capability allows businesses to streamline their workflows when handling Form 1120 REIT and other required documents. By integrating with accounting and tax software, users can improve data accuracy and save time in filing.

-

What are the benefits of using airSlate SignNow for Form 1120 REIT submissions?

Using airSlate SignNow for Form 1120 REIT submissions brings numerous benefits, including time-saving automated workflows and enhanced document security. Additionally, the solution provides a user-friendly interface that simplifies the process of sending and receiving eSigned documents. This can be especially advantageous when meeting urgent Internal Revenue Service deadlines.

-

Is airSlate SignNow compliant with the Internal Revenue Service regulations?

Yes, airSlate SignNow complies with all the necessary regulations set forth by the Internal Revenue Service, ensuring that your Form 1120 REIT submissions meet legal standards. The platform prioritizes security and compliance, allowing users to confidently send sensitive tax documents without risk. This commitment to compliance makes airSlate SignNow a reliable choice for businesses.

-

How can I ensure my Form 1120 REIT is accurately filled out using airSlate SignNow?

To ensure that your Form 1120 REIT is accurately filled out, utilize airSlate SignNow's customizable templates and instructional resources. These tools allow for error-checking and guide users through the completion process. Additionally, leveraging the platform's collaborative features can enable team members to review the document before final submission.

Get more for Form 1120 REIT Internal Revenue Service

Find out other Form 1120 REIT Internal Revenue Service

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU