PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE

What is the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE

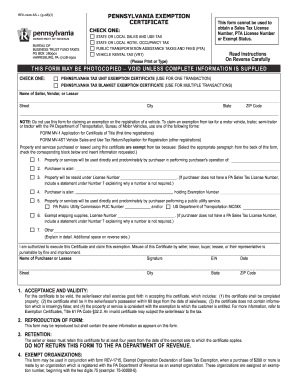

The Pennsylvania Exemption Certificate is a crucial document used primarily for tax purposes. This form allows certain individuals and businesses to claim exemption from state sales tax on specific purchases. It is essential for those who qualify to prevent unnecessary tax charges when acquiring goods or services that are exempt under Pennsylvania law.

Key elements of the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE

The form includes several key elements that must be accurately completed to ensure its validity. These elements typically consist of the purchaser's name, address, and the reason for the exemption. Additionally, it may require the seller's information and a signature from the purchaser, confirming the accuracy of the information provided. Understanding these components is vital for proper completion and compliance with state regulations.

Steps to complete the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE

Completing the Pennsylvania Exemption Certificate involves several straightforward steps:

- Gather necessary information, including your name, address, and the reason for claiming exemption.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Sign and date the certificate to validate your claim.

- Provide the completed certificate to the seller at the time of purchase.

Legal use of the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE

The legal use of the Pennsylvania Exemption Certificate is governed by state tax laws. It is important to use this form only for eligible purchases as outlined in Pennsylvania's tax regulations. Misuse of the certificate, such as claiming exemptions for ineligible items, can lead to penalties and back taxes owed. Therefore, understanding the legal framework surrounding the use of this form is essential for compliance.

Eligibility Criteria

Eligibility to use the Pennsylvania Exemption Certificate is typically limited to specific categories of purchasers. Common eligible entities include non-profit organizations, government agencies, and certain businesses that purchase goods for resale. Individuals must ensure they meet the criteria set forth by the Pennsylvania Department of Revenue to avoid potential legal issues.

How to obtain the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE

Obtaining the Pennsylvania Exemption Certificate is a straightforward process. The form can often be downloaded from the Pennsylvania Department of Revenue's website or requested directly from the department. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax law or regulations.

Quick guide on how to complete pennsylvania exemption certificate this form may be

Effortlessly Prepare [SKS] on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed documents and signatures, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any platform with the airSlate SignNow apps for Android or iOS and simplify your document-centric processes today.

How to Edit and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE

Create this form in 5 minutes!

How to create an eSignature for the pennsylvania exemption certificate this form may be

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE used for?

The PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE utilized to exempt certain purchases from sales tax. This form is designed for businesses and entities that meet specific criteria for tax exemption under Pennsylvania law.

-

How can airSlate SignNow assist with the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE?

AirSlate SignNow empowers users to easily send and eSign the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE. Our platform provides streamlined document management, ensuring secure and efficient handling of essential tax exemption paperwork.

-

What are the costs associated with using airSlate SignNow for the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE?

AirSlate SignNow offers various pricing plans tailored to business needs. The cost of using our service for the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE is competitive, providing signNow value through efficient document processing and eSignature capabilities.

-

Can I integrate airSlate SignNow with other software to manage my PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE?

Yes, airSlate SignNow integrates seamlessly with popular business applications, allowing users to manage the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE alongside other essential workflows. Our integrations enhance productivity by streamlining document handling directly within the tools you already use.

-

What are the benefits of using airSlate SignNow for the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE?

Using airSlate SignNow for the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely while providing a user-friendly experience.

-

Is it easy to track the status of my PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE in airSlate SignNow?

Absolutely! AirSlate SignNow includes robust tracking features that allow you to monitor the status of your PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE in real time. You will receive notifications and updates, ensuring you are always in the loop.

-

Are there templates available for the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE?

Yes, airSlate SignNow provides customizable templates for the PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE. These templates make it easy to fill out and submit your exemption forms with minimal hassle, saving you time and effort.

Get more for PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE

Find out other PENNSYLVANIA EXEMPTION CERTIFICATE THIS FORM MAY BE

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement