Summary of Changes on Draft Form 1065 Deloitte

What is the Summary of Changes on Draft Form 1065 Deloitte

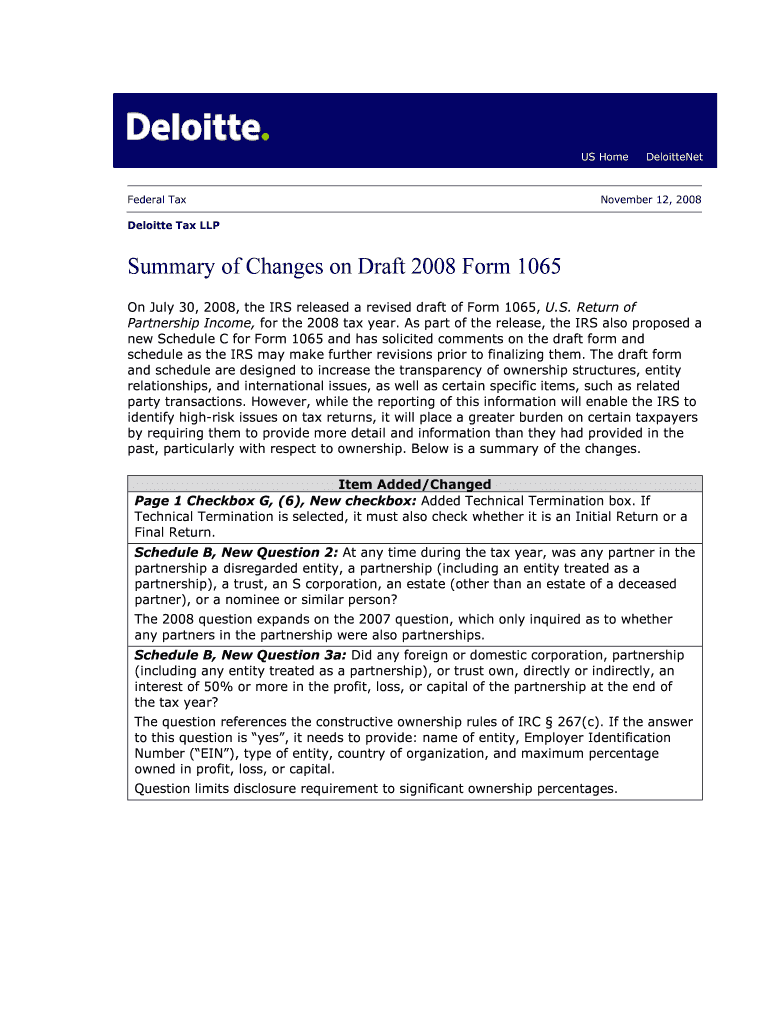

The Summary of Changes on Draft Form 1065 Deloitte outlines the modifications made to the draft version of the IRS Form 1065, which is used by partnerships to report income, deductions, gains, and losses. This summary serves as a crucial resource for tax professionals and business owners to understand the updates and ensure compliance with the latest tax regulations. The changes may include alterations in reporting requirements, new line items, or adjustments to existing instructions that affect how partnerships file their returns.

Key Elements of the Summary of Changes on Draft Form 1065 Deloitte

Key elements of the Summary of Changes include:

- New Reporting Requirements: Details on any new information that must be reported by partnerships.

- Line Item Adjustments: Changes to existing line items that may affect how income or deductions are calculated.

- Instruction Updates: Clarifications or revisions to the instructions that guide users in completing the form accurately.

- Compliance Dates: Important deadlines for implementation of the changes to ensure timely filing.

Steps to Complete the Summary of Changes on Draft Form 1065 Deloitte

To effectively utilize the Summary of Changes, follow these steps:

- Review the summary document thoroughly to identify all changes relevant to your partnership.

- Update your accounting practices to align with new reporting requirements as specified in the summary.

- Consult with a tax professional if any changes are unclear or if your partnership's situation is complex.

- Ensure that all necessary documentation is prepared in accordance with the revised guidelines.

- File the completed Form 1065 by the designated deadline to avoid penalties.

Legal Use of the Summary of Changes on Draft Form 1065 Deloitte

The Summary of Changes serves a legal purpose by providing official guidance on how to comply with IRS regulations. Partnerships must adhere to the changes outlined in the summary to avoid potential legal issues, including penalties for non-compliance. It is essential for taxpayers to ensure that their filings reflect the most current rules and requirements as detailed in the summary.

Filing Deadlines / Important Dates

Understanding filing deadlines is critical for compliance. The deadlines for submitting Form 1065 typically fall on the fifteenth day of the third month after the end of the partnership's tax year. If the partnership operates on a calendar year basis, the due date is March 15. Any updates to these deadlines will be specified in the Summary of Changes, and partnerships should mark their calendars accordingly to ensure timely submissions.

Who Issues the Form

The IRS is the issuing authority for Form 1065. The agency provides the necessary guidelines and updates through publications and the Summary of Changes document. Tax professionals and businesses rely on these resources to stay informed about any modifications that may impact their tax filings.

Quick guide on how to complete summary of changes on draft form 1065 deloitte

Manage [SKS] easily on any device

Online document management has become increasingly popular among companies and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed papers, as you can locate the right form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow apps for Android or iOS and simplify any document-driven process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to apply your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Summary Of Changes On Draft Form 1065 Deloitte

Create this form in 5 minutes!

How to create an eSignature for the summary of changes on draft form 1065 deloitte

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Summary Of Changes On Draft Form 1065 Deloitte?

The Summary Of Changes On Draft Form 1065 Deloitte highlights the key revisions and modifications made to the form, including updates to certain reporting requirements. Understanding these changes is crucial for accurate tax reporting. airSlate SignNow can streamline the process of documenting these changes in your eSigned agreements.

-

How does airSlate SignNow simplify the eSigning process for Draft Form 1065?

airSlate SignNow offers a seamless way to send, sign, and store your Draft Form 1065 documents electronically. Our platform integrates the Summary Of Changes On Draft Form 1065 Deloitte, making it easy to ensure compliance. The user-friendly interface ensures that all stakeholders can review and eSign documents without hassle.

-

What features does airSlate SignNow offer for managing Draft Form 1065?

airSlate SignNow includes advanced features such as customizable templates, automated workflows, and real-time tracking. These tools facilitate the effective management of Draft Form 1065. Specifically, the inclusion of the Summary Of Changes On Draft Form 1065 Deloitte ensures that all users are aware of the latest modifications.

-

Is airSlate SignNow cost-effective for small businesses handling Draft Form 1065?

Yes, airSlate SignNow provides a cost-effective solution tailored for small businesses needing to manage Draft Form 1065. Our pricing plans are designed to fit various budgets while offering extensive features. Utilizing the Summary Of Changes On Draft Form 1065 Deloitte within our platform further enhances its value.

-

Can airSlate SignNow integrate with other software systems for Draft Form 1065?

Absolutely! airSlate SignNow offers robust integrations with popular software systems such as CRM platforms and accounting software. This integration capability allows users to manage the Summary Of Changes On Draft Form 1065 Deloitte within their existing workflows efficiently.

-

What benefits does eSigning Draft Form 1065 provide using airSlate SignNow?

E-signing Draft Form 1065 using airSlate SignNow ensures enhanced security, faster turnaround times, and improved accuracy. Our platform simplifies the review of the Summary Of Changes On Draft Form 1065 Deloitte to ensure legal compliance. Businesses can save time and resources while maintaining document integrity.

-

How does airSlate SignNow address compliance related to Draft Form 1065?

airSlate SignNow prioritizes compliance by keeping users updated on changes like the Summary Of Changes On Draft Form 1065 Deloitte. Our platform includes features that ensure documentation meets legal standards. This proactive approach minimizes risks associated with tax reporting errors.

Get more for Summary Of Changes On Draft Form 1065 Deloitte

Find out other Summary Of Changes On Draft Form 1065 Deloitte

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter