Personal Property Tax Forms and Instructions Excel 2023-2026

Understanding Kentucky Personal Property Tax Forms

The Kentucky personal property tax is assessed on tangible personal property owned by individuals and businesses within the state. This tax is based on the value of the property and is typically reported using specific forms. The primary form used for reporting personal property in Kentucky is the Revenue Form 62A500. This form requires detailed information about the property owned, including its type, value, and location. Understanding the requirements for this form is crucial for accurate reporting and compliance with state tax laws.

Steps to Complete the Kentucky Personal Property Tax Form 62A500

Filling out the Kentucky personal property tax form involves several key steps:

- Gather necessary information about your personal property, including descriptions and values.

- Obtain the 62A500 form from the Kentucky Department of Revenue or through authorized channels.

- Carefully fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

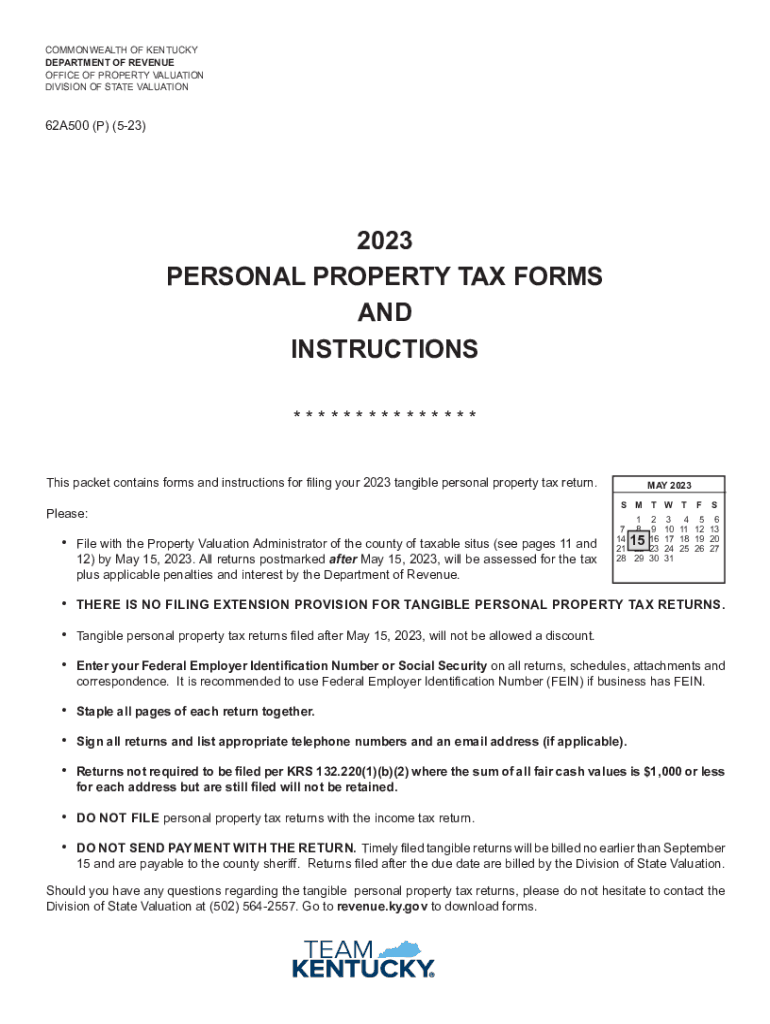

Filing Deadlines for Kentucky Personal Property Tax

It is important to be aware of the filing deadlines for the Kentucky personal property tax to avoid penalties. Generally, the deadline for submitting the 62A500 form is April fifteenth each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Always check with the Kentucky Department of Revenue for the most current information regarding deadlines and any potential extensions.

Required Documents for Filing Personal Property Tax

When filing the Kentucky personal property tax form, certain documents may be required to support your claims. These documents can include:

- Proof of ownership for the property being reported.

- Valuation documents, such as purchase receipts or appraisals.

- Previous tax returns, if applicable, to provide context for reported values.

Having these documents ready can facilitate a smoother filing process and ensure compliance with state regulations.

Penalties for Non-Compliance with Personal Property Tax Requirements

Failure to file the Kentucky personal property tax form by the deadline can result in significant penalties. These penalties may include:

- Late filing fees, which can increase the total tax owed.

- Interest charges on unpaid taxes.

- Potential legal actions or liens against the property.

It is essential to adhere to filing requirements to avoid these consequences and maintain good standing with the Kentucky Department of Revenue.

Legal Use of the Kentucky Personal Property Tax Form

The Revenue Form 62A500 is a legal document that must be filled out accurately to reflect the personal property owned. Misrepresentation or failure to report property can lead to legal repercussions, including fines or audits. It is important to understand that this form serves not only as a tax declaration but also as a legal record of ownership and valuation for state purposes.

Quick guide on how to complete personal property tax forms and instructions excel

Effortlessly Prepare Personal Property Tax Forms And Instructions excel on Any Device

Digital document management is increasingly favored by both businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Personal Property Tax Forms And Instructions excel on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Personal Property Tax Forms And Instructions excel with Ease

- Locate Personal Property Tax Forms And Instructions excel and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the information and click on the Done button to secure your adjustments.

- Select your preferred method for sharing your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Personal Property Tax Forms And Instructions excel to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct personal property tax forms and instructions excel

Create this form in 5 minutes!

How to create an eSignature for the personal property tax forms and instructions excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's role in managing ky personal tax documents?

airSlate SignNow streamlines the management of ky personal tax documents by allowing users to send, sign, and store all necessary forms electronically. This reduces the chance of errors and ensures that all submissions are made on time. With our solution, you can focus on tax strategies rather than the paperwork.

-

How does airSlate SignNow ensure the security of my ky personal tax information?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption protocols and secure cloud storage to protect your ky personal tax information. You can conduct all your transactions with confidence, knowing that your sensitive data is well-guarded.

-

Is there a free trial available for airSlate SignNow for handling ky personal tax?

Yes, airSlate SignNow offers a free trial that allows you to explore its features for managing ky personal tax documents. This trial provides an opportunity to evaluate how our eSignature solution can benefit your personal tax needs without any upfront costs.

-

What integrations does airSlate SignNow offer for ky personal tax processes?

airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your workflow for ky personal tax. These integrations allow you to pull in necessary data and easily manage documents, ensuring a smooth process from start to finish.

-

How can airSlate SignNow help me save time on my ky personal tax filings?

By utilizing airSlate SignNow, you can complete your ky personal tax filings faster with our intuitive platform. The ability to eSign documents and send them electronically eliminates printing and mailing delays, drastically reducing the time spent on paperwork.

-

What features does airSlate SignNow offer for handling ky personal tax documents?

airSlate SignNow includes a variety of features tailored for ky personal tax, including customizable templates, bulk sending capabilities, and automated reminders. These tools simplify the document preparation and signing process, making it easy to manage your tax obligations.

-

Are there any monthly fees associated with using airSlate SignNow for ky personal tax?

AirSlate SignNow offers flexible pricing plans with affordable monthly fees depending on the features you need for ky personal tax management. This ensures you have access to essential tools without any unnecessary expenditure, making it a cost-effective solution.

Get more for Personal Property Tax Forms And Instructions excel

- Iprf injury description form 45 a

- Client history form

- Department of financial institutions mayo underwood building kentucky form

- Maryland physicians care mcomaryland medicaid with a form

- Dancemovement therapy certification board inc form

- State of maryland maryland department of human services form

- Western maryland hospital system physician order form

- Maryland code annotated health general 5 601 to 5 618 form

Find out other Personal Property Tax Forms And Instructions excel

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement