Accessing Your 1099 R Tax Statement Form

Understanding the 1099-R Tax Statement

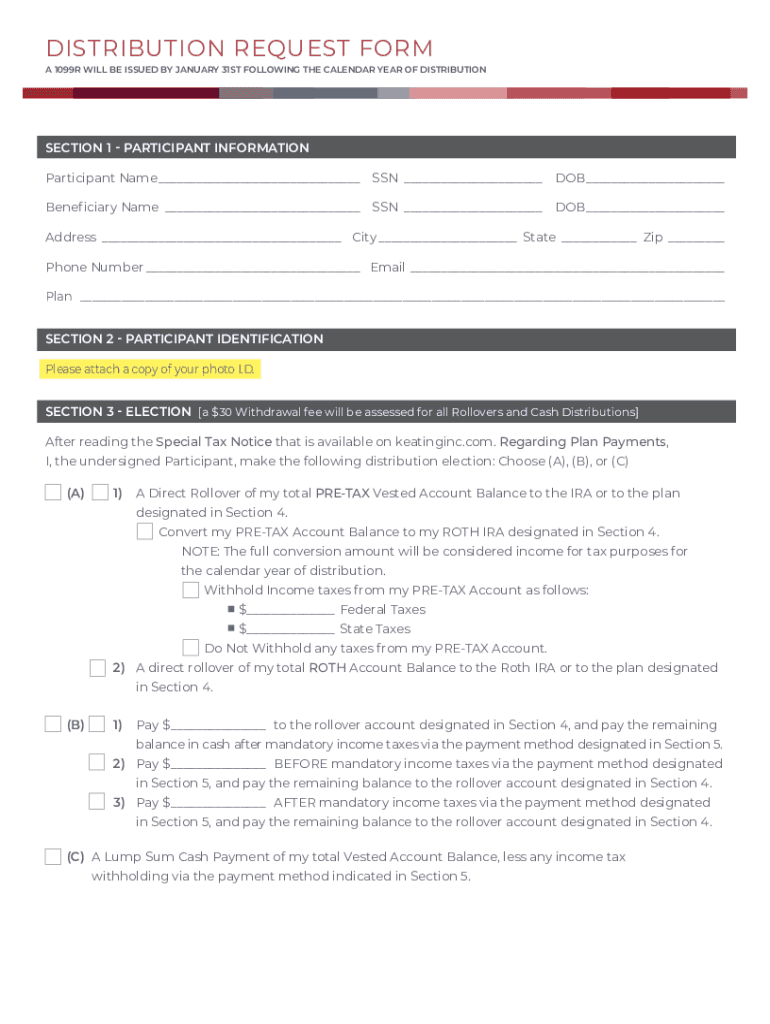

The 1099-R tax statement is a crucial document for individuals who receive distributions from retirement accounts, pensions, or annuities. This form reports the total amount distributed to the taxpayer during the tax year, including any taxable amounts and the federal income tax withheld. Understanding the details of your 1099-R is essential for accurate tax filing and compliance with IRS regulations.

How to Obtain Your 1099-R Tax Statement

To access your 1099-R tax statement, you can typically request it from the financial institution or plan administrator that manages your retirement account. Most institutions provide electronic access through their online portals, allowing you to download the form directly. If you prefer a paper copy, you can contact customer service to request that it be mailed to you. Ensure that you have your account information handy to facilitate the process.

Key Elements of the 1099-R Tax Statement

Your 1099-R includes several important fields that you should review carefully. Key elements include:

- Payer Information: This section identifies the financial institution or plan administrator issuing the form.

- Recipient Information: Your name, address, and taxpayer identification number (TIN) are listed here.

- Distribution Amount: This indicates the total amount distributed to you during the year.

- Taxable Amount: This shows how much of the distribution is subject to federal income tax.

- Federal Income Tax Withheld: This reflects any federal tax that has been withheld from your distribution.

Filing Deadlines for the 1099-R Tax Statement

It is important to be aware of the filing deadlines associated with the 1099-R. The IRS typically requires that you receive your 1099-R by January 31 of the year following the tax year in which the distributions were made. If you do not receive your form by this date, you should contact the issuer to ensure it was sent. When filing your taxes, you must include the information from your 1099-R by the April 15 deadline for most taxpayers.

IRS Guidelines for Reporting 1099-R Income

The IRS has specific guidelines for reporting income from your 1099-R. You must report the total distribution amount on your tax return, and if any portion is taxable, it should be included in your gross income. Additionally, if federal income tax was withheld, you can report this on your return to potentially reduce your overall tax liability. It is essential to follow these guidelines to avoid any issues with your tax return.

Common Scenarios for 1099-R Recipients

Various taxpayer scenarios can affect how you handle your 1099-R. For example:

- Retirees: Individuals receiving retirement benefits must ensure they report all distributions accurately.

- Self-Employed Individuals: Those who withdraw from retirement accounts may need to consider additional tax implications.

- Beneficiaries: If you inherit a retirement account, you may receive a 1099-R, and specific rules apply to inherited distributions.

Quick guide on how to complete accessing your 1099 r tax statement

Accomplish Accessing Your 1099 R Tax Statement effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without any hold-ups. Manage Accessing Your 1099 R Tax Statement on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to edit and eSign Accessing Your 1099 R Tax Statement effortlessly

- Locate Accessing Your 1099 R Tax Statement and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or mask sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Alter and eSign Accessing Your 1099 R Tax Statement while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the accessing your 1099 r tax statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for Accessing Your 1099 R Tax Statement with airSlate SignNow?

Accessing Your 1099 R Tax Statement through airSlate SignNow is straightforward. Users can log into their account, navigate to the document storage, and locate the 1099 R Tax Statement in their documents. Once found, it can be easily viewed, signed, or downloaded as needed.

-

Are there any fees associated with Accessing Your 1099 R Tax Statement?

There are no hidden fees for Accessing Your 1099 R Tax Statement with airSlate SignNow. Our pricing is transparent and designed to fit various budgets, allowing businesses to efficiently manage their documents without worrying about unexpected costs.

-

What features does airSlate SignNow offer for Accessing Your 1099 R Tax Statement?

AirSlate SignNow offers several features that enhance the process of Accessing Your 1099 R Tax Statement. Users can securely eSign documents, track their status in real-time, and manage multiple templates, all from an intuitive dashboard that simplifies document handling.

-

How does airSlate SignNow ensure the security of Accessing Your 1099 R Tax Statement?

When Accessing Your 1099 R Tax Statement, airSlate SignNow prioritizes security with advanced encryption protocols. We also adhere to industry-leading compliance standards to protect sensitive information throughout the document handling process.

-

Can I integrate other software with airSlate SignNow while Accessing My 1099 R Tax Statement?

Yes, airSlate SignNow allows integration with various software tools, enhancing your experience when Accessing Your 1099 R Tax Statement. Popular integrations include platforms like Google Drive and Dropbox, which streamline the document management process.

-

What are the benefits of using airSlate SignNow for Accessing Your 1099 R Tax Statement?

Using airSlate SignNow for Accessing Your 1099 R Tax Statement offers several advantages, including time savings and improved efficiency. Our platform is designed to simplify document workflows, ensuring that users can manage their tax statements conveniently and swiftly.

-

Is there customer support available while Accessing Your 1099 R Tax Statement?

Absolutely! Customers can access dedicated support whenever they have questions while Accessing Your 1099 R Tax Statement. Our support team is available through multiple channels, ready to assist with any inquiries or concerns.

Get more for Accessing Your 1099 R Tax Statement

- Wisconsin homestead printable rent certificate form

- Employment application form ramada amp days hotel

- Water reconnaissance report da form 1712 r may apd army

- E iwo employer profile prefill form acf hhs

- What is psp number usaa form

- Nebraska power of attorney for health care statutory form 4460379

- Tech agreement template form

- Technical assistance agreement template form

Find out other Accessing Your 1099 R Tax Statement

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile