Www Irs Govretirement Plansverifying RolloverVerifying Rollover Contributions to PlansInternal Revenue Form

Understanding the IRS Guidelines for Rollover Contributions

The Internal Revenue Service (IRS) provides specific guidelines regarding rollover contributions to retirement plans. These guidelines ensure that funds transferred from one retirement account to another maintain their tax-deferred status. To qualify for a tax-free rollover, the funds must be deposited into the new account within sixty days of withdrawal. Additionally, the rollover must be reported on your tax return, and it is essential to keep records of the transaction for future reference.

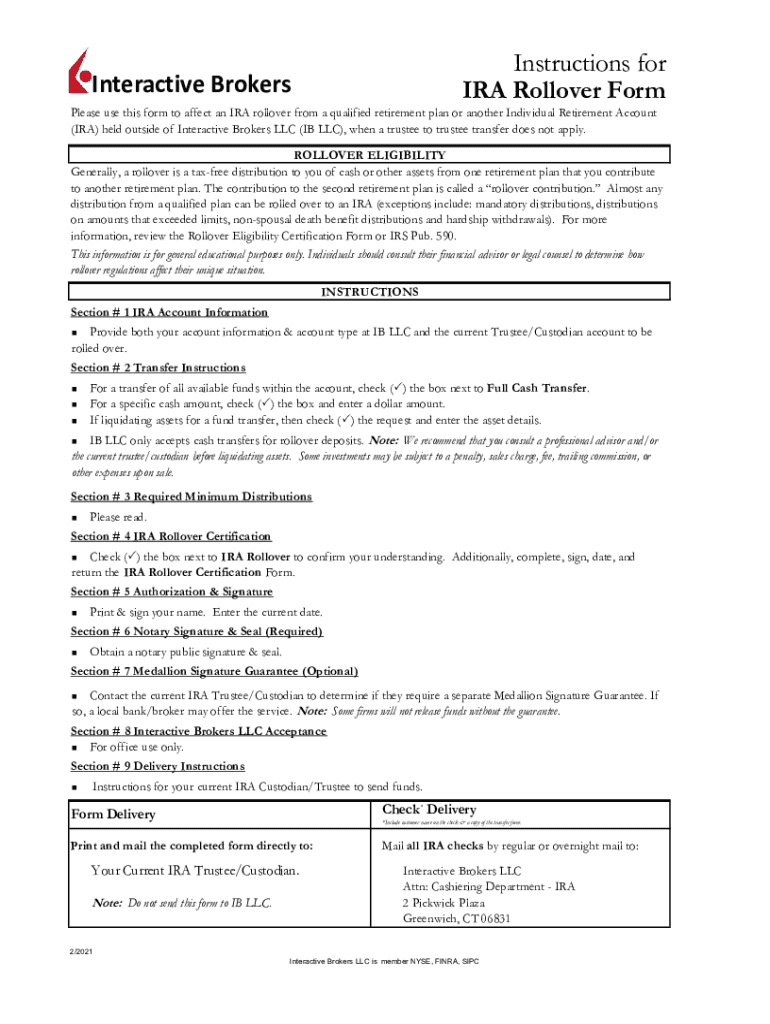

Steps to Complete the Interactive Brokers IRA Rollover Form

Completing the Interactive Brokers IRA rollover form involves several key steps. First, gather all necessary information, including your current account details and the account you are rolling funds into. Next, accurately fill out the form, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form according to the specified submission methods, which may include online, mail, or in-person options.

Required Documents for the Rollover Process

When initiating a rollover, certain documents are typically required to ensure compliance with IRS regulations. These may include:

- Your current retirement account statement.

- The completed Interactive Brokers IRA rollover form.

- Identification documents, such as a driver’s license or Social Security number.

- Any additional forms required by the receiving institution.

Having these documents ready can streamline the rollover process and help avoid delays.

Eligibility Criteria for Rollover Contributions

Not all retirement accounts are eligible for rollovers. Generally, you must have a qualified retirement account, such as a 401(k) or an IRA. Additionally, you must be the account holder, and the funds must be eligible for transfer without incurring penalties. It is important to verify your eligibility before initiating the rollover to ensure compliance with IRS rules.

Form Submission Methods

The Interactive Brokers IRA rollover form can be submitted through various methods. Common submission options include:

- Online submission via the Interactive Brokers platform.

- Mailing the completed form to the designated address.

- In-person submission at a local Interactive Brokers office.

Choosing the right method can depend on your preferences and the urgency of the rollover.

Penalties for Non-Compliance

Failure to comply with IRS regulations regarding rollovers can result in significant penalties. If the rollover is not completed within the sixty-day timeframe, the IRS may classify the funds as taxable income, leading to potential tax liabilities and penalties. Additionally, early withdrawal penalties may apply if the account holder is under the age of fifty-nine and a half. Understanding these consequences is crucial for maintaining compliance and avoiding unnecessary costs.

Quick guide on how to complete www irs govretirement plansverifying rolloververifying rollover contributions to plansinternal revenue

Complete Www irs govretirement plansverifying rolloverVerifying Rollover Contributions To PlansInternal Revenue effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents swiftly without delays. Handle Www irs govretirement plansverifying rolloverVerifying Rollover Contributions To PlansInternal Revenue on any device with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest way to modify and eSign Www irs govretirement plansverifying rolloverVerifying Rollover Contributions To PlansInternal Revenue seamlessly

- Locate Www irs govretirement plansverifying rolloverVerifying Rollover Contributions To PlansInternal Revenue and click on Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that function by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method for submitting your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you choose. Modify and eSign Www irs govretirement plansverifying rolloverVerifying Rollover Contributions To PlansInternal Revenue and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the www irs govretirement plansverifying rolloververifying rollover contributions to plansinternal revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the interactive brokers ira rollover form?

The interactive brokers ira rollover form is a specific document that facilitates the transfer of retirement funds into an IRA with Interactive Brokers. It helps ensure that your rollover is completed seamlessly, adhering to IRS regulations and protecting your tax advantages.

-

How do I fill out the interactive brokers ira rollover form?

Filling out the interactive brokers ira rollover form is straightforward. You'll need to provide personal information, account details, and the amount you're rolling over. Always double-check your entries to avoid delays in processing.

-

Are there any fees associated with the interactive brokers ira rollover form?

While the interactive brokers ira rollover form itself doesn't incur fees, there may be charges related to the transfer of funds or account management. It's essential to review Interactive Brokers' fee schedule for any applicable charges.

-

What are the benefits of using the interactive brokers ira rollover form?

Using the interactive brokers ira rollover form offers several benefits, including tax deferral on your investments and seamless management of your retirement funds. This form ensures compliance with IRS guidelines, making the rollover process straightforward and efficient.

-

Can I complete the interactive brokers ira rollover form online?

Yes, you can complete the interactive brokers ira rollover form online through the Interactive Brokers platform. This allows for a faster and more efficient experience, ensuring your rollover is processed promptly.

-

What documents do I need to submit with the interactive brokers ira rollover form?

Typically, you may need to provide identification documents, your current account statements, and any relevant paperwork from your existing IRA. Check with Interactive Brokers for any additional requirements to streamline the process.

-

How long does it take to process the interactive brokers ira rollover form?

The processing time for the interactive brokers ira rollover form can vary, but it usually takes between 5 to 10 business days. Factors like the current workload and accuracy of your submitted information can influence the timeline.

Get more for Www irs govretirement plansverifying rolloverVerifying Rollover Contributions To PlansInternal Revenue

- Citibank dtvm ficha cadastral form

- Eslpod download all mp3 form

- U s air force form afrs1328 usa federal forms com

- Photosynthesis and cellular respiration flipped classroom video docx form

- Laboratory licensing change form maryland

- Maryland department of health office of health car form

- Trainer agreement template form

- Training acas agreement template form

Find out other Www irs govretirement plansverifying rolloverVerifying Rollover Contributions To PlansInternal Revenue

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast