Earned Income Credit EIC Worksheet CP 09 2023-2026

Understanding the Earned Income Credit EIC Worksheet CP 09

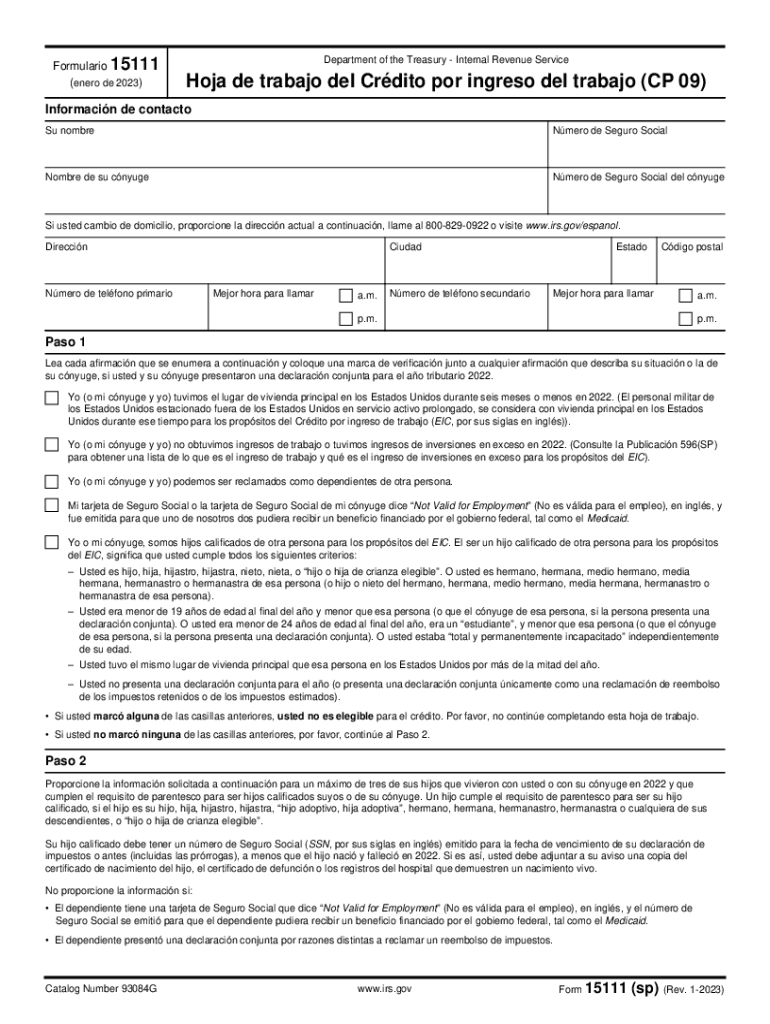

The Earned Income Credit (EIC) Worksheet CP 09 is a crucial document used by eligible taxpayers to calculate their earned income credit for the tax year. This worksheet helps individuals determine the amount of credit they can claim based on their income and number of qualifying children. The EIC is designed to benefit low to moderate-income working individuals and families, providing them with financial relief and encouraging employment.

How to Use the Earned Income Credit EIC Worksheet CP 09

To effectively use the EIC Worksheet CP 09, taxpayers need to follow specific steps. First, gather all necessary financial documents, including W-2 forms and any other income statements. Next, fill out the worksheet by entering your earned income, adjusted gross income, and the number of qualifying children. The worksheet includes instructions on how to calculate the credit based on your inputs. Accurate completion is essential to ensure you receive the correct amount of credit.

Steps to Complete the Earned Income Credit EIC Worksheet CP 09

Completing the EIC Worksheet CP 09 involves several clear steps:

- Gather all relevant income documents, such as W-2 forms and 1099s.

- Determine your filing status and the number of qualifying children.

- Input your earned income and adjusted gross income into the worksheet.

- Follow the instructions to calculate your credit based on the provided tables.

- Review your entries for accuracy before submitting your tax return.

Eligibility Criteria for the Earned Income Credit EIC Worksheet CP 09

To qualify for the Earned Income Credit, taxpayers must meet specific eligibility criteria. These include:

- Having earned income from employment or self-employment.

- Meeting income limits, which vary based on filing status and number of children.

- Being a U.S. citizen or resident alien for the entire tax year.

- Having a valid Social Security number.

Obtaining the Earned Income Credit EIC Worksheet CP 09

The EIC Worksheet CP 09 can be obtained through several channels. Taxpayers can download the worksheet directly from the IRS website in PDF format. Additionally, it is often included in tax preparation software, making it easily accessible for those filing electronically. For individuals who prefer paper forms, the worksheet can also be found in tax preparation books available at bookstores or libraries.

IRS Guidelines for the Earned Income Credit EIC Worksheet CP 09

The IRS provides comprehensive guidelines regarding the use of the EIC Worksheet CP 09. Taxpayers are encouraged to review these guidelines to understand the requirements and limitations of the credit. Key points include the importance of accurate reporting of income, the necessity of maintaining documentation for any claims, and the potential for audits if discrepancies arise. Familiarizing oneself with IRS guidelines can help ensure compliance and maximize the benefits of the credit.

Quick guide on how to complete earned income credit eic worksheet cp 09

Complete Earned Income Credit EIC Worksheet CP 09 seamlessly on any gadget

Digital document management has become increasingly favored by both businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary template and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Earned Income Credit EIC Worksheet CP 09 on any device with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest way to edit and eSign Earned Income Credit EIC Worksheet CP 09 effortlessly

- Locate Earned Income Credit EIC Worksheet CP 09 and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive details using tools that airSlate SignNow specially offers for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Choose your preferred method to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced paperwork, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and eSign Earned Income Credit EIC Worksheet CP 09 and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the earned income credit eic worksheet cp 09

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the eic table 2023 and how can it help my business?

The eic table 2023 is a crucial resource that outlines the latest guidelines for e-signatures. By utilizing airSlate SignNow in conjunction with the eic table 2023, your business can ensure compliance while streamlining document workflows, thus boosting efficiency.

-

How does airSlate SignNow integrate with the eic table 2023?

airSlate SignNow helps businesses leverage the eic table 2023 by providing e-signature solutions that adhere to the latest standards. This integration ensures that your documents are not just signed, but also compliant with industry regulations outlined in the eic table 2023.

-

What features does airSlate SignNow offer in relation to the eic table 2023?

Key features of airSlate SignNow include customizable templates, real-time tracking, and secure storage, all designed with the eic table 2023 guidelines in mind. These features make it easier for you to manage documents while adhering to the compliance requirements set forth in the eic table 2023.

-

Is there a cost associated with using airSlate SignNow alongside the eic table 2023?

Yes, airSlate SignNow offers competitive pricing plans that are tailored to your business needs, even as you focus on the eic table 2023. By investing in SignNow, you gain access to valuable features that ensure your e-signature processes are compliant and efficient.

-

Can airSlate SignNow assist in tracking compliance with the eic table 2023?

Absolutely! airSlate SignNow provides robust tracking features that allow you to monitor compliance with the eic table 2023. You can easily access audit trails and reports to ensure all your documents meet the necessary regulatory requirements.

-

What are the benefits of using e-signatures in line with the eic table 2023?

Utilizing e-signatures that comply with the eic table 2023 can signNowly reduce processing time for documents. It enhances the customer experience while ensuring legal validity, thus reducing the risk of non-compliance.

-

Does airSlate SignNow offer support for teams using the eic table 2023?

Yes, airSlate SignNow provides dedicated support for teams looking to implement solutions based on the eic table 2023. Our customer service team is well-versed in the eic table 2023 guidelines to help you navigate any challenges.

Get more for Earned Income Credit EIC Worksheet CP 09

- Bill of sale in connection with sale of business by individual or corporate seller kentucky form

- Ky marriage form

- Marital legal separation and property settlement agreement no children kentucky form

- Office lease agreement kentucky form

- Dissolution marriage order form

- Kentucky marriage form application

- Legal separation property form

- Final divorce decree order verbiage in kentucky form

Find out other Earned Income Credit EIC Worksheet CP 09

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract