TC 62M, Schedule a Forms & Publications Tax Utah

What is the TC 62M, Schedule A Forms & Publications Tax Utah

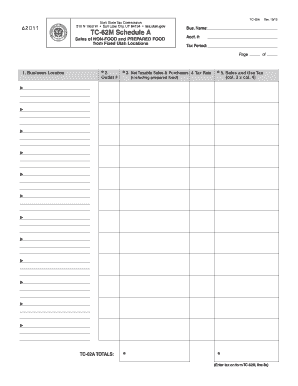

The TC 62M is a tax form used in Utah for reporting specific tax information related to individual income tax. It is part of the Schedule A Forms & Publications, which provide guidelines and instructions for taxpayers in Utah. This form is essential for individuals who need to report various deductions and credits applicable to their state tax obligations. Understanding the purpose of TC 62M is crucial for accurate tax filing and compliance with state tax laws.

Steps to complete the TC 62M, Schedule A Forms & Publications Tax Utah

Completing the TC 62M involves several key steps to ensure accurate reporting. Start by gathering all necessary financial documents, including W-2 forms, 1099 forms, and any receipts for deductible expenses. Next, follow these steps:

- Carefully read the instructions provided with the TC 62M form to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income as instructed, ensuring all figures are accurate and match your financial documents.

- Detail any deductions or credits you are eligible for, following the guidelines provided in the form.

- Review your completed form for any errors or omissions before submission.

How to obtain the TC 62M, Schedule A Forms & Publications Tax Utah

The TC 62M form can be obtained through several avenues. Taxpayers can download the form directly from the official Utah State Tax Commission website. Alternatively, physical copies may be available at local tax offices or public libraries. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Legal use of the TC 62M, Schedule A Forms & Publications Tax Utah

The TC 62M is legally recognized as a valid form for reporting state income tax information in Utah. Taxpayers must use this form in accordance with Utah tax laws to ensure compliance. Failing to use the correct form or providing inaccurate information can lead to penalties. It is advisable to consult with a tax professional if you have questions regarding the legal implications of using the TC 62M.

Filing Deadlines / Important Dates

Filing deadlines for the TC 62M are typically aligned with the federal tax filing deadlines. Taxpayers should be aware that the deadline for submitting the TC 62M is usually April 15 of each year, unless it falls on a weekend or holiday, in which case the deadline may be extended. It is crucial to stay informed about any changes to these dates to avoid late penalties.

Required Documents

When completing the TC 62M, certain documents are required to support the information reported on the form. These documents include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Any other documentation that verifies income or deductions claimed.

Quick guide on how to complete tc 62m schedule a forms amp publications tax utah

Accomplish TC 62M, Schedule A Forms & Publications Tax Utah seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily access the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage TC 62M, Schedule A Forms & Publications Tax Utah on any gadget using the airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

The easiest way to alter and electronically sign TC 62M, Schedule A Forms & Publications Tax Utah without hassle

- Obtain TC 62M, Schedule A Forms & Publications Tax Utah and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign TC 62M, Schedule A Forms & Publications Tax Utah and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 62m schedule a forms amp publications tax utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is TC 62M, Schedule A Forms & Publications Tax Utah?

TC 62M, Schedule A Forms & Publications Tax Utah are essential documents required for tax submissions in the state of Utah. These forms help taxpayers report various income types and claim deductions. Understanding these forms is crucial for ensuring compliance with state tax regulations.

-

How does airSlate SignNow help with TC 62M, Schedule A Forms & Publications Tax Utah?

airSlate SignNow simplifies the process of preparing, signing, and submitting TC 62M, Schedule A Forms & Publications Tax Utah. Our tool enables users to easily create, edit, and eSign these documents, reducing the time spent on tax paperwork. By streamlining document management, we help you focus on what matters most.

-

What are the pricing options for using airSlate SignNow for my TC 62M needs?

airSlate SignNow offers flexible pricing plans to fit different business needs when managing TC 62M, Schedule A Forms & Publications Tax Utah. Our plans range from basic to comprehensive, ensuring that there's an option for every budget. Each plan provides access to powerful features tailored to tax document management.

-

Can I integrate airSlate SignNow with other software for handling TC 62M documents?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage TC 62M, Schedule A Forms & Publications Tax Utah more effectively. Our integrations with popular tools like Google Drive, Dropbox, and CRM platforms enhance your ability to store and retrieve important tax documents. This ensures your workflow remains efficient and organized.

-

What benefits can I expect from using airSlate SignNow for tax purposes?

By utilizing airSlate SignNow for TC 62M, Schedule A Forms & Publications Tax Utah, you can expect increased efficiency and security in document handling. Our platform prioritizes ease of use, enabling you to complete your tax forms quickly. Additionally, registered documents offer legal protection and a clear audit trail.

-

Is airSlate SignNow secure for handling sensitive tax documents like TC 62M?

Absolutely! airSlate SignNow employs industry-leading security measures to protect sensitive information associated with TC 62M, Schedule A Forms & Publications Tax Utah. Our encrypted platform ensures that your data is secure during transmission and storage, providing peace of mind when signing and managing tax documents.

-

How do I get started with airSlate SignNow for TC 62M, Schedule A Forms & Publications Tax Utah?

Getting started with airSlate SignNow is simple and intuitive. Sign up for an account, choose the plan that best suits your needs, and start creating and managing your TC 62M, Schedule A Forms & Publications Tax Utah documents right away. Our user-friendly interface makes it easy to navigate through the document signing process.

Get more for TC 62M, Schedule A Forms & Publications Tax Utah

- A i r e registration form and changes of addressfamily status

- Exemption for ignition interlock device form

- Michigan legal last will and testament form for married person with adult children

- Dch 1625 form in michigan

- Form it 205 a fiduciary allocation tax year

- Cosigner agreement template form

- Cosigner loan agreement template form

- Healthcare consult contract template form

Find out other TC 62M, Schedule A Forms & Publications Tax Utah

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free