Form 1040 SP U S Individual Income Tax Return Spanish Version

What is the Form 1040 SP U S Individual Income Tax Return Spanish Version

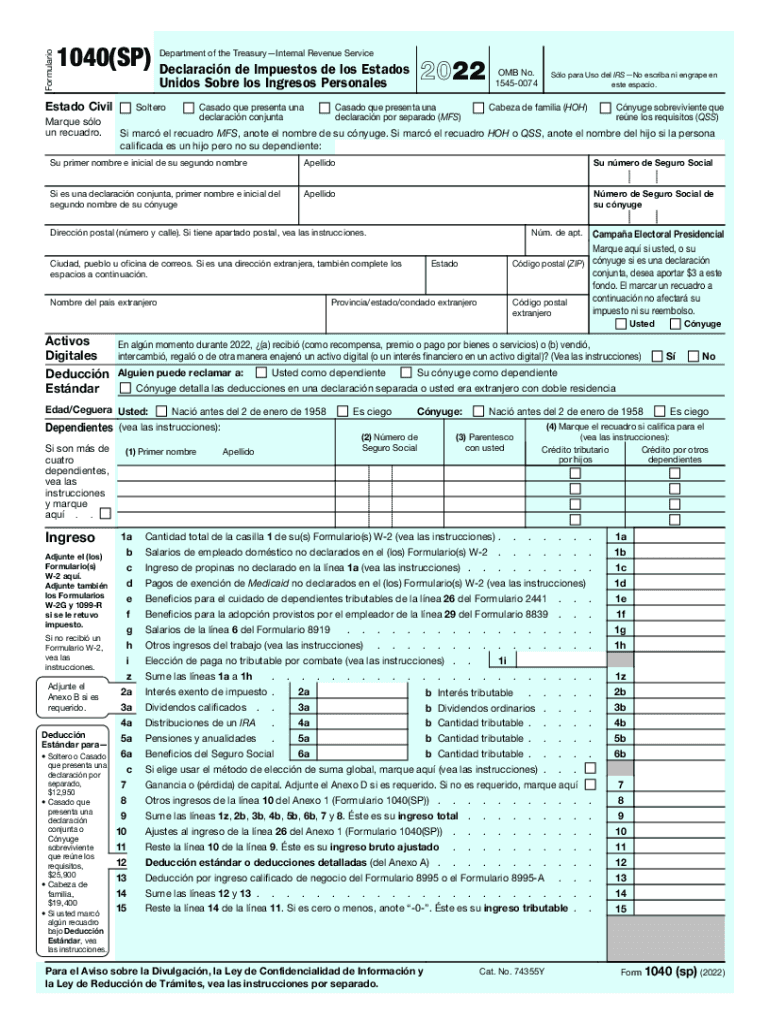

The Form 1040 SP U S Individual Income Tax Return Spanish Version is a tax form designed for U.S. taxpayers who prefer to complete their income tax return in Spanish. This form serves the same purpose as the standard Form 1040 but is tailored for Spanish-speaking individuals, ensuring they can accurately report their income, deductions, and credits to the Internal Revenue Service (IRS). It is essential for individuals who are residents or citizens of the United States and need to file their federal income tax returns while using their preferred language.

How to obtain the Form 1040 SP U S Individual Income Tax Return Spanish Version

To obtain the Form 1040 SP U S Individual Income Tax Return Spanish Version, taxpayers can visit the official IRS website, where the form is available for download. Additionally, taxpayers can request a physical copy by contacting the IRS directly or visiting local IRS offices. It is important to ensure that you are accessing the most current version of the form to comply with the latest tax regulations.

Steps to complete the Form 1040 SP U S Individual Income Tax Return Spanish Version

Completing the Form 1040 SP involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your income by entering amounts from your financial documents in the designated sections.

- Claim deductions and credits applicable to your situation, ensuring to follow the instructions provided on the form.

- Review your completed form for accuracy and completeness.

- Sign and date the form before submitting it to the IRS.

Key elements of the Form 1040 SP U S Individual Income Tax Return Spanish Version

The Form 1040 SP includes several key elements that taxpayers must complete:

- Filing Status: Indicate whether you are filing as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Income Section: Report all sources of income, including wages, dividends, and interest.

- Deductions: Detail any deductions you are claiming, such as standard deductions or itemized deductions.

- Tax and Credits: Calculate your tax liability and any credits that may reduce your tax burden.

- Payments: Report any tax payments made, including withholding and estimated tax payments.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the Form 1040 SP. The standard deadline for filing individual tax returns is typically April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to file on time to avoid penalties and interest on any unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 1040 SP. These methods include:

- Online Filing: Taxpayers can file electronically using IRS-approved tax software, which often simplifies the process and allows for faster processing.

- Mail: The completed form can be printed and mailed to the appropriate IRS address, which varies based on the taxpayer's location and whether a payment is included.

- In-Person: Taxpayers may also visit local IRS offices to submit their forms directly, although this option may require an appointment.

Quick guide on how to complete form 1040 sp u s individual income tax return spanish version 624654294

Effortlessly prepare Form 1040 SP U S Individual Income Tax Return Spanish Version on all devices

Managing documents online has gained signNow popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the features required to swiftly create, modify, and electronically sign your documents without any delays. Handle Form 1040 SP U S Individual Income Tax Return Spanish Version on any device using the airSlate SignNow applications for Android or iOS and simplify your document-related processes today.

The simplest way to modify and electronically sign Form 1040 SP U S Individual Income Tax Return Spanish Version with ease

- Obtain Form 1040 SP U S Individual Income Tax Return Spanish Version and click on Get Form to initiate.

- Utilize the tools provided to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools designed by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you would prefer to send your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, exhausting form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in a matter of clicks from any device of your selection. Modify and electronically sign Form 1040 SP U S Individual Income Tax Return Spanish Version and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 sp u s individual income tax return spanish version 624654294

Create this form in 5 minutes!

How to create an eSignature for the form 1040 sp u s individual income tax return spanish version 624654294

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040 SP U S Individual Income Tax Return Spanish Version?

The Form 1040 SP U S Individual Income Tax Return Spanish Version is a simplified version of the standard individual income tax return for Spanish-speaking taxpayers. It is designed to help individuals easily report their income and claim deductions while ensuring compliance with U.S. tax laws.

-

Is there a cost associated with using the Form 1040 SP U S Individual Income Tax Return Spanish Version?

Using the Form 1040 SP U S Individual Income Tax Return Spanish Version through airSlate SignNow comes with a subscription fee. However, the platform offers an affordable pricing structure tailored for individuals and businesses, making it a cost-effective solution for tax preparations.

-

How does airSlate SignNow simplify the process of using the Form 1040 SP U S Individual Income Tax Return Spanish Version?

airSlate SignNow streamlines the process by allowing users to fill out, eSign, and send the Form 1040 SP U S Individual Income Tax Return Spanish Version seamlessly. Its user-friendly interface enhances productivity and reduces the guesswork often associated with tax forms.

-

Can I eSign the Form 1040 SP U S Individual Income Tax Return Spanish Version securely?

Yes, airSlate SignNow provides secure electronic signatures for the Form 1040 SP U S Individual Income Tax Return Spanish Version. The platform complies with legal standards and ensures that your personal information is protected during the signing process.

-

What features are available when using the Form 1040 SP U S Individual Income Tax Return Spanish Version on airSlate SignNow?

When using the Form 1040 SP U S Individual Income Tax Return Spanish Version on airSlate SignNow, users benefit from features such as cloud storage, collaborative editing, and real-time tracking. These features make it easy to manage tax documents efficiently.

-

Does airSlate SignNow integrate with other tax software or accounting tools?

Yes, airSlate SignNow can integrate with various accounting and tax software, making it convenient to use alongside the Form 1040 SP U S Individual Income Tax Return Spanish Version. This integration helps users maintain consistency across their financial documents.

-

What are the advantages of using the Form 1040 SP U S Individual Income Tax Return Spanish Version with airSlate SignNow?

Using the Form 1040 SP U S Individual Income Tax Return Spanish Version with airSlate SignNow allows for greater efficiency, accuracy, and compliance in tax filing. It also reduces the hassle of printing and mailing documents, ultimately saving time and resources.

Get more for Form 1040 SP U S Individual Income Tax Return Spanish Version

Find out other Form 1040 SP U S Individual Income Tax Return Spanish Version

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT