Form 1040 SP U S Individual Income Tax Return Spanish Version 2023

What is the Form 1040 SP U S Individual Income Tax Return Spanish Version

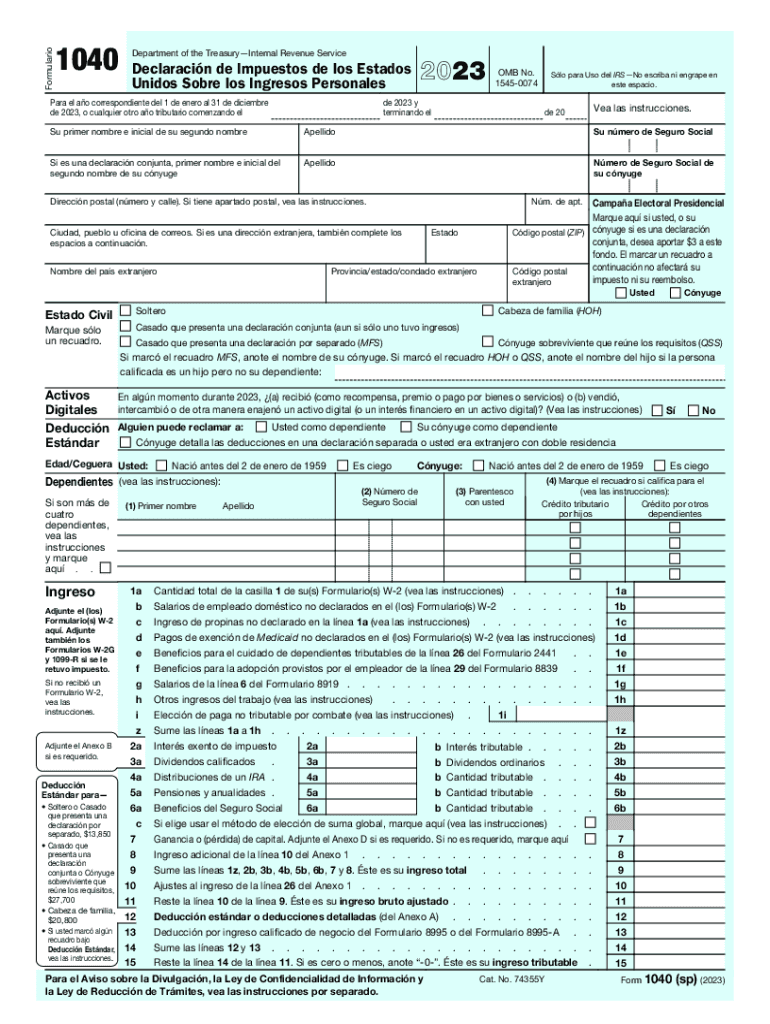

The Form 1040 SP U S Individual Income Tax Return Spanish Version is a simplified tax return form designed for U.S. taxpayers who prefer to complete their tax filings in Spanish. This form allows individuals to report their income, claim deductions, and calculate their tax liability in a language that may be more comfortable for them. It is specifically tailored for residents and citizens who meet the eligibility criteria for filing individual income tax returns in the United States.

How to obtain the Form 1040 SP U S Individual Income Tax Return Spanish Version

To obtain the Form 1040 SP U S Individual Income Tax Return Spanish Version, taxpayers can visit the official IRS website or contact the IRS directly. The form is available for download in PDF format, ensuring easy access for individuals who need to print and fill it out. Additionally, taxpayers can request a physical copy to be mailed to their address by reaching out to the IRS. It is important to ensure that you have the most current version of the form to avoid any issues during filing.

Steps to complete the Form 1040 SP U S Individual Income Tax Return Spanish Version

Completing the Form 1040 SP U S Individual Income Tax Return Spanish Version involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Begin filling out the form by entering your personal information, such as your name, address, and Social Security number.

- Report your income in the appropriate sections, ensuring all figures are accurate.

- Claim any deductions or credits you qualify for, which can help reduce your overall tax liability.

- Calculate your total tax owed or refund due based on the information provided.

- Review the completed form for accuracy before signing and dating it.

Key elements of the Form 1040 SP U S Individual Income Tax Return Spanish Version

The Form 1040 SP includes several key elements that are essential for accurate tax reporting:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: Taxpayers must report all sources of income, including wages, dividends, and interest.

- Deductions and Credits: This section allows taxpayers to claim various deductions and tax credits to reduce their taxable income.

- Tax Calculation: The form includes a section for calculating the total tax owed based on reported income and deductions.

- Signature: Taxpayers must sign and date the form to validate their submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 SP U S Individual Income Tax Return Spanish Version align with standard tax deadlines in the United States. Typically, the due date for filing individual tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to be aware of these dates to avoid penalties and ensure timely submission of their tax returns.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Form 1040 SP U S Individual Income Tax Return Spanish Version through several methods:

- Online Filing: Many taxpayers choose to file electronically using tax software that supports the Spanish version of the form.

- Mail: Completed forms can be mailed to the appropriate IRS address based on the taxpayer's location.

- In-Person: Some individuals may opt to file their taxes in person at designated IRS offices or authorized tax preparation sites.

Quick guide on how to complete form 1040 sp u s individual income tax return spanish version

Complete Form 1040 SP U S Individual Income Tax Return Spanish Version seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Form 1040 SP U S Individual Income Tax Return Spanish Version on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to revise and electronically sign Form 1040 SP U S Individual Income Tax Return Spanish Version effortlessly

- Obtain Form 1040 SP U S Individual Income Tax Return Spanish Version and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or hide sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Revise and electronically sign Form 1040 SP U S Individual Income Tax Return Spanish Version to ensure excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 sp u s individual income tax return spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 1040 sp u s individual income tax return spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040 SP U S Individual Income Tax Return Spanish Version?

The Form 1040 SP U S Individual Income Tax Return Spanish Version is a simplified tax return designed for Spanish-speaking taxpayers in the U.S. It allows individuals to report their income and claim deductions in their preferred language, making the tax filing process easier and more accessible.

-

How can airSlate SignNow help with the Form 1040 SP U S Individual Income Tax Return Spanish Version?

airSlate SignNow provides an efficient platform for electronically signing and sending the Form 1040 SP U S Individual Income Tax Return Spanish Version. With its user-friendly interface, taxpayers can complete and submit their tax returns securely and quickly, saving time during tax season.

-

Is there a cost associated with using airSlate SignNow for filing the Form 1040 SP U S Individual Income Tax Return Spanish Version?

airSlate SignNow offers cost-effective solutions tailored to meet various business needs. Users can choose from different pricing plans, ensuring that filing the Form 1040 SP U S Individual Income Tax Return Spanish Version is affordable for everyone, from individuals to large organizations.

-

What features does airSlate SignNow offer for the Form 1040 SP U S Individual Income Tax Return Spanish Version?

airSlate SignNow includes features such as drag-and-drop document uploads, customizable templates, and in-document collaboration. These features enhance the filing experience for the Form 1040 SP U S Individual Income Tax Return Spanish Version, making it easier to complete and submit your tax return.

-

Can I integrate airSlate SignNow with other software for the Form 1040 SP U S Individual Income Tax Return Spanish Version?

Yes, airSlate SignNow offers integration capabilities with various accounting and tax preparation software. This allows users to seamlessly transfer data, reducing errors while completing the Form 1040 SP U S Individual Income Tax Return Spanish Version and improving overall efficiency.

-

What are the benefits of using airSlate SignNow for the Form 1040 SP U S Individual Income Tax Return Spanish Version?

Using airSlate SignNow for the Form 1040 SP U S Individual Income Tax Return Spanish Version provides numerous benefits, such as increased efficiency, reduced paper clutter, and enhanced security. Users can track document statuses in real-time, ensuring timely submissions and compliance with tax regulations.

-

Is airSlate SignNow easy to use for the Form 1040 SP U S Individual Income Tax Return Spanish Version?

Absolutely! AirSlate SignNow is designed for users of all skill levels. The platform's intuitive interface makes it easy to navigate and complete the Form 1040 SP U S Individual Income Tax Return Spanish Version without overwhelming technical jargon.

Get more for Form 1040 SP U S Individual Income Tax Return Spanish Version

- Confidential medical report form

- Wa dol physical examination report form

- 330 23 fillable form

- Solar system reading comprehension pdf form

- Lpc hours log template excel form

- Medical practice new patient application form

- I proceedings of the workshop on millimeter form

- Commitment to purchase agreement template form

Find out other Form 1040 SP U S Individual Income Tax Return Spanish Version

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online