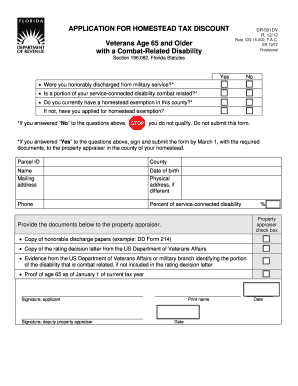

APPLICATION for HOMESTEAD TAX DISCOUNT Veterans Age 65 and Older with a Combat Related Disability Form

What is the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability

The APPLICATION FOR HOMESTEAD TAX DISCOUNT for Veterans Age 65 and Older With A Combat Related Disability is a specific form designed to provide eligible veterans with a reduction in property taxes. This application acknowledges the unique sacrifices made by veterans who are both aged and have a combat-related disability. By completing this form, veterans can apply for tax relief on their primary residence, easing the financial burden associated with homeownership.

Eligibility Criteria

To qualify for the homestead tax discount, applicants must meet specific criteria. Veterans must be at least sixty-five years old and have a combat-related disability as recognized by the Department of Veterans Affairs. Additionally, applicants must own and occupy the property for which they are seeking the discount. Proof of age and disability status is typically required, along with documentation confirming property ownership.

Steps to complete the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability

Completing the application involves several key steps:

- Gather necessary documents, including proof of age, disability status, and property ownership.

- Obtain the application form from your local tax office or relevant government agency.

- Carefully fill out the form, ensuring all information is accurate and complete.

- Submit the form along with the required documentation to the appropriate tax authority by the designated deadline.

Required Documents

When applying for the homestead tax discount, certain documents are essential for verification. Applicants typically need:

- A copy of the veteran's identification or military discharge papers.

- Documentation proving the combat-related disability, such as a letter from the Department of Veterans Affairs.

- Proof of age, which may include a birth certificate or government-issued ID.

- Evidence of property ownership, such as a deed or tax statement.

Form Submission Methods

The APPLICATION FOR HOMESTEAD TAX DISCOUNT can be submitted through various methods, depending on local regulations. Common submission options include:

- Online submission through the local tax authority's website, if available.

- Mailing the completed form and documents to the designated tax office.

- In-person submission at the local tax office during business hours.

Legal use of the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability

This application serves a legal purpose by enabling qualified veterans to receive tax benefits as outlined by state laws. The form must be completed accurately to ensure compliance with local tax regulations. Misrepresentation or failure to provide required information may result in penalties or denial of the tax discount.

Quick guide on how to complete application for homestead tax discount veterans age 65 and older with a combat related disability 1630010

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-intensive process today.

The easiest way to modify and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to secure your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability

Create this form in 5 minutes!

How to create an eSignature for the application for homestead tax discount veterans age 65 and older with a combat related disability 1630010

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability?

The APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability is a form that eligible veterans can fill out to receive property tax discounts. This program is designed to provide financial relief to veterans over 65 who have a combat-related disability. Completing this application can help reduce the tax burden on qualifying properties.

-

Who is eligible to apply for the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability?

Eligibility for the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability typically includes veterans aged 65 and older who have a documented combat-related disability. Each state may have specific requirements, so it's important to check local regulations and documentation needed when applying. Ensuring you meet these criteria can streamline the application process.

-

How do I submit the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability?

To submit the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability, you usually need to fill out the required form and submit it to your local tax office. Many jurisdictions now offer online submission options, making the process easier and quicker. Ensure that all required documentation is included to prevent delays.

-

What documentation is required for the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability?

When applying for the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability, you may need to provide proof of age, proof of disability, and ownership of the property. Check with your local tax office for the specific documents required as they can vary by state. Proper documentation will help ensure your application is processed without issues.

-

Is there a fee to file the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability?

Typically, there is no fee to file the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability. The application process is designed to be accessible and provide financial assistance without additional costs. However, it’s always best to verify with your local tax authority for any specific fees that may apply.

-

What benefits can I expect from the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability?

The primary benefit of the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability is the reduced property taxes for qualified veterans. This financial relief can signNowly lower your annual tax expenses, allowing you to allocate funds to other essential areas of your life. It's an important financial support for our deserving veterans.

-

Can the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability be renewed?

Yes, the APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability can often be renewed annually, depending on state regulations. It is essential to check with your local tax authority to understand their specific renewal requirements and deadlines. Keeping your application up-to-date ensures continuous benefits.

Get more for APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability

Find out other APPLICATION FOR HOMESTEAD TAX DISCOUNT Veterans Age 65 And Older With A Combat Related Disability

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later