4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards 4569, MICHIGAN Business Tax Single Business Tax SBT Cre Form

Understanding the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards

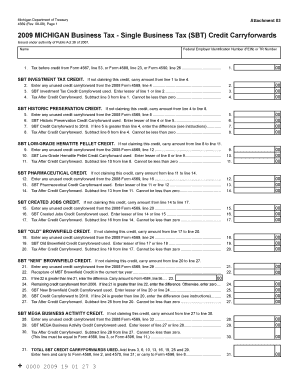

The 4569, MICHIGAN Business Tax Single Business Tax (SBT) Credit Carryforwards form is essential for businesses in Michigan that have previously claimed SBT credits. This form allows eligible businesses to carry forward unused credits to future tax years, effectively reducing future tax liabilities. Understanding the nuances of this form is critical for compliance and optimal tax planning.

How to Complete the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards

Completing the 4569 form involves several key steps. First, gather all necessary financial documents that detail your business's earnings and previous SBT credits. Ensure that you accurately report the amount of credit you wish to carry forward. It is crucial to follow the instructions provided with the form closely to avoid errors that could result in penalties or delays in processing.

Eligibility Criteria for the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards

To qualify for the SBT Credit Carryforwards, your business must have previously claimed SBT credits that were not fully utilized in the tax year. Additionally, your business must meet specific operational criteria defined by the Michigan Department of Treasury. Understanding these eligibility requirements helps ensure that your business can benefit from potential tax savings.

Key Elements of the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards

The form contains several important sections that require careful attention. Key elements include the identification of your business, the calculation of the credit amount being carried forward, and any relevant tax year information. Each section must be filled out accurately to ensure compliance with state tax regulations.

Filing Deadlines for the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards

Timely filing of the 4569 form is crucial. Businesses must submit the form by the designated deadlines established by the Michigan Department of Treasury. Missing these deadlines may result in the forfeiture of the ability to carry forward credits, impacting future tax obligations.

Submission Methods for the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards

The 4569 form can be submitted through various methods, including online filing, mail, or in-person submission at designated tax offices. Each method has its own set of requirements and processing times, so businesses should choose the option that best suits their needs while ensuring compliance with submission guidelines.

Quick guide on how to complete 4569 michigan business tax single business tax sbt credit carryforwards 4569 michigan business tax single business tax sbt

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the functionalities necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The easiest way to modify and eSign [SKS] without hassle

- Locate [SKS] and select Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with features specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your edits.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards 4569, MICHIGAN Business Tax Single Business Tax SBT Cre

Create this form in 5 minutes!

How to create an eSignature for the 4569 michigan business tax single business tax sbt credit carryforwards 4569 michigan business tax single business tax sbt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards?

The 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards provides essential features for managing tax credits efficiently. It allows businesses to carry forward unused credits to future tax periods, helping to optimize tax liabilities. With easy tracking and management, businesses can maximize their tax savings effectively.

-

How does the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards benefit my business?

Utilizing the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards can greatly reduce your overall tax burden. By taking advantage of credit carryforwards, businesses can ensure they do not forfeit potential savings that can be used for reinvestment or growth. This financial strategy can signNowly improve cash flow management.

-

What is the pricing structure for the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards?

Pricing for the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards varies based on the services needed. Typically, there are flexible packages available to cater to different business sizes and needs, ensuring all clients can find a solution fitting their financial capabilities. Contact us for a tailored quote.

-

Are there any integrations available with the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards?

Yes, the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards can integrate seamlessly with various accounting and financial software. These integrations enhance the user experience by allowing automatic calculations and reports to be generated efficiently. This compatibility ensures your business can maintain smooth operations.

-

What types of businesses can benefit from the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards?

Any business that is subject to the MICHIGAN Business Tax can benefit from the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards. Small to large enterprises will find value in utilizing these credit carryforwards to improve their tax strategies. It's especially advantageous for businesses looking to optimize their tax savings over multiple years.

-

How do I apply for the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards?

Applying for the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards involves completing the required tax forms accurately and submitting them during your tax filing process. Ensure you consult a tax professional to maximize your benefits and avoid any common pitfalls. Our team can also guide you through the application process.

-

Can I combine my credits from different tax periods using the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards?

Yes, the 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards allows you to combine credits from different tax periods, which enhances your overall tax strategy. By consolidating credits, businesses can optimize their tax obligations more effectively. This flexibility is beneficial in planning for future financial years.

Get more for 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards 4569, MICHIGAN Business Tax Single Business Tax SBT Cre

- English grammar exercises form

- Vbfh form

- Las vegas hotel credit card authorization form 95306070

- Adhs immunization record request form

- Interview questions for cement industry pdf form

- Certificate of disposition 458452849 form

- Dd form 1617

- Application for an authorization to return to canada capic form

Find out other 4569, MICHIGAN Business Tax Single Business Tax SBT Credit Carryforwards 4569, MICHIGAN Business Tax Single Business Tax SBT Cre

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe