403b Plans Salary Reduction AgreementChange Form

Understanding the 403b Plans Salary Reduction Agreement Change Form

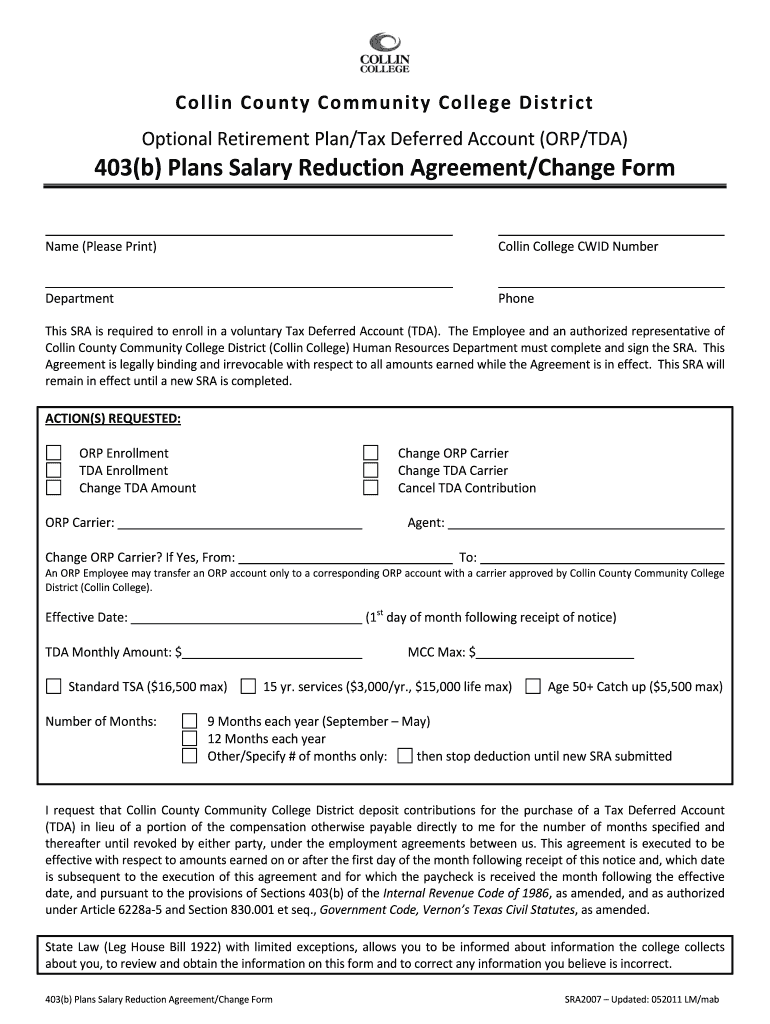

The 403b Plans Salary Reduction Agreement Change Form is a crucial document used by employees participating in 403(b) retirement plans. This form allows individuals to adjust their salary reduction contributions to their retirement accounts. It is essential for employees to understand how changes to their contributions can impact their retirement savings and tax liabilities. The form is typically provided by employers and must be filled out accurately to ensure compliance with IRS regulations.

Steps to Complete the 403b Plans Salary Reduction Agreement Change Form

Completing the 403b Plans Salary Reduction Agreement Change Form involves several key steps:

- Obtain the form from your employer or the designated benefits administrator.

- Review the current contribution amounts and determine the new salary reduction percentage or dollar amount you wish to contribute.

- Fill out the form with your personal information, including your name, employee ID, and the requested changes.

- Sign and date the form to validate your request.

- Submit the completed form to your employer’s human resources or payroll department for processing.

How to Use the 403b Plans Salary Reduction Agreement Change Form

The form is designed to facilitate changes in your retirement plan contributions. To use it effectively:

- Ensure you are aware of the maximum contribution limits set by the IRS for the year.

- Consider consulting with a financial advisor to determine the optimal contribution level for your retirement goals.

- Keep a copy of the completed form for your records after submission.

Legal Use of the 403b Plans Salary Reduction Agreement Change Form

This form is legally binding and must be filled out in accordance with IRS guidelines. It is essential to provide accurate information to avoid penalties or complications with your retirement plan. Employers are required to maintain records of all submitted forms for compliance purposes.

Key Elements of the 403b Plans Salary Reduction Agreement Change Form

When filling out the form, pay attention to the following key elements:

- Employee Information: Your full name, employee ID, and contact details.

- Contribution Amount: The new percentage or dollar amount you wish to contribute.

- Effective Date: The date when the new salary reduction will take effect.

- Signature: Your signature to authorize the changes.

Obtaining the 403b Plans Salary Reduction Agreement Change Form

The form can typically be obtained through your employer's human resources department or benefits portal. Some organizations may also provide the form in a digital format, allowing for easier access and submission. If you are unsure where to find the form, consider reaching out to your HR representative for assistance.

Quick guide on how to complete 403b plans salary reduction agreementchange form

Manage [SKS] effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute to traditional printed and signed documents, as you can access the required template and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and efficiently. Handle [SKS] on any device with airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specializes in for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require additional printed copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 403b Plans Salary Reduction AgreementChange Form

Create this form in 5 minutes!

How to create an eSignature for the 403b plans salary reduction agreementchange form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 403b Plans Salary Reduction AgreementChange Form?

The 403b Plans Salary Reduction AgreementChange Form is a document that allows employees to express their desire to change their salary reduction amount for contributions to a 403(b) retirement plan. This form is essential for ensuring compliance with IRS guidelines while managing contributions effectively. By using this form, employees can easily manage their retirement savings strategy.

-

How do I fill out the 403b Plans Salary Reduction AgreementChange Form?

Filling out the 403b Plans Salary Reduction AgreementChange Form is straightforward. You'll need to provide personal details, current contribution amounts, and the desired changes to your contributions. Make sure to review the form for accuracy before submitting it to ensure it reflects your intentions clearly.

-

What are the benefits of using a 403b Plans Salary Reduction AgreementChange Form?

The 403b Plans Salary Reduction AgreementChange Form offers several benefits, including flexibility in managing retirement contributions and ensuring compliance with tax regulations. It allows employees to make informed decisions about their savings without any hassle. This form is an important tool for employees aiming to maximize their retirement benefits.

-

Is there a cost associated with using the 403b Plans Salary Reduction AgreementChange Form?

Using the 403b Plans Salary Reduction AgreementChange Form is generally free for employees, as it is a standard document provided by most employers. However, some employers may have administrative fees that could be associated with processing your changes. It's best to check with your HR department for specifics regarding any potential costs.

-

Can I change my 403b contribution at any time using the Salary Reduction AgreementChange Form?

In most cases, you can change your contribution to your 403b plan using the Salary Reduction AgreementChange Form during specific enrollment periods or at designated times throughout the year. It's crucial to familiarize yourself with your employer's policies regarding contribution changes to ensure your adjustments are processed timely.

-

How does the 403b Plans Salary Reduction AgreementChange Form integrate with other retirement plans?

The 403b Plans Salary Reduction AgreementChange Form is designed to work seamlessly with other retirement plans offered by your employer. It ensures that your contributions are correctly allocated and helps maintain compliance across all retirement savings options. Be sure to consult with your benefits administrator for clarification on integration with your specific retirement plans.

-

What happens after I submit my 403b Plans Salary Reduction AgreementChange Form?

Once you submit your 403b Plans Salary Reduction AgreementChange Form, your employer's HR or payroll department will process the changes. You should receive confirmation of the updates and the timing of your revised contributions. It’s advisable to keep a copy of the form for your records until you confirm that the changes have taken effect.

Get more for 403b Plans Salary Reduction AgreementChange Form

Find out other 403b Plans Salary Reduction AgreementChange Form

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile