Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return

What is the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return

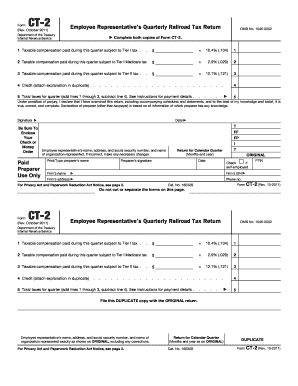

The Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return is a tax form used by employee representatives in the railroad industry to report and remit taxes withheld from employee wages. This form is essential for ensuring compliance with federal tax regulations and helps maintain accurate records of tax obligations. It is specifically tailored for representatives who handle payroll and tax matters for railroad employees, making it a critical component of the tax reporting process in this sector.

How to use the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return

To use the Form CT 2 Rev October, employee representatives must first gather all necessary payroll information for the quarter. This includes details about wages paid, taxes withheld, and any applicable deductions. Once the information is compiled, representatives can fill out the form accurately, ensuring that all sections are completed as required. After completing the form, it must be submitted to the appropriate tax authority by the specified deadline to avoid penalties.

Steps to complete the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return

Completing the Form CT 2 Rev October involves several key steps:

- Gather payroll data for the reporting quarter, including total wages and taxes withheld.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the appropriate tax authority by the deadline.

Following these steps helps ensure compliance and accurate tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 2 Rev October are crucial for compliance. Typically, the form must be submitted quarterly, with specific due dates set by the IRS. It is important for employee representatives to stay informed about these dates to avoid late fees and penalties. Generally, the deadlines align with the end of each quarter, requiring submissions by the last day of the month following the quarter's end.

Key elements of the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return

The Form CT 2 Rev October includes several key elements that must be accurately reported:

- Total wages paid to employees during the quarter.

- Total amount of taxes withheld from employee wages.

- Identification information for the employee representative.

- Signature of the representative certifying the accuracy of the information provided.

Each of these elements plays a vital role in ensuring the form is complete and compliant with tax regulations.

Legal use of the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return

The legal use of the Form CT 2 Rev October is governed by federal tax laws and regulations. Employee representatives are required to use this form to report taxes withheld from employee wages accurately. Failure to use the form correctly can result in legal penalties, including fines and interest on unpaid taxes. It is essential for representatives to understand their legal obligations and ensure that the form is submitted in accordance with IRS guidelines.

Quick guide on how to complete form ct 2 rev october employee representatives quarterly railroad tax return

Complete [SKS] effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly without any holdups. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and electronically sign [SKS] without stress

- Find [SKS] and select Get Form to begin.

- Use the tools we provide to complete your form.

- Mark important paragraphs of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form ct 2 rev october employee representatives quarterly railroad tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return?

The Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return is a tax form required for railroad employers to report and pay employee taxes. This form provides essential information to the IRS, ensuring compliance while simplifying the filing process for businesses.

-

How can airSlate SignNow help with the completion of the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return?

airSlate SignNow offers a user-friendly platform that allows you to fill out and eSign the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return efficiently. Our solution simplifies document management, enabling you to capture signatures and store completed forms securely.

-

Is there a cost associated with using airSlate SignNow for the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return?

Yes, airSlate SignNow provides various pricing plans to accommodate businesses of all sizes, allowing you to choose a plan that fits your needs. Each plan offers access to powerful features, including the ability to complete and eSign the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return.

-

What features does airSlate SignNow offer for handling the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return?

airSlate SignNow includes features like templates for the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return, automated reminders, and tracking of signature requests. These tools help businesses streamline the filing process and enhance overall efficiency.

-

Can airSlate SignNow integrate with other software for managing the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, enhancing your ability to manage the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return. This integration allows for smoother workflows and better data management.

-

What are the benefits of using airSlate SignNow for the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return?

Using airSlate SignNow for the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return streamlines the filing process, reduces errors, and ensures compliance. With our platform, you can expedite approvals and manage your documents more effectively.

-

Is airSlate SignNow secure for handling sensitive documents like the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return?

Yes, airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your sensitive documents, including the Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return. Your data's safety is our top priority.

Get more for Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return

Find out other Form CT 2 Rev October Employee Representative's Quarterly Railroad Tax Return

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure