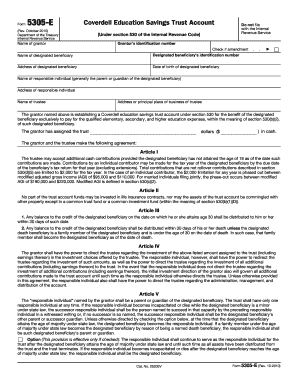

Form 5305 E Rev October Coverdell Education Savings Trust Account

What is the Form 5305 E Rev October Coverdell Education Savings Trust Account

The Form 5305 E Rev October is a legal document used to establish a Coverdell Education Savings Trust Account (CESA). This form is essential for individuals looking to save for educational expenses for a designated beneficiary. The CESA allows tax-free growth of contributions, and distributions for qualified education expenses are also tax-free. This form outlines the terms and conditions of the account, ensuring compliance with IRS regulations. It is specifically designed for U.S. taxpayers who wish to take advantage of the tax benefits associated with education savings.

How to use the Form 5305 E Rev October Coverdell Education Savings Trust Account

Using the Form 5305 E Rev October involves completing the document accurately to set up a Coverdell Education Savings Trust Account. To begin, the account owner must provide personal information, including their name, address, and Social Security number. Additionally, details about the beneficiary, such as their name and date of birth, must be included. Once the form is completed, it should be signed and dated by the account owner. This signed form must then be retained for tax purposes, as it serves as proof of the account's establishment and its compliance with IRS guidelines.

Steps to complete the Form 5305 E Rev October Coverdell Education Savings Trust Account

Completing the Form 5305 E Rev October involves several key steps:

- Gather necessary personal information, including Social Security numbers for both the account owner and the beneficiary.

- Fill in the account owner's details, including name and address.

- Provide the beneficiary's information, ensuring accuracy in their name and date of birth.

- Review the terms and conditions outlined in the form to ensure understanding and compliance.

- Sign and date the form to validate the establishment of the account.

- Keep a copy of the completed form for personal records and tax purposes.

Legal use of the Form 5305 E Rev October Coverdell Education Savings Trust Account

The legal use of the Form 5305 E Rev October is crucial for establishing a valid Coverdell Education Savings Trust Account. This form must be completed in accordance with IRS regulations to ensure that the account qualifies for tax benefits. By using this form, account owners can legally contribute to the account and benefit from tax-free growth on their investments. It is important to adhere to the guidelines set forth in the form to avoid any potential penalties or issues with the IRS.

Key elements of the Form 5305 E Rev October Coverdell Education Savings Trust Account

Several key elements are essential to the Form 5305 E Rev October. These include:

- Account Owner Information: Personal details of the individual establishing the account.

- Beneficiary Information: Details about the child or student for whom the account is being established.

- Contribution Limits: Information regarding the maximum allowable contributions to the account.

- Qualified Expenses: A list of expenses that qualify for tax-free distributions, including tuition, fees, and educational supplies.

- Account Terms: Conditions that govern the operation of the account, including withdrawal rules and penalties for non-compliance.

Quick guide on how to complete form 5305 e rev october coverdell education savings trust account

Effortlessly Prepare [SKS] on Any Device

The management of documents online has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your files quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

Edit and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Use the provided tools to complete your form.

- Mark pertinent sections of the documents or conceal sensitive data using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5305 e rev october coverdell education savings trust account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5305 E Rev October Coverdell Education Savings Trust Account?

The Form 5305 E Rev October Coverdell Education Savings Trust Account is a tax-advantaged savings plan designed to help families save for education expenses. It allows contributions to be made for qualified education expenses while offering tax benefits. This account can cover a wide range of educational costs, making it an appealing option for parents.

-

How can airSlate SignNow help with the Form 5305 E Rev October Coverdell Education Savings Trust Account?

AirSlate SignNow simplifies the process of eSigning and managing documents related to the Form 5305 E Rev October Coverdell Education Savings Trust Account. Our platform allows users to easily create, send, and sign necessary documents securely online. This streamlines the process, saving both time and effort for parents setting up an education savings trust.

-

What are the benefits of using airSlate SignNow for my Form 5305 E Rev October Coverdell Education Savings Trust Account?

Using airSlate SignNow for your Form 5305 E Rev October Coverdell Education Savings Trust Account offers several benefits, including enhanced security and efficiency. You can manage all necessary documents in one place and ensure they are signed quickly and correctly. Additionally, the platform’s user-friendly interface makes it accessible for everyone, allowing for managed workflows.

-

Is there any pricing associated with airSlate SignNow for processing the Form 5305 E Rev October Coverdell Education Savings Trust Account?

Yes, there is a subscription model for airSlate SignNow that provides different pricing tiers depending on features and usage. The cost is reasonable and designed to be cost-effective for families utilizing the Form 5305 E Rev October Coverdell Education Savings Trust Account. You can select the plan that fits your needs best, ensuring you’re covered without overspending.

-

What features does airSlate SignNow offer for handling Form 5305 E Rev October Coverdell Education Savings Trust Account documents?

AirSlate SignNow offers a variety of features specifically designed to manage Form 5305 E Rev October Coverdell Education Savings Trust Account documentation. Users can create templates, customize document workflows, and utilize infinite signing options. These features enhance document preparation and ensure compliance with regulations pertaining to education savings accounts.

-

Can I integrate airSlate SignNow with my financial software for managing Coverdell Education Savings Accounts?

Absolutely! AirSlate SignNow can be seamlessly integrated with various financial software solutions to help you manage your Form 5305 E Rev October Coverdell Education Savings Trust Account. This integration helps ensure a smooth workflow for handling documentation related to your education savings account while keeping everything organized.

-

Who can open a Form 5305 E Rev October Coverdell Education Savings Trust Account?

Any individual or entity with a designated beneficiary can open a Form 5305 E Rev October Coverdell Education Savings Trust Account. This typically includes parents, guardians, or family members who wish to save for a child’s education. It’s an effective tool for anyone committed to investing in future educational expenses.

Get more for Form 5305 E Rev October Coverdell Education Savings Trust Account

Find out other Form 5305 E Rev October Coverdell Education Savings Trust Account

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure